ECB Interest Rate Prep

Sentiment:

ING: Trying to convince markets that pricing rate cuts is wrong requires offering guidance, something that the European Central Bank may have little interest in doing at this stage. We are, indeed, in a phase of data dependency. We don’t expect this meeting to be a turning point for Eurozone rates or for the euro

JPMorgan: Analysts at the firm are wary of the trend in core inflation, saying its recent slowing may be the result of the dissipating of transitory factors and making the trend difficult to discern. They expect a total of 100 BPS in cuts, having previously expected 75 BPS.

MFS Investment Management: Our view remains that the weak growth outlook – with activity below potential for many quarters ahead – and falling inflation will mean cuts can happen sooner rather than later

Societe Generale: The January ECB meeting this Thursday is, as usual, unlikely to deliver any policy changes or major policy messages, involving instead a reflection on the year ahead

BNP Paribas: The ECB will suggest on 25 January that it is closer to starting its normalisation cycle, we expect, but without signalling an imminent rate cut, nor declaring victory in the inflation fight

UBS: I think you cannot be very confident about an April rate cut. We previously expected June, but then brought it forward to April.

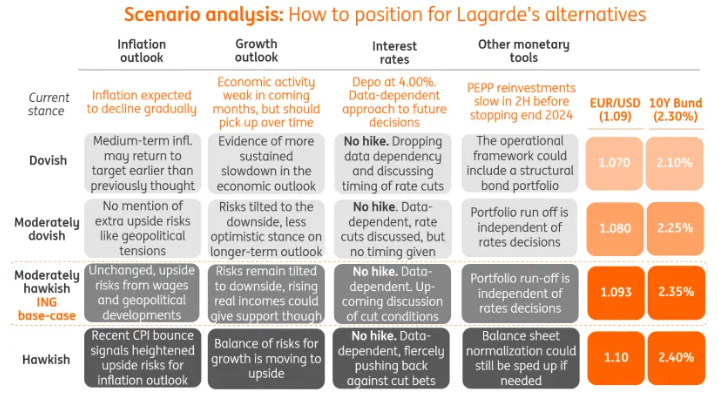

ING Cheat Sheet:

Prior Reaction:

ECB Interest Rate Actual 4.50% (Forecast 4.5%, Previous 4.50%) – 14 Dec 2023