US Interest Rate Prep

On Wednesday the 20th of March, at 14:00 ET, the FOMC is set to release the US Interest Rate decision, alongside the Rate Statement, and the Summary of Economic Projections (SEP).

Here are some views on what to expect.

Overview

The FOMC is widely expected to keep rates unchanged at 5.5%.

If realized, attention will turn to the Rate Statement, but more importantly, the SEP.

Markets will look for any changes in longer-run inflation and GDP forecasts in the latest SEP, alongside the much-anticipated ‘Dot-Plot’, which outlines each FOMC voter’s forecasts on the short and long-term outlook for US interest rates.

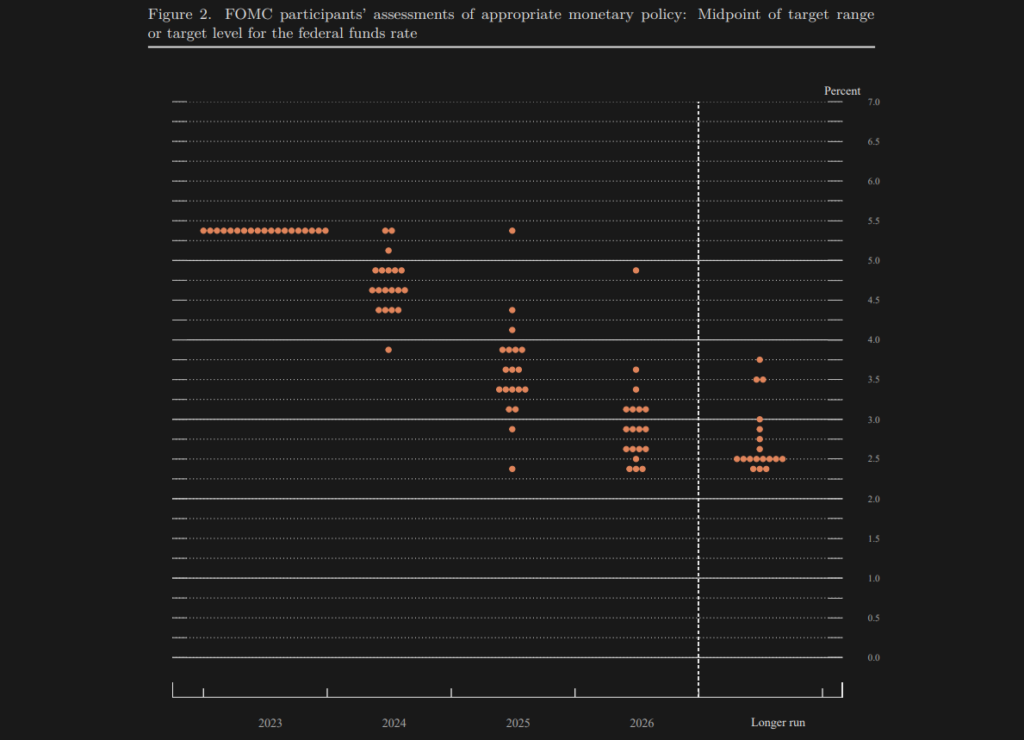

Below is the previous Dot Plot, which was released in the December Summary of Economic Projections

Markets will be looking for any pushing forward or moving back of rate cut bets from the FOMC members in the new dot plot.

Financial market pricing puts the probability of a cut at roughly zero for next week, 10% by 1st May, and 65% by 12th June.

Several Fed officials have indicated there is no immediate hurry to cut rates, which is supported by the recent pickup in monthly inflation and resilient payrolls.

In his testimony to congress just before the blackout period, Fed Chair Powell said that the committee is “not far” from cutting rates and needs a “little bit more data” to become confident inflation is moving sustainably towards 2%.

Fed’s Powell in the press conference following the last rate decision, said: “Based on the meeting today (January 31st), I don’t think it is likely that we will have a rate cut in March.”

Commentary

UniCredit

We expect the FOMC to leave interest rates and the pace of balance-sheet reduction unchanged at its meeting on 19th-20th March.

The FOMC’s updated macro projections are likely to be little changed, indicating three rate cuts this year. We still expect rate cuts to start in June and total 125bp this year.

The focus at this meeting will mostly be on the updated Summary of Economic Projections (SEP), although we expect little or no meaningful changes.

GDP growth was 3.1% yoy in 4Q23, 0.5pp higher than the FOMC median projection, but we expect the FOMC’s 4Q24 projection to be broadly unchanged at 1.4% yoy, as recent data point to growth slowing.

Core PCE inflation for 4Q23, at 3.2% yoy, was in line with FOMC projections, although the pickup at the beginning of the year suggests the median projection for end-2024 could be revised up slightly from 2.4%.

Given that we expect little change to growth and inflation forecasts, the updated “dot plot” of interest rate projections is likely to be broadly unchanged too, with the median “dot” indicating cuts of 75bp this year and 100bp next year.

The risks are skewed towards the median “dot” moving up slightly, more so for 2024 than beyond, given recent stronger inflation data as well as the upward skew of the December SEP 2024 dots (when 8 participants expected less than three cuts, and 5 expected more than three cuts).

Nomura

We expect a hawkish update to the summary of economic projections at the March FOMC meeting.

The year-end inflation forecast for 2024 should move higher in the wake of two months of upside surprises.

In our view, it is more likely than not that the median dots move higher for 2024 and 2025, which is consistent with our own monetary policy outlook. In addition, we expect the average of longer-run dots to move up, while its median likely remains unchanged.

Wells Fargo

The Federal Open Market Committee (FOMC) will hold its next regularly scheduled policy meeting on March 19th-20th.

We do not expect any policy changes at this meeting, an expectation that is held by most market participants.

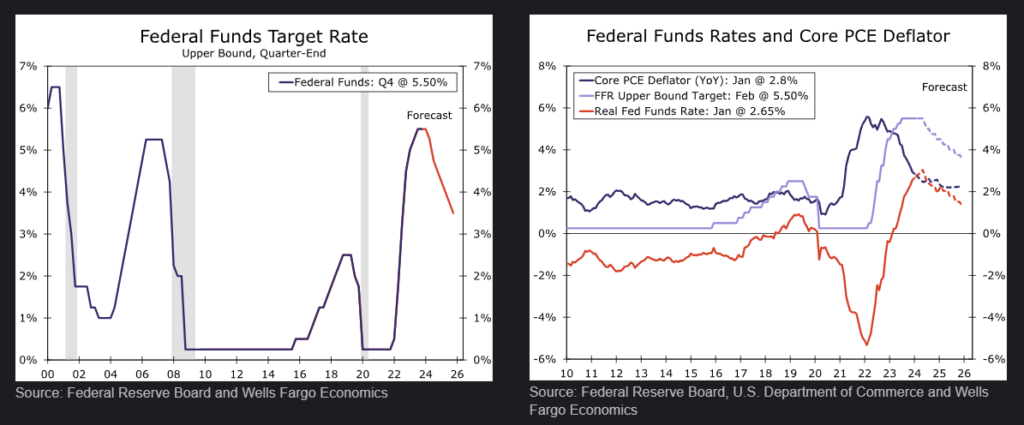

Recent data, including the 275K jobs that were added to payrolls in February and the 0.4% increase in the Consumer Price Index (CPI) in February relative to January, give the Committee little incentive to ease policy at this time. In that regard, we revised our outlook for Fed policy in the US Economic Outlook that we published this week.

Previously, we had looked for the first rate cut at the May 1st FOMC meeting, but it appears that Fed policymakers need greater confidence that inflation is indeed receding to 2% on a sustained basis before they sanction an easing of the policy stance.

We now believe the Committee will wait until its June 12 meeting before reducing its target range for the federal funds rate by 25 bps. We then look for the FOMC to cut rates by 25 bps at each of its meetings in July, September and December.

That said, we readily acknowledge that the risks to our federal funds forecast are skewed to later rather than sooner.

That is, we believe the probability that the FOMC waits until its meeting on July 31 to commence its easing cycle is higher than the probability that it cuts rates at its May 1 meeting.

If the Committee waits until its July 31 meeting to begin cutting rates, then it likely will not deliver the 100 bps of total easing that we anticipate this year.

Could the FOMC refrain from cutting rates at all this year? Perhaps, but we do not think the probability of that scenario is very high. The real fed funds rate is 2-1/2% at present.

The current level of the real fed funds rate is significantly higher than it was at any point during the economic expansion of 2010-2019.

Morgan Stanley

On the net, we think not much has changed for the Fed.

We expect changes to the Summary of Economic Projections (SEP) will paint a picture of optimism around

supply-driven growth – higher GDP forecasts coupled with an unchanged forecast for core inflation.

We think the median view for rate cuts remains at three this year. And we continue to expect the first rate cut in June, followed by a pause, then cuts in September, November, and December.

But there is a risk that the median moves to two cuts.

After a pop in January, incoming inflation data point to a big reversal in core PCE services inflation excluding housing – a key focus for the Fed.

At a higher level, assuming our core PCE forecast of 0.32%M for Feb-24 is correct and that Jan-24 is revised to 0.46%M, to achieve the Fed’s forecast of 2.4% core PCE in 2024, the monthly pace would need to average 0.17% for the rest of this year.

Such a run rate is a low bar that implies a risk of upward revisions to inflation next week. It is a close call, but we still believe that the Fed’s inflation forecasts will remain unchanged for 2024.

As a reminder, the monthly pace of core inflation was below an average 0.17% in 2H23.

JPMorgan

At next week’s meeting we expect the FOMC will leave rates on hold and make few changes to the post-meeting statement. In the dot plot we think there are better than even odds that the median dot for this year moves to showing two 25bp cuts by YE24 vs. the three such cuts in the December dot plot.

We also think there’s a good chance the median longer-run dot moves up from 2.5% to 2.625% or 2.75%. We expect little change in the median economic forecasts, though the median core PCE forecast for this year could move up a tick.

At next week’s meeting we expect the FOMC will leave rates on hold and make few changes to the post-meeting statement.

In the dot plot we think there are better than even odds that the median dot for this year moves to showing two 25bp cuts by YE24 vs. the three such cuts in the December dot plot.

We also think there’s a good chance the median longer-run dot moves up from 2.5% to 2.625% or 2.75%. We expect little change in the median economic forecasts, though the median core PCE forecast for this year could move up a tick.

Previous Release

On January 31st at 14:00 ET, the FOMC released it’s latest Interest Rate decision, and Rate statement.

At this meeting, the FOMC left rates unchanged at 5.5%, as expected.

In the Rate Statement, it was noted that the Fed does not expect it will be appropriate to reduce rates until there is greater confidence inflation is moving sustainably toward 2%.

This initially caused strength in the Dollar and Government Bond Yields, and weakness in US stock indexes.

In the subsequent press conference with Fed Chair Powell, he noted that they do not think they need to see weaker GDP to see inflation come down to 2%.

This caused a reversal in the initial reaction, as the Dollar and US Treasury yields weakened, and the US stock indexes strengthened, as it discounted the effect that the higher-than-expected GDP numbers that were seen before this meeting would have on the future of the inflation path, and subsequently, the Interest Rate path.

Later in the presser, Fed’s Powell noted that “based on the meeting today (January 31st), I don’t think likely we will have a rate cut in March.”

This caused immediate repricing of future rate cuts, as seen in the market reaction from the dollar and the US 2-year government bond yields pictured above.

This repricing also caused weakness in the US stock indexes.