US Nonfarm Payrolls Prep

On Friday the 3rd of May at 08:30 ET, the BLS is set to release the latest Nonfarm Payrolls report, representing the month of April.

Here are some views on what to expect.

Overview

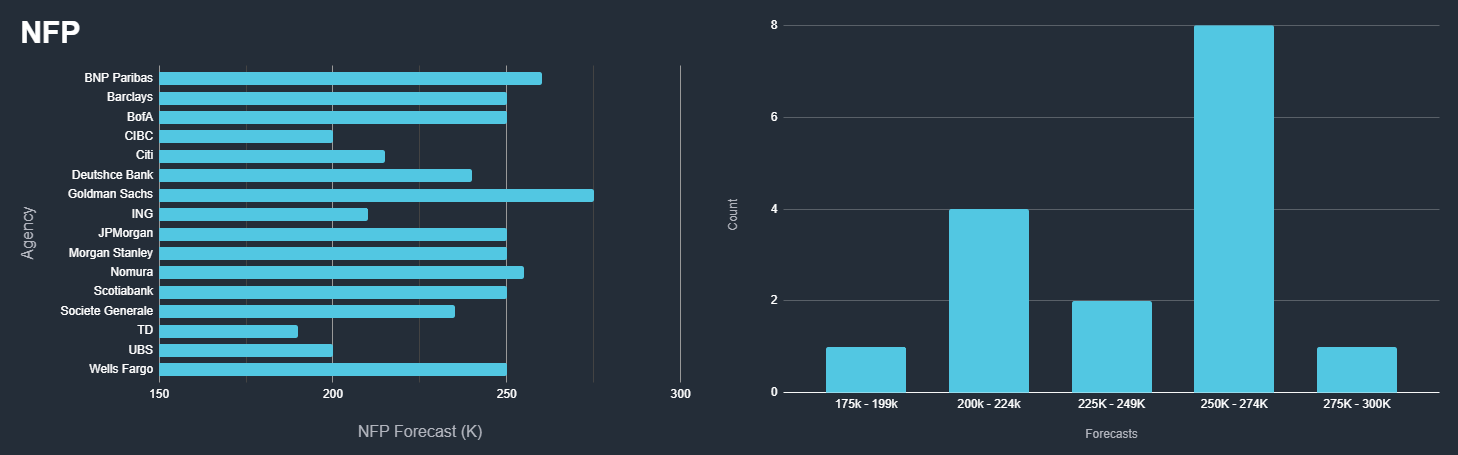

For Nonfarm Payrolls, median analyst expectations see a gain of 241k.

According to a survey of 65 economists, the highest estimate is 280K, and the lowest is 150K.

The majority of bets are in the range of 208K – 262K.

For the Unemployment Rate, the median forecast is 3.8%, with the highest estimate at 3.9%, and the lowest at 3.7%

Here are some views from the forecasters at some of largest invest banks

Commentary

Wells Fargo

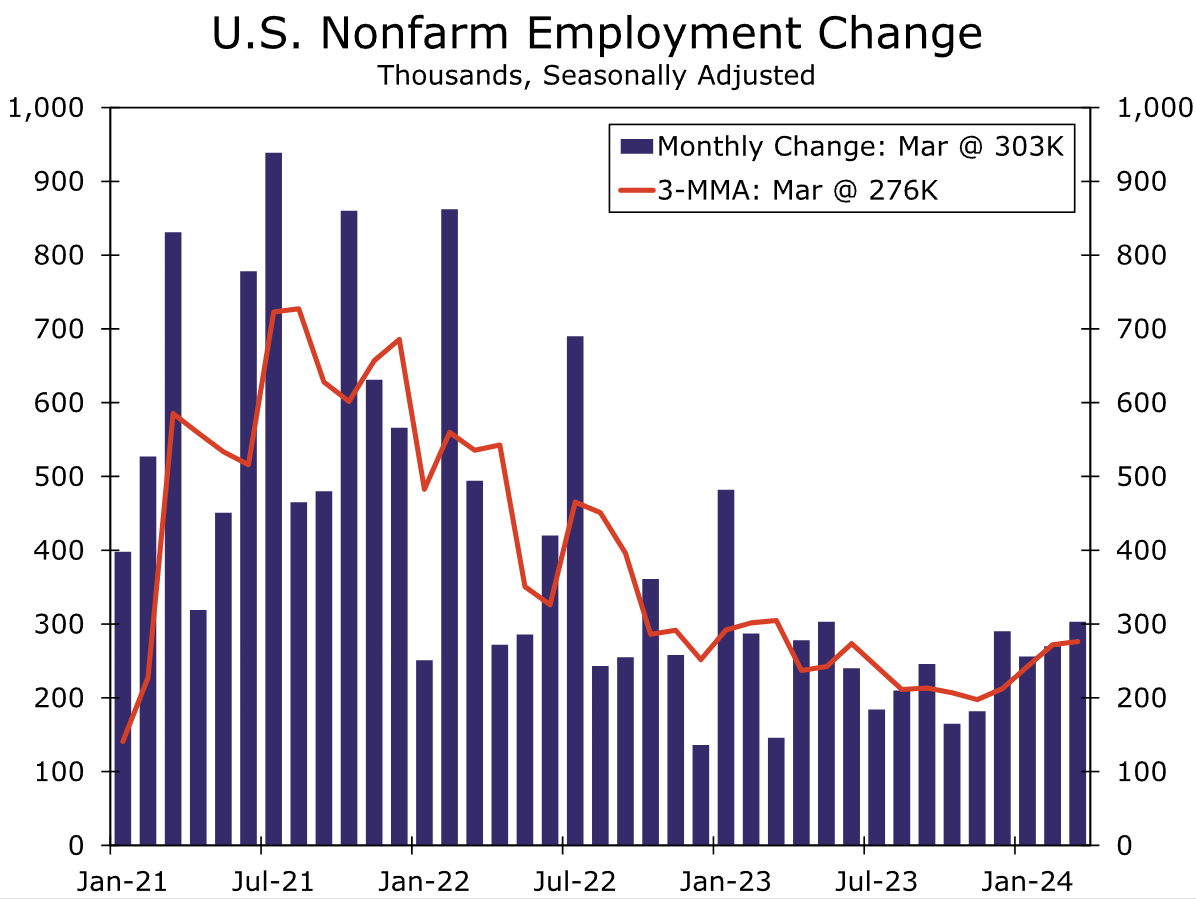

The labor market was widely expected to lose momentum this year, but the opposite has happened.

The economy created an average of 276K jobs per month in Q1-2024, up from 212K per month in the fourth quarter of last year.

The sustained strength in hiring has left few people without work.

The unemployment rate has been below 4.0% for 26 consecutive months. That is more than the total number of months below 4% in the previous 50 years combined.

Despite the evident strength in the job market, there are some chinks in the armor.

There has been a trend decline in job postings, fewer small businesses looking to hire and news of layoffs keeps popping up.

Despite these headwinds, resilient spending and robust economic growth ought to be supportive of further growth in payrolls in our view.

We anticipate the economy added another 250K jobs in April and that the jobless rate will stay at 3.8% to remain below 4% for a 27th consecutive month.

Bank Of America

We forecast a 250k increase in May nonfarm payrolls (200k private).

With initial jobless claims low and moving sideways, we don’t expect the recent momentum in the labor market to slow. Moreover, catch-up effects in certain industries continue to buoy job growth.

The unemployment rate should stay flat at 3.8%, although we see risks that it will round down to 3.7%.

We expect average hourly earnings to accelerate to 0.4% m/m, or 4.2% y/y, driven by the fast-food wage hike in California.

UniCredit

Nonfarm payrolls likely rose 230k in April, less than the average of 276k in 1Q24. The NFIB survey of small businesses points to a slowdown in private-sector hiring.

We expect the unemployment rate to have ticked up to 3.9% from 3.8%. Measures of labor-market tightness continue to ease, partly driven by improved labor supply.

Average hourly earnings growth likely rose another 0.3% mom, taking the yoy rate down slightly to 4.0% from 4.1%.

JPMorgan

We think the Goldilocks zone is 125k to 250k jobs. Anything above 300k and the market will move to thinking the economy is overheating especially if we see any increase to Avg. Hourly Earnings.

Alternatively, while a 75k – 125k print will not crush Equities it will shift investors to a more cautious stance as there are still critical mass of investors who see an inverted yield curve as too powerful a signal to ignore.

While I am not in that camp, since the yield curve has been inverted since July 2022 and think a recession comes at earliest in 2025, this view is espoused by material amount of AUM.

That said, once you get to 50k, zero, or negative NFP prints then this changes the narrative to recession or stagflation (subject to CPI levels).

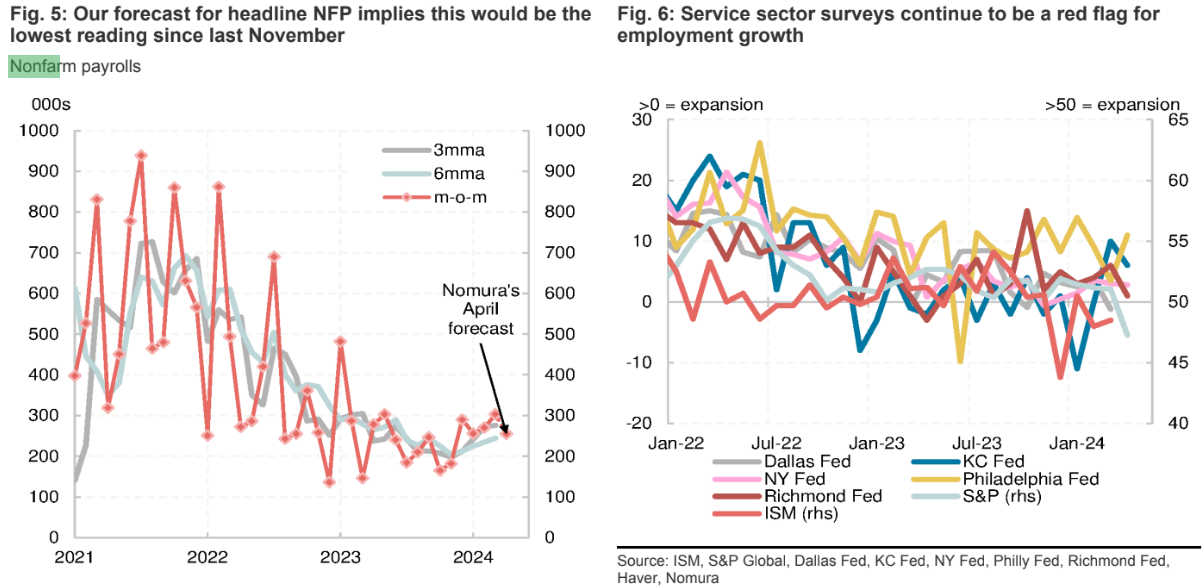

Nomura

We expect job gains slowed in April to 255k. This would be the lowest reading since last November, but in line with the six-month and 12-month averages.

Lead indicators for employment growth have been mixed. Continuing claims ticked down in the survey week and tax withholding was strong in early April. Service sector surveys are a red flag though. Both national surveys, the ISM and PMI, show contracting employment in their latest readings (and ISM services employment has been below 50 for

three of the past four months).

Previous Release

On April 5th at 08:30 ET, the BLS released the US Nonfarm Payrolls and Unemployment Rate numbers representing the month of March.

Nonfarm Payrolls surprised to the upside at 303K, on expectations of 214K. The prior was 275K.

The Unemployment Rate came in as expected at 3.8%.

This caused strength in the dollar and US government bond yields, and weakness is US stocks, as traders took the higher employment reading as a potential upside risk to inflation, feeding into the higher-for-longer rate narrative.