ECB Interest Rate Prep

Sentiment:

BNYMellon: Markets don’t expect the ECB to ease until June but the need to act sooner is clearly in play. The markets have unwound from 150bps of easing to just 90bps – matching the FOMC shift. However, the current environment sees the ECB acting first, something that is different than the start of the year. The effect on the EUR was hard to discern this week as US bonds and US data suggested a slowing in US growth, but the way that ECB statement reads and what President Lagarde says about easing plans ahead is central to FX and bonds globally.

BofA: We expect unchanged ECB guidance in the press release, but soft guidance that cuts are coming very soon at the press conference. ECB forecasts are likely to show 2.0% core in late 2026. Confidence will be the missing ingredient, the next few months’ data crucial. We stick to our call that cuts are likely to start in June.

JPMorgan: Caution and data dependence should be the watch words next week from Chair Powell’s testimony and the ECB meeting. Both are likely to affirm their views that inflation will move lower and open a window for easing later this year, but to eschew guidance on the timing and magnitude of the rate cuts ahead.

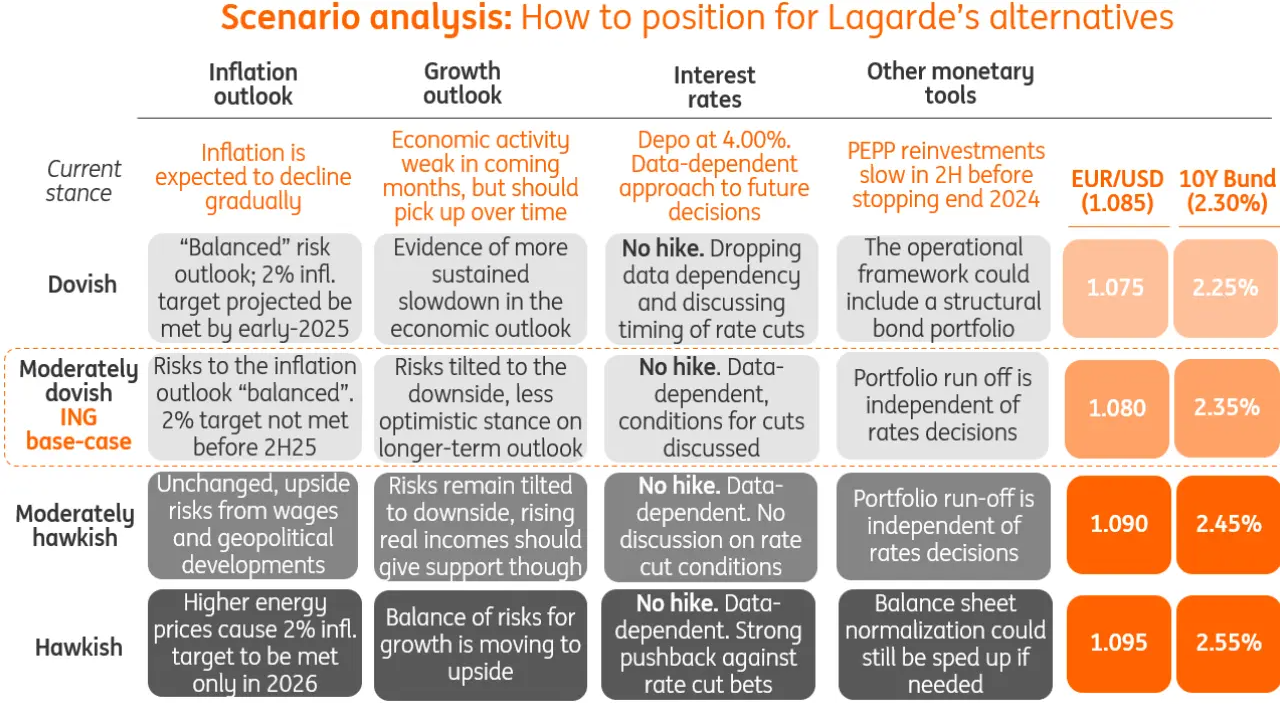

ING: We expect further subtle changes to the European Central Bank’s communication next week, paving the way for a June rate cut. However, the latest macro data should have increased the pressure on the ECB to act even earlier.

MUFG: It is less likely that the ECB will deliver a dovish policy signal at this week’s policy meeting after the release of stronger euro-zone inflation data at the end of last week. It was revealed on Friday that core inflation was more sticky than expected in February when it fell by less than expected to 3.1%. The firmer euro-zone inflation readings at the start of this year make it less likely that there will be a significant downward revision to the ECB’s updated staff forecasts. Without a dovish catalyst, ECB officials have indicated recently that they are willing to wait until June to begin cutting rates when they will have more information over whether wage growth slowed further at the start of this year. A development which is helping to ease downside risks for the euro in the near-term.

Societe Generale: We think the ECB will remain on hold this Thursday. In recent weeks, data and central bank speakers have pushed markets to scale back their rate-cut expectations materially. With many ECB policymakers making it clear they want to see a further deceleration in wage growth, the June meeting is increasingly in focus for discussing rate cuts.

Money Market Pricing:

Feb 22nd: Money markets scale back bets on future ECB rate cuts, pricing in 99 bps in 2024.

Feb 13th: Money Markets price in 110 bps of ECB rate cuts in 2024 from 120 bps before US data.

ING Cheat Sheet:

Prior Release: The figure saw very little movement within the markets.

ECB Interest Rate Actual 4.5% (Forecast 4.5%, Previous 4.50%) – January 25th 2024

–