US S&P PMI January Prelim: Breakdown

On Wednesday, the 24th of January, S&P released its January preliminary PMI report for the US.

Here’s the breakdown.

The latest data for the US S&P Composite PMI indicates an actual value of 52.3, surpassing the forecast of 51 and the previous figure of 50.9.

In the services sector, the US S&P Services PMI was 52.9, exceeding the forecast of 51.5 and the previous figure of 51.4.

For manufacturing, the US S&P Manufacturing PMI was 50.3, surpassing the forecast of 47.6 and the previous figure of 47.9.

These numbers suggest an overall improvement, stronger expansion in services, and a turnaround in manufacturing activity.

Overview

In the US, businesses experienced a robust start to the year, marked by the sharpest increase in output growth in seven months.

Service providers led the expansion, compensating for a decline in manufacturing output due to ongoing supply challenges.

Despite this, there was a widespread improvement in demand, with stronger new orders for goods and services, contributing to a 20-month high in business confidence for the upcoming year.

While input costs rose at a slightly softer pace, firms increased selling prices at the slowest rate since May 2020.

Additionally, companies added to their workforce at a modest pace, accompanied by a rise in backlogs of work for the first time in ten months.

Output & Demand

The Composite Output Index for January rose to 52.3 from December’s 50.9, indicating the fastest increase in business activity since June 2023.

The expansion was driven by service providers, while manufacturing firms experienced a moderate drop in activity, albeit less severe than in December.

New business saw its sharpest growth since June 2023, with both manufacturers and service providers contributing to the upturn. However, new export orders declined for the second consecutive month, primarily due to a faster drop in manufacturing new export sales.

Despite this, businesses expressed heightened optimism for the outlook, reaching the highest level since May 2022, driven by expectations of improving demand conditions and investment.

Employment

In January, US companies reported a slight increase in employment, albeit at a slower pace than in December.

The marginal rise, the second-softest since August, was attributed to increased business requirements, the hiring of skilled workers for longstanding vacancies, and efforts to address backlogs of work.

Labor shortages were noted as a constraint on hiring.

The growth in outstanding work, driven by service providers, marked the first expansion since April, while manufacturers experienced a slower but still notable drop in work-in-hand.

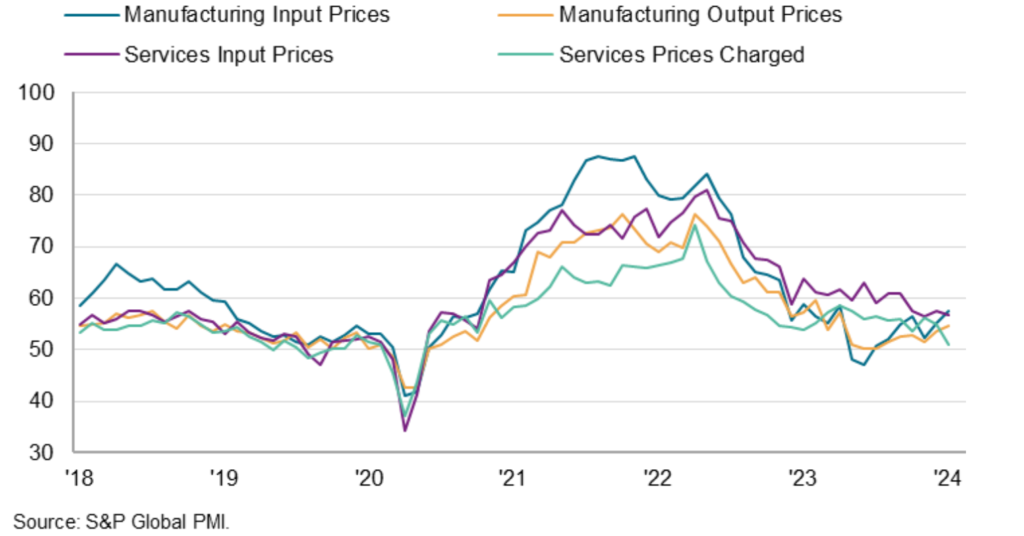

Prices

At the beginning of the year, inflationary pressures eased as input prices increased at a slower pace, marking the second-weakest rate since October 2020.

However, goods producers, particularly in manufacturing, experienced a sharper uptick in cost burdens, driven by challenges in sourcing materials and increased transportation and fuel costs.

There was a sectoral divergence in selling prices, with service providers indicating the slowest rise in output charges since June 2020, while manufacturers raised prices at the steepest rate since April 2023 to offset higher costs.

Overall, average prices for goods and services increased at a much-reduced rate in January, the smallest monthly rise since May 2020.