ECB Interest Rate Prep

Sentiment:

BofA: We expect no major change at next week’s ECB press conference. Confidence in getting closer to rate cuts is rising, but still insufficient for action. The “meeting-by-meeting” approach means we shouldn’t expect guidance on the pace and depth of the cutting cycle. Our call remains: Jun. Sep. Dec-24 cuts and one per meeting to 2% by Jul-25.

Goldman Sachs: We expect next week’s ECB meeting will continue to put the focus on the fact that there will be “a lot of data” available at the June meeting to start rate cuts. Importantly, while Euro area growth expectations have stabilized, consensus expectations for the US have easily beaten that bar (and we think there is more to go).

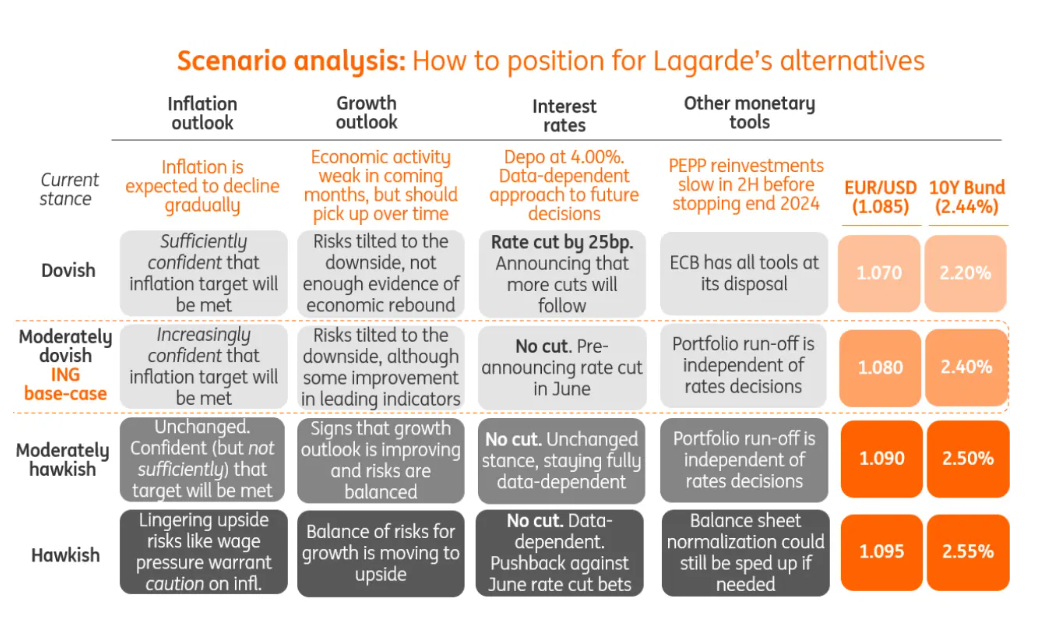

ING: We look at four scenarios and implications for FX and rates ahead of this week’s ECB policy announcement. Our base case is that the ECB will signal it is ready to lower rates in June, reinforcing market expectations on monetary easing this year. For markets, it may be more relevant how the ECB communicates about its plans beyond June though.

Deutsche Bank: The downside surprise on March core HICP was not large enough to think the hawks will concede to the doves and agree to a rate cut already on 11 April. The ECB needs additional data over the next two months to underpin its confidence in price stability and open the door to a rate cut in June. We do not expect the ECB to precommit in April to cutting in June, but it should be clear that a June cut is the working assumption barring a significant shock. The path of monetary policy beyond June will remain uncertain, in part because the ECB intends to keep its options open. The reasonable range for the volume of cuts in 2024 is 75-125bp. Our baseline expectation remains 25bp rate cuts at each of the five Governing Council meetings from June to year-end. This is a little aggressive and needs data to weaken further. The clear risk is the ECB skips one or both nonforecast meetings (July and/or October) and cuts only three or four times. Whether the ECB skips one or both non-forecast meetings will depend on the data. The downside surprise on March core HICP tells us that the upside prints in January and February were not necessarily an inflection point in the disinflation trend and leaves the door open to more frequent cuts. On the other hand, financial conditions need careful monitoring. Effective monetary transmission requires financial conditions to remain tight enough for long enough. A premature and rapid easing of financial conditions would be counterproductive and could encourage the ECB to skip cuts.

JPMorgan: The ECB has sent a strong signal of late for a June cut. This is surprising given the latest data. After the upside inflation surprise in February, which the latest minutes discussed as a “warning shot,” this week’s flash HICP report for March looked sticky in services with a 0.42%m/m, SA, gain. An early Easter does not look to have artificially boosted this number given that package holiday price inflation eased in Germany. Overall, core inflation eased from a 0.35%m/m average in Jan/Feb to 0.24%m/m in March, but even the latter is still a 3%ar and reflects strength in services. On balance, we see core inflation tracking 2.8%oya this quarter compared to the ECB’s implied forecast of 2.5%. In addition, incoming wage data still look solid while productivity data look weak. Combined with the latest upward revision in the final composite PMI signaling a 0.9%ar on GDP growth, the urgency for rate cuts should be reduced. Nevertheless, recent ECB commentary keeps risks balanced for a June move, but we will watch Lagarde’s comments next week for any thawing in the seemingly firm calendar guidance on the June cut.

MUFG: Market participants see increasing prospects of a divergence in the monetary policy path between the Fed and the ECB and we certainly concur that over the short-term at least there are increased downside risks for EUR/USD. A key determinant of those expectations will come on Thursday when the ECB meets for its monetary policy decision. The inflation data has continued to come in on the weaker side with both the headline and core YoY estimates last week weaker than expected. That should certainly give President Lagarde the scope on Thursday to confirm increasing confidence in the achievement of the price stability goal. The March forecasts on inflation are already essentially very close to officially acknowledging that.

Societe Generale: This week, both euro area headline and core inflation came in 0.1pp below the consensus forecasts. Yet again, base effects caused the main movements, however, it is the core story that is now more important. Next Thursday, we expect no policy changes at the ECB meeting. The ECB has pointed to June for a first rate cut. Even if we see risks that activity and wage data by June will look strong, the focus seems to be on tempering market expectations beyond June.

Money Market Pricing:

April 11th: Money Markets price in 75 basis points of rate cuts from the European Central Bank this year, from around 100 bps in mid-March

April 10th: Money markets price in around 80 bps of ECB rate cuts in 2024 from 87 bps before US data.

ING Cheat Sheet:

Prior Release:

ECB Interest Rate Actual 4.5% (Forecast 4.5%, Previous 4.50%) – March 07th 2024