BoE Interest Rate Prep

Commentary:

ING: We suspect the Bank will still want to tread carefully as it gears up for the first meeting of 2024. But the reality is that defending a “higher for longer” stance on interest rates is getting harder as the inflation backdrop shows signs of improving. Remember that the BoE has pinned the chances of rate cuts on three variables. One is the strength of the jobs market, but data here is suffering from well-known reliability problems. So, in practice, it comes down to service inflation and private-sector wage growth. Both are tracking well below the November BoE projections.

Deutsche Bank: Any hawkish votes would make the BoE quickly stand out as one major central bank with members still pushing for even more restrictive rates – despite downside misses to growth, pay and inflation.

BNY Mellon: Economists expect the BoE to drop its long-held warning that it will hike rates again if inflation rebounds. Investors are also wary of the ruling Conservative party cutting taxes too generously in its March Budget, ahead of an election expected by year-end. They might have some headroom, but the prospect of entering unsustainable spending territory could hurt GBP as investors shift to stagflation, geopolitical concerns.

BofA: We expect the BoE on hold at 5.25% until Aug-24 and a cutting cycle of 25bp per quarter from there. The UK will be the last of the major central banks to start the cutting cycle and is likely to move slower, at least vs the ECB. We see a risk that the BoE cuts rates 25bp per meeting when it starts in August of this year. We think that would have short legs if it were to materialise: faster cuts in 2024 would likely need to be followed by, likely, a long pause down the line or, under some circumstances, even some small reversal of the move.

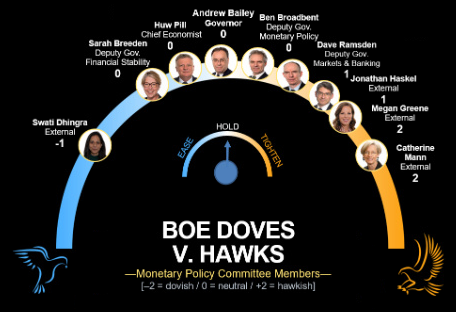

BoE Voting Member Split:

ING’s Four BoE Scenario’s:

Previous Reaction:

BoE Bank Rate Actual 5.25% (Forecast 5.25%, Previous 5.25%) [December 14th 2023]