US CPI Prep

On Wednesday, the 10th of April, at 08:30 ET, the BLS is set to release the latest US inflation print representing the month of March.

Here are some views on what to expect.

Overview

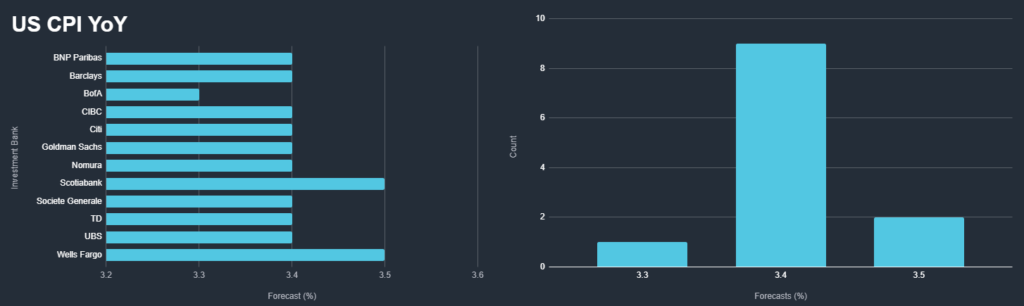

For US CPI YoY, the median forecast is 3.4%, up from the prior of 3.2%. According to a survey of 40 qualified economists, the highest forecast is 3.5%, and the lowest is 3.3%.

As for CPI MoM, the median forecast is 0.3%, down from the prior of 0.4%, the highest estimate is 0.5%, and the lowest is 0.2%.

Here are the expectations from some of the largest investment bank forecasters.

Commentary

Unicredit

We expect CPI inflation to decelerate to 0.3% MoM in March from 0.4% in February. In annual terms, the index will probably be up to 3.4% from 3.2%.

Energy and food prices likely provided only modest upward contributions.

We also see core CPI inflation slowing to 0.3% MoM from 0.4%.

Prices of used cars were probably flat or fell slightly in March.

The main source of core inflation is again likely to come from housing, although rent inflation is on a gradual downward path.

The market, and the Fed, will pay much attention to the evolution of supercore inflation, after the spike recorded in January that was followed by a still elevated rate in February.

Wells Fargo

The March consumer price data demand increased attention after consumer inflation surprised to the upside at the start of the year.

At a high level, we expect the bumpy and stubbornly slow retreat in inflation was on full display in March.

We forecast the headline CPI rose by 0.4% for a second straight month, pushing the year-ago rate to 3.5%.

Part of that gain will come from higher gasoline prices during the month, and when excluding food and energy, we expect core CPI to advance 0.3%.

It was likely more of the same in terms of the drivers of core inflation.

We anticipate core goods inflation likely fell back into deflation territory in March while core services inflation was likely little changed as a further moderation in shelter costs was offset by a pickup in services ex-housing.

While we believe core goods prices have some additional room to fall over the next few months, services prices will need to cool more markedly to keep overall inflation on its downward path.

Societe Generale

When is the earliest we can expect the first cut in interest rates? This is a common query we encounter, with concerns over potential delays and growing apprehensions about no rate cuts at all.

We anticipate rate cuts to begin in June.

A prerequisite for this is a more modest Consumer Price Index growth this week.

An unexpectedly high CPI figure could significantly postpone cuts.

A subdued CPI reading now needs to be followed by another subdued reading in May.

The price jumps in January and February that led to a 0.4% increase in the core CPI was primarily due to spikes in a few volatile items, which have historically shown weak pricing.

We are less concerned about the persistent price increases of these items.

The greater concern is the possibility of a continuous trend of items posting significant price increases, which could drive the overall CPI above the 2% target.

This would result in a steadily increasing inflation rate.

Bank of America

After two firm reports to start the year, core CPI inflation should cool off in March. We expect core CPI inflation to round down to 0.2% m/m (0.24% unrounded) owing to a slight decline in core goods prices and a little less price pressure from core services.

If our forecast proves correct, it will be a confidence builder for the Fed and keep the option to cut in June alive.

Previous Release

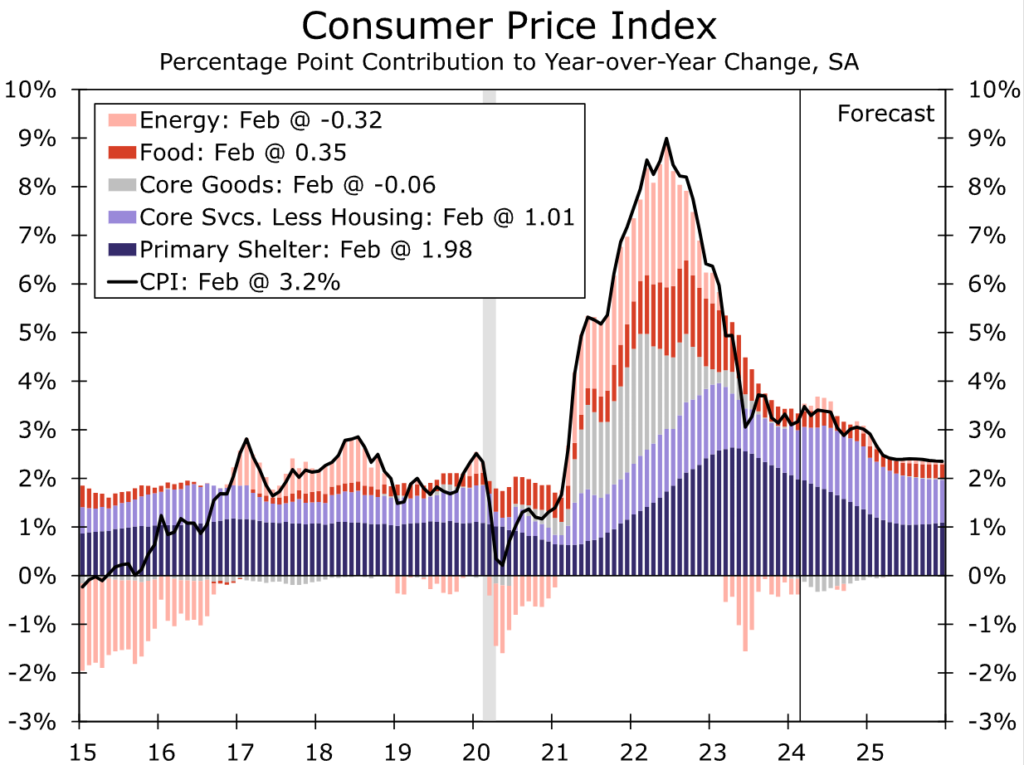

On March 12th, at 08:30 ET, the BLS released the February CPI report.

US CPI YoY came out at 3.2%, which was higher than the forecast and previous of 3.1%.

US CPI MoM came out at 0.4%, as expected, and higher than the previous of 0.3%.

For the Core CPI numbers, Core YoY came in at 3.8%, which was higher than the forecast of 3.7%, but still lower than the previous of 3.9%

This caused a whipsaw in the dollar, US indices, and US government bond yields.

This is because the US inflation data came in slightly mixed, but broadly as expected.

The CPI YoY did come in higher; however, the Core CPI YoY came in lower than the previous.