US Nonfarm Payrolls Prep

On Friday the 2nd of February at 08:30 ET, the BLS is set to release the latest Nonfarm Payrolls report, representing the month of January.

Here are some views on what to expect.

Overview

For Nonfarm Payrolls, median analyst expectations see a gain of 180K.

According to a survey of 60 economists, the highest estimate is 296K, and the lowest is 120K.

The majority of bets are in the range of 180K-185K.

For the Unemployment Rate, the median forecast is 3.8%.

The highest estimate is 3.9%, the lowest is 3.6%.

Some of the largest investment bank views

Commentary

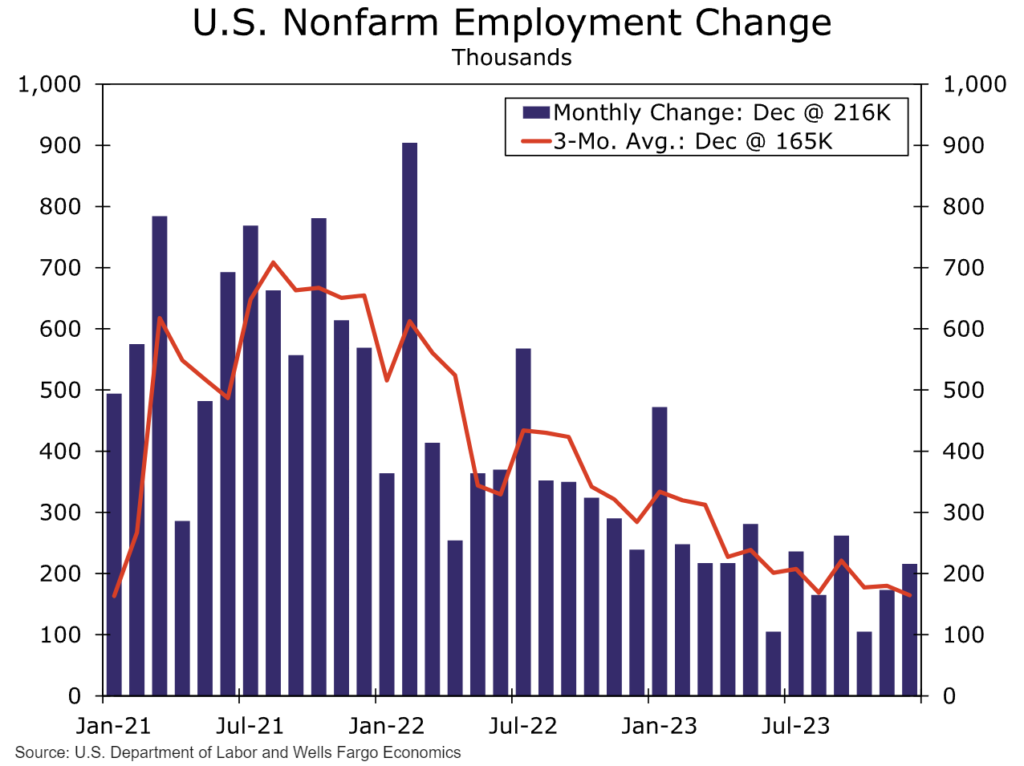

Wells Fargo

The themes of improving supply, cooling demand, and overall labor market normalization likely continued in January.

We estimate that nonfarm payrolls rose by 155K in January, a downshift from December’s gain and a bit below the current consensus.

Although payroll growth has held up remarkably well recently, there are several signs of further moderation in the months ahead.

On the net, fewer industries are adding headcounts each month, and job openings and hiring plans continue to pull back. Furthermore, initial jobless claims remain low, but continuing claims have edged up, indicating that displaced workers are having a more challenging time finding new work.

We expect the unemployment rate to be up to 3.8% and average hourly earnings to increase by 0.3%.

Morgan Stanley

Low jobless claims and warm weather in early January suggest strong payrolls.

Earnings probably continued to rise at their recent pace of +0.3%/M.

We expect the unemployment rate to remain unchanged at 3.7%, with some rebound in the labor force.

The report includes the benchmark revision, probably about a 25k per month average cut to payrolls in the year through March 2023.

Some downward revision probably spills into later in the year, adding to the pattern of downward revision.

Unicredit

We expect payrolls to rise by 160k in January.

The annual benchmarking process means payroll data since April 2022 will be subject to revision, and new seasonal factors will affect data from January 2019.

The BLS’ preliminary estimate of the benchmark revision announced in August 2023 indicated a downward revision to March 2023 payrolls of 306k.

We expect the unemployment rate to rise 0.1pp to 3.8% in January.

The annual update of population controls for household survey data (historical data will not be revised) could create volatility between December 2023 and January 2024.

Average hourly earnings probably rose 0.3% MoM in January (4.1% YoY).

The labor market is loosening gradually, and the short-term inflation expectations of firms and consumers are not far above pre-pandemic levels.

Societe Generale

We forecast a 165k non-farm payroll gain for January, which matches the average of the previous three months.

In late 2023, employment gains were lifted by returning strikers. We assume that strike activity is no longer an influence on the monthly results.

Job gains have been strong for government payrolls, particularly local government payrolls, which still benefit from remaining COVID transfers from the federal government.

The unemployment rate is expected to climb modestly to 3.8% from 3.7%.

Previous Release

On January 5th, at 08:30 ET, the BLS released the latest Nonfarm Payrolls and Unemployment Rate numbers representing the month of December.

NFP came in hotter than expected, showing a gain of 216K, on estimates of 175K, and up from the downward-revised prior of 173K.

However, the Unemployment Rate came in at 3.7%, inline with the prior read, but lower than the expected 3.8%.

The Average Earnings figure also came in higher than expected, at 4.1% YoY, higher than the expected 3.9%, and the prior 4%.

This caused strength in the dollar and the US 2-year governemnt bond yield, and weakness in the S&P, as the higher than expected NFP and Average Earnings print fueled upside inflation risk, and caused markets to pare back on their bets for Fed rate cuts this year.