BoE Interest Rate Prep

Commentary:

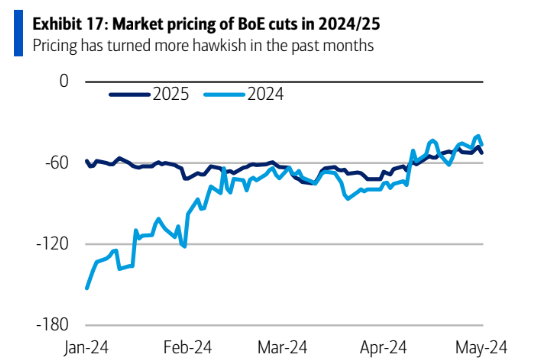

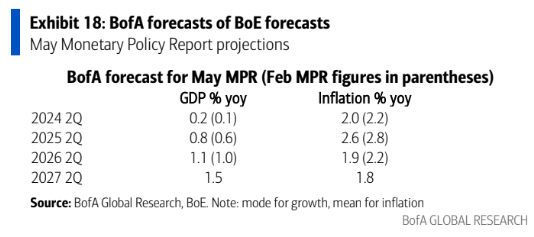

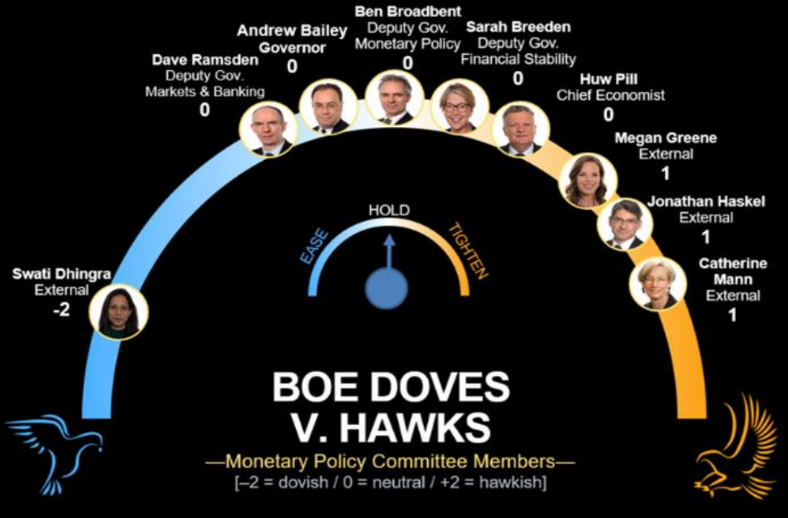

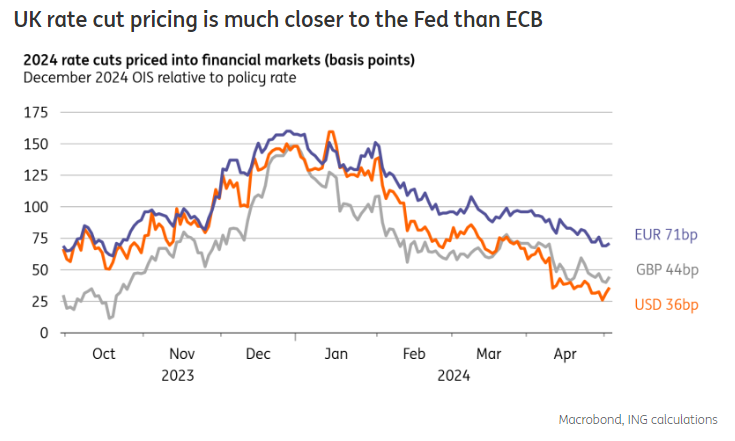

BofA: We expect the Bank of England (BoE) to keep the Bank Rate unchanged at next week’s policy meeting with a 7-2 vote in favour (with Dhingra and Ramsden voting for a cut). While Bailey is probably moving towards a cut, we doubt he will vote against a majority. We don’t expect guidance to change, at least not yet, we think the BoE is likely to maintain that “monetary policy would need to be sufficiently restrictive for sufficiently long”. But we should see in the minutes a continuation of the pivot towards cuts. Forecasts are likely to reflect that. Given hawkish market pricing (Exhibit 17) we would expect inflation slightly below target by 2026, leaving the door open for a cut in the next few meetings, including June.

Citi: We expect an 8-1 vote split, though it sees risks of 7-2. The MPC split on when to cut and changes to the majority paragraph may indicate a cutting bias. 9 out of 11 last meetings has seen a daily rally in 10s, our rates strategists point out.

Deutsche Bank: Our UK economist expects this week’s meeting to set the stage for the first rate cut in June and foresees dovish shifts in the MPC’s modal CPI projections and its forward guidance.

Goldman Sachs: We expect the market to focus on the conviction of the core of the committee on how secure the underlying trend disinflation is. This is because with more uncertainty in the global duration backdrop and labour market data quality remaining a challenge in the UK, the onus falls more squarely on policy to provide a clear signal.

MUFG: While the BoE is expected to leave the policy rate on hold at 5.25% in the week ahead, recent comments from MPC officials have indicated that more MPC members may join arch dove Swati Dinghra in voting for a rate cut. Deputy Governor Dave Ramsden is the most likely candidate given he recently judged that risks to the BoE’s inflation forecasts are now “titled to the downside”. He expressed a similar view to Governor Bailey in having more confidence that the UK appears less of an outlier in terms of higher inflation than in other major economies, and now appears more of a laggard with inflation set to slow further this year. The shift in the balance of risks should be captured in the updated inflation projections in next week’s Quarterly Inflation Report. We expect the updated forecasts to indicate a lower probability of inflation

overshooting the BoE’s inflation target over the forecast period. In light of these developments, we have held on to our forecast for the BoE to begin cutting rates.

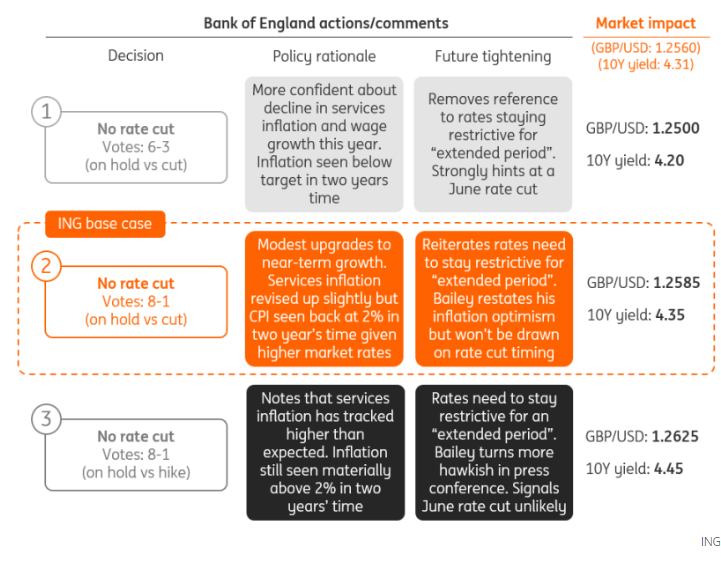

ING:The Bank of England is inching towards the first rate cut, which we expect in August. Expect an optimistic air to Thursday’s meeting but we think the Bank will stop short of rewriting its forward guidance, which would be tantamount to endorsing a June rate cut at a time when the near-term direction of UK inflation is still uncertain.

UniCredit: Today, we expect the Bank of England’s monetary policy committee (MPC) to vote 7-2 to maintain the bank rate at 5.25%, with Deputy Governor Dave Ramsden joining MPC member Swati Dhingra in voting for an immediate cut. If we are right on the vote split, it would be another small step towards a first rate cut after the March MPC minutes stated that policy “could remain restrictive even if Bank Rate were to be reduced”. Recent macro data point to ongoing disinflation and a weakening labor market, but a pick-up in GDP growth. We expect the central bank to forecast inflation falling slightly below 2% at the two-year horizon, and then further below 2% at the three-year horizon, largely reflecting the higher market-implied path for the bank rate that the forecasts will be conditioned on. We still expect the MPC to cut the bank rate by a total of 75bp this year, starting in August.,

BoE Voting Member Split:

ING’s Market Pricing:

ING’s Three Scenarios:

Previous Reaction:

BoE Bank Rate Actual 5.25% (Forecast 5.25%, Previous 5.25%) [March 21st 2024]