US GDP Q4 Advance: Breakdown

Overview

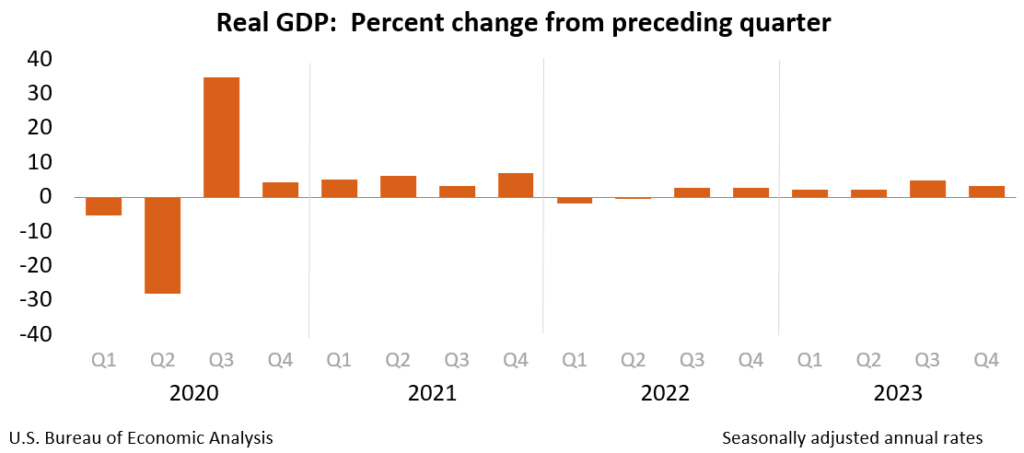

Real US gross domestic product grew at an annual rate of 3.3% in the fourth quarter of 2023, as per the “advance” estimate from the Bureau of Economic Analysis.

This follows a growth of 4.9% in the third quarter.

The rise in real GDP was driven by increases in various sectors, including consumer spending, exports, state and local government spending, nonresidential fixed investment, federal government spending, private inventory investment, and residential fixed investment.

However, imports, which subtract from the GDP calculation, also increased during this period.

GDP/PCE Price Index (Inflation)

Notably, the price index for gross domestic purchases rose by 1.9% in Q4, down from 2.9% in Q3.

The PCE price index increased by 1.7%, compared to a 2.6% rise in the previous quarter.

Excluding food and energy prices, the PCE price index saw a 2.0% increase, unchanged from Q3.

Breakdown

Consumer spending rose in both services and goods, driven by food services, accommodations, health care, other nondurable goods (especially pharmaceuticals), and recreational goods.

State and local government spending grew, driven by higher employee compensation and increased investment in structures.

Nonresidential fixed investment saw a boost, led by intellectual property products, structures, and equipment. Federal government spending increased in nondefense areas.

Inventory investment, led by wholesale trade, contributed to the rise.

Residential fixed investment increased in new structures, partially offset by a decrease in brokers’ commissions.

Exports increased in both goods (led by petroleum) and services (primarily financial services).

Imports rose, driven by higher services, particularly in travel.

Income

In the fourth quarter, current-dollar personal income rose by $224.8 billion, reflecting increases in compensation and income from assets, offset by a decline in transfer receipts.

Disposable personal income increased by $211.7 billion (4.2%), and real disposable income increased by 2.5%.

Personal saving was $818.9 billion, with a saving rate of 4.0%, compared to $851.2 billion and a 4.2% rate in the third quarter.