US Nonfarm Payrolls Prep

On Friday the 5th of April at 08:30 ET, the BLS is set to release the latest Nonfarm Payrolls report, representing the month of March.

Here are some views on what to expect.

Overview

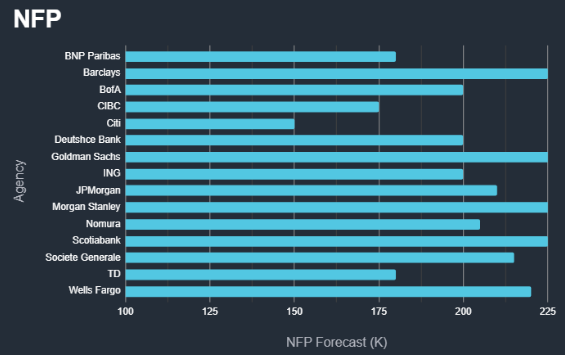

For Nonfarm Payrolls, median analyst expectations see a gain of 213K.

According to a survey of 63 economists, the highest estimate is 250K, and the lowest is 150K.

The majority of bets are in the range of 186K-231K.

Here are some views from the top investment bank forecasters.

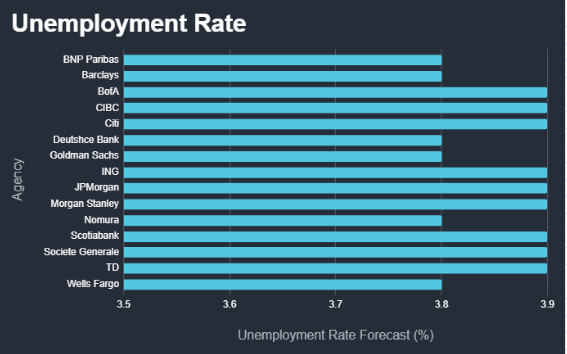

For the Unemployment Rate, the median forecast is 3.8%.

According to a survey of 60 economists, the highest estimate is 3.9%, the lowest is 3.6%.

Here are some views from the top investment bank forecasters.

Commentary

Wells Fargo

We estimate payroll growth moderated in March but remained healthy with employers adding 220K jobs. While demand for new workers has eased, the low JOLTS layoff rate and level of initial jobless claims indicate businesses continue to hold onto existing workers, thus supporting net hiring. The household measure of employment has painted a bleaker picture of hiring recently, having declined by an average of 300K over the past three months. Yet the household measure’s volatility and tendency to oscillate around the trend in payrolls leads us to anticipate a rebound in March that should push the unemployment rate back down to 3.8%. Average hourly earnings likely expanded 0.3% in March, bringing the 12-month change to nearly a three-year low of 4.1% in another sign the jobs market is gradually cooling.

As we move through the year, we expect to see payroll growth downshift further amid dwindling scope for catch-up hiring and slower growth in the labor supply. However, with payroll growth still flying north of 200K, there is altitude to lose before the Fed is faced with a more menacing trade-off between the employment and price stability sides of its mandate.

ING

The jobs report will be the main focus in the US next week. Payrolls are expected to rise by just under 200k, but once again are likely to be concentrated in just three sectors – local government, leisure and hospitality, and private education and healthcare services. 80% of all the jobs added over the past 14 months have come from these sectors and we don’t see much change given that employment surveys have pointed to a slowdown in hiring. The unemployment rate is expected to remain at 3.9% with wage growth remaining benign. We suspect this will keep market pricing for a June federal reserve interest cut at around 80%. Expectations will be firmed up ahead of time with ADP payrolls and the ISM surveys released before next Friday’s jobs figures.

BlackRock

We keep a close eye on the U.S. payroll report out this week to gauge if job gains can keep growing sharply due to elevated migration. Longer term, we think the U.S. could face the risk of structurally slower labor force growth – a key production constraint – as its population ages and without a further boost from migration.

Barclays

In the US, the few data releases published so far this week have done little to change the picture of fairly resilient growth. We expect February personal income estimates to reaffirm these benign dynamics, showing a solid 0.5% m/m increase in income and 0.1% m/m increase in real PCE. On the inflation front, core PCE is likely to post another firm print, rising 0.32% m/m, but this has already been well telegraphed by the CPI and PPI releases. Indeed, the FOMC had this translation to hand at last week’s meeting, and Chair Powell’s communication suggested that the committee regarded stronger inflation pressures at the beginning of the year as more of a bump in the road, from which it did not infer any additional momentum in the coming months.

Previous Release

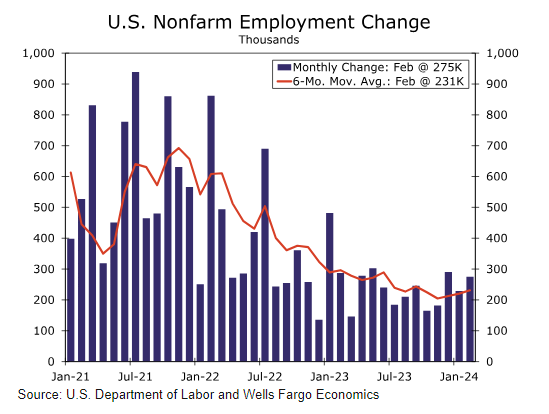

On March 8th at 08:30 ET, the BLS released the US Nonfarm Payrolls and Unemployment Rate numbers representing the month of February.

Nonfarm Payrolls surprised to the upside at 275K, on expectations of 200K. The prior was also revised down to 229K, from 353K.

The Unemployment Rate ticked up to 3.9%, which was higher than the expectations of no change at 3.7%.

Surprisingly with non-farm payrolls coming in 75k higher than forecast, we still saw downside in the DXY, upside in stocks, and a drop following in the US 2 year yield. This being due to the 0.2% increase in the unemployment rate, which maintained the view for traders that the Fed will cut rates by 25bps in June.