US CPI Prep

On Tuesday, the 13th of February, the BLS is set to release the latest US inflation print, representing the month of January.

Here are some views on what to expect.

Overview

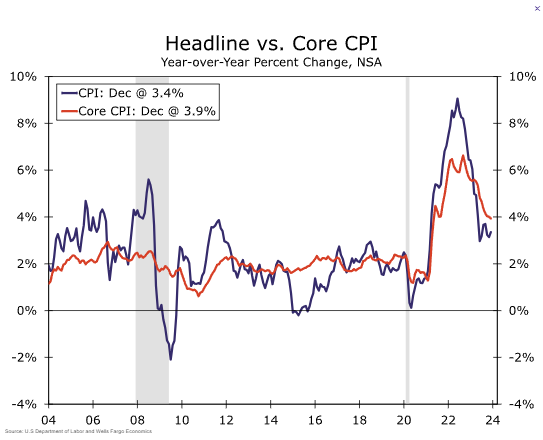

For CPI YoY, the median economist’s forecast sees it moving down to 2.9% from 3.4% previously. In a survey of 49 economists, the highest estimate is seen at 3.3% and the lowest at 2.8%.

For CPI MoM, the median forecast is 0.6% on the prior 0%. The highest estimate is 1%, and the lowest is 0.2%.

Here are the views of some of the largest investment banks

Seasonal Adjustments

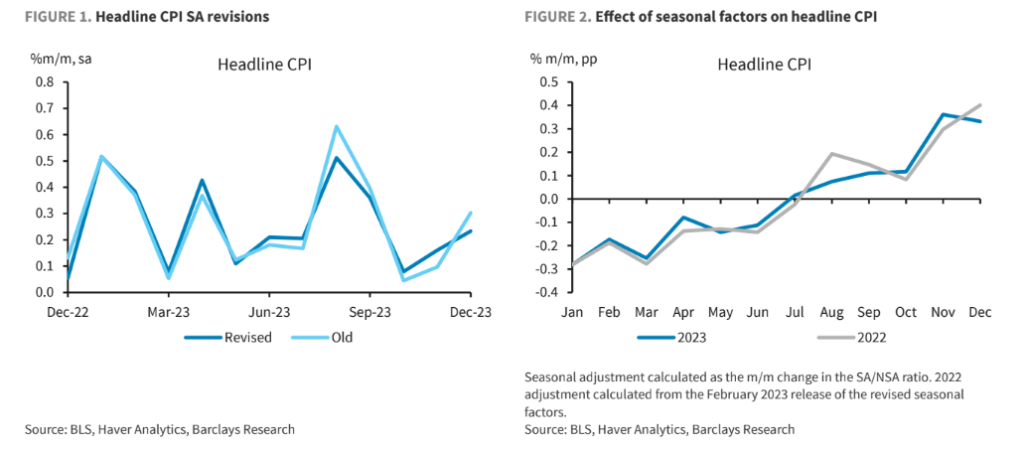

It is worth noting the CPI seasonal adjustments that were released last week.

Each year, with the release of the January CPI, seasonal adjustment factors are recalculated to reflect price movements from the just-completed calendar year.

This routine annual recalculation often results in revisions to seasonally adjusted indexes for the previous five years.

The BLS made available these recalculated seasonally adjusted indices, as well as the new seasonal factors for the period January 2019 through December 2023.

The updated seasonally adjusted CPI indices showed only minor revisions to the 2023 inflation path, though markets reacted strongly to a downward revision for the most recent December MoM CPI print.

Commentary

Morgan Stanley

We think that core CPI decelerated to 0.26% MoM in January (versus 0.31% MoM in December and 0.3% MoM consensus), bringing the annual rate to 3.7% YoY.

Core services Inflation moves sideways, and goods decelerate due to weak used cars.

Energy prices drop, bringing the headline to 0.14% MoM (2.9% YoY).

Wells Fargo

We expect inflation to continue to recede and forecast the headline CPI to rise 0.2% in January, which would push the year-ago pace down to 3.0%.

Falling gasoline prices and moderating price increases at the grocery store should keep the headline gain in check.

Core inflation likely continued to cool more slowly last month, and we anticipate the core CPI rose 0.3%, translating to a 3.7% year-ago pace.

We ultimately look for inflation to cool further this year, albeit at a slower rate than in 2023, and believe price growth is still more likely to modestly overshoot rather than undershoot the Fed’s target.

The inflation data will continue to garner most of the Fed’s attention this year as it tries to fine-tune the precise timing of rate cuts.

We continue to believe the first cut will come in May, though risks look tilted more toward June than March based on recent data.

ING

This week’s numbers could point in this direction, with retail sales and industrial production as the activity highlights, while consumer price inflation is also scheduled for release.

Starting with CPI, it has been posting more rapid month-on-month increases than the PCE deflator, largely due to the heavy weighting of housing and vehicles in the basket of goods and services used to calculate the inflation rate.

Rents are slowing in the open market, but the way the series is constructed within the CPI report means those movements take a long time to show up in official data.

Manheim used car auction prices suggest vehicle prices will be a depressing factor on January inflation. We are looking for a 0.3% MoM increase in the core inflation rate, with the risks skewed slightly in favor of a 0.2% outcome rather than a 0.4% increase.

Bank of America

The inflation outlook is mixed: we see downside risks to housing and used cars in the coming months, but upside risks to growth could mean slower disinflation.

Our analysis suggests that most of the recent strength in consumer spending has been due to supply expansion.

Nomura

US core CPI inflation is expected to show a +0.3% MoM increase based on the consensus, the same pace as in December.

Meanwhile, a steady decline from +3.9% in December to +3.7% is likely in terms of yearly inflation, though it is unlikely to significantly alter the market’s expectations about the timing of the first rate

cut.

Previous Release

On January 11th, US CPI MoM came in at 0.3% on the forecast of 0.2%.

The YoY came in at 3.4%, higher than the expected 3.2%

The higher-than-expected rises in both CPI figures led to the upside movement seen in the dollar and US 2Y yields, coupled with the downside in the S&P 500, as it caused markets to pare back their bets on Fed rate cuts this year.