US CPI Prep

On Tuesday, the 12th of March, the BLS is set to release the latest US inflation print, representing the month of January.

Here are some views on what to expect.

Overview

The median forecast for CPI YoY is seen at 3.1%, unchanged from the prior.

According to a survey of 39 qualified economists, the highest estimate is 3.2%, and the lowest is 2.9%.

Here are some views from the largest investment bank forecasters:

For the MoM CPI, the median forecast is 0.4%, form the prior 0.3%, the highest estimate is seen 0.5%, the lowest is 0.3%

Commentary

UniCredit

We see headline CPI rising 0.4% MoM in February, while stabilizing at 3.1% in YoY terms. Gasoline prices will likely contribute 0.1pp to the monthly reading.

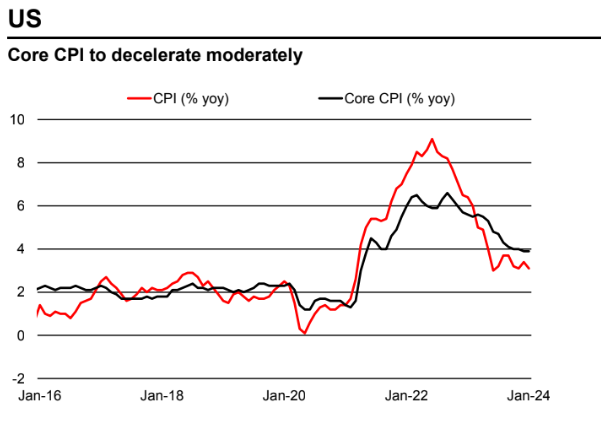

Core inflation likely declined to 0.3% MoM from 0.4%. In annualized terms, this would be roughly consistent with a 3.5% rate, which is too high for the Fed’s liking. Prices for used vehicles likely fell again, but at a slower pace.

In January, supercore inflation surprised to the upside, jumping to 0.9% mom. This appears to be driven by one-offs and monthly volatility, but significant progress on this front needs to be made before the Fed can feel comfortable cutting rates.

Societe Generale

CPI for February should be the most closely followed economic release next week.

Headline CPI is expected to be strong at 0.4%, and core could be 0.2-0.3%. Our calculation is a round-down to 0.2%.

Sticky inflation and resilient job markets are maintaining a cloud over when the Fed can start cutting rates, yet Chair Powell and others report cuts are still their expectation for later in 2024.

Wells Fargo

We forecast headline CPI to rise 0.4% in February, fueled in part by a jump in gasoline prices, which would keep the year-over-year rate at 3.1%.

Core CPI, however, likely moderated in February; we look for a 0.3% monthly gain and for the year-over-year rate to edge down to 3.7%.

While goods deflation was likely less pronounced in February, we expect to see a smaller increase in core services relative to January.

Owners’ equivalent rent growth should continue to trend lower despite January’s pop, while we see less chance of residual seasonality boosting services in February.

Nevertheless, with the core CPI likely to be running at a 3.9% annualized pace in the three months through February, the Fed is likely to be searching for more confidence that inflation is on course to return to target on a sustained basis for a little while longer before easing policy.

ING

We expect a 0.3% MoM core CPI this week, which remains inconsistent with a cut before June and can offer the dollar some support.

Previous Release

On February 13th at 08:30 ET, the US CPI YoY came in at 3.1%, higher than the expected 2.9%, but down from the prior 3.4%.

MoM came out at 0.3%, unchanged from the prior, but up from the forecast of 0.2%.

Although the CPI numbers came in lower/in line with the previous reads, they still came in higher than expectations.

This caused traders to reprice rate cuts for this year, as it shows the journey down for inflation may be bumpier than they had thought.

As shown above, this caused strength in the dollar and US Treasury yields, and weakness in the S&P 500, as traders reduced their expectations of rate cuts later this year.