US Nonfarm Payrolls Prep

On Friday the 8th of February at 08:30 ET, the BLS is set to release the latest Nonfarm Payrolls report, representing the month of February.

Here are some views on what to expect.

Overview

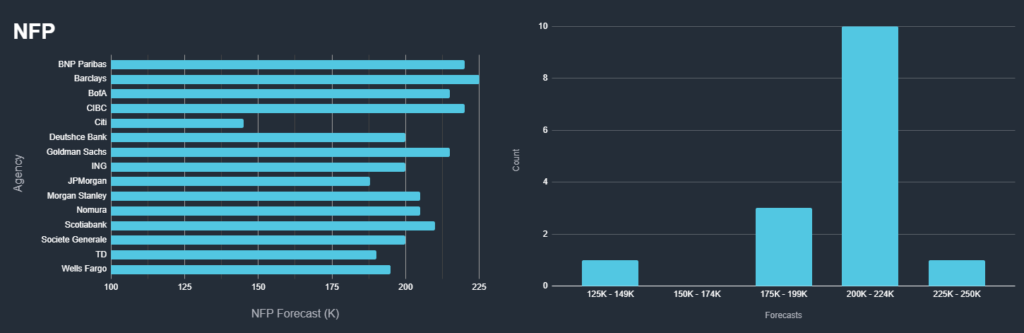

For Nonfarm Payrolls, median analyst expectations see a gain of 200K.

According to a survey of 67 economists, the highest estimate is 286K, and the lowest is 125K.

The majority of bets are in the range of 169K-226K.

Here are some views from the top investment bank forecasters.

For the Unemployment Rate, the median forecast is 3.7%.

The highest estimate is 3.8%, the lowest is 3.6%.

Here are some views from the top investment bank forecasters.

Commentary

JPMorgan

We forecast that nonfarm employment increased by 200,000 in February while the unemployment rate held at 3.7%. Job growth was robust in January, with the 353,000 jobs added.

We believe that this strong January job growth could have been flattered by favorable seasonal adjustment that anticipated steep job cuts before the seasonal adjustment and this is one of the reasons we expect job growth to slow significantly in February relative to January (the increase in jobless claims filings between the reference weeks for the January and February reports is another).

But even though we believe job growth will cool in February, we still see a number of signs that the labor market remains strong and we expect a still-solid amount of jobs to be added that month; filings for unemployment insurance generally have stayed low lately and consumer responses about the availability of jobs have remained fairly upbeat.

We also think that the public sector likely continued to make a decent-sized contribution to employment growth in February, with governments adding another 40,000 jobs that month.

For the private sector, we look for 160,000 jobs to be added in February with goods industries generating 35,000 and the services sector account- ing for 125,000.

Wells Fargo

All eyes will be on the employment report on Friday. During January, nonfarm payrolls surprised to the upside and rose by 353K net new jobs. The unemployment rate held steady at 3.7%, while average hourly earnings came in on the hot side and jumped 0.6% during the month, twice the rate expected by the consensus. All told, January’s sizzling employment report shows that the labor market, although cooling, is holding up remarkably well despite tighter monetary policy.

What’s more, upward revisions to prior months’ data indicate a stronger pace of payroll growth over the past few months than what was previously reported. In our view, however, the past two months of robust monthly gains over 300K are not likely to be repeated in February. Initial jobless claims and continuing claims remain low, yet on balance, have ticked slightly higher in recent weeks. The rise in claims indicates the labor market may have lost a bit of momentum in February. That said, the pace of hiring still appears to be on solid ground, and we anticipate payrolls rose by 195K during February, just slightly above the current consensus. Furthermore, we look for the unemployment rate to remain unchanged at 3.7% and for average hourly earnings to ease to 0.2% during the month alongside normalizing supply and demand for workers.

UniCredit

We expect payrolls rose 170k in February after a surge of 353k in January. We would not be surprised if payrolls in the prior two months were revised downward. A range of private surveys point to a softening labor market.

Still, the labor market remains tight, and the unemployment rate (we forecast it to be unchanged at 3.7%) is unlikely to rise in a sustained way until monthly payroll gains fall below the around 100k needed to absorb population growth. Consistent with this, initial jobless claims remain low.

Average hourly earnings likely rose 0.2% MoM in February after the jump of 0.6% mom in January.

The surge in January was very likely noise created by the big drop in average hours worked (which would mechanically push up the average hourly earnings of those reporting unchanged weekly or monthly pay), probably reflecting the impact of severe weather.

A correction likely occurred in February. In year-on-year terms, average hourly earnings look set to have eased to 4.4% from 4.5%.

Societe Generale

The January increase of 353k non-farm jobs was widely distributed among the industries. We are not anticipating any specific sector weakness.

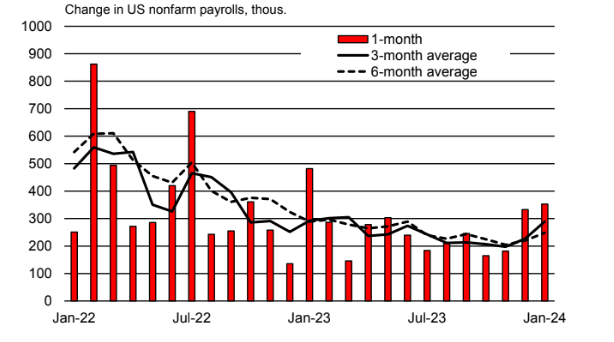

More generally, we expect job growth to return to a trend. The question is, what is the underlying trend? Before the January employment update that also included upward revisions to November and December gains, non-farm job growth appeared to be slowing to well below 200k per month.

Prior to the revisions, non-farm job growth posted an average monthly gain of 165k in the fourth quarter. After the revisions, non-farm job growth averaged 227k in 4Q.

In the latest three months, which include the stellar January increase, non-farm job growth averaged 289k. We expect the underlying trend to be closer to 200k and make that our projection for February. We suspect there could be some downward revision to the extraordinary January increase.

Previous Release

On February 2nd at 08:30 ET, the BLS released the US Nonfarm Payrolls and Unemployment Rate numbers representing the month of January.

Nonfarm Payrolls surprised to the upside at 353K, on expectations of 216K. The prior was also revised up markedly to 333K, from 216K.

The Unemployment Rate remained unchanged at 3.7%, but was lower than the expectations of 3.8%.

As shown on these charts, this caused the dollar and the US Treasury yields to strengthen, and the S&P 500 to weaken, as traders pushed back bets on Fed rate cuts this year. The higher-than-expected Nonfarm Payrolls number, as well as the upward revision to the prior figure, stoked fears that inflation may be stickier than expected.