US CPI Prep

On Wednesday the 15th of May, at 08:30 ET, the BLS is set to release the the latest US inflation print representing the month of April.

Here are some views on what to expect.

Overview

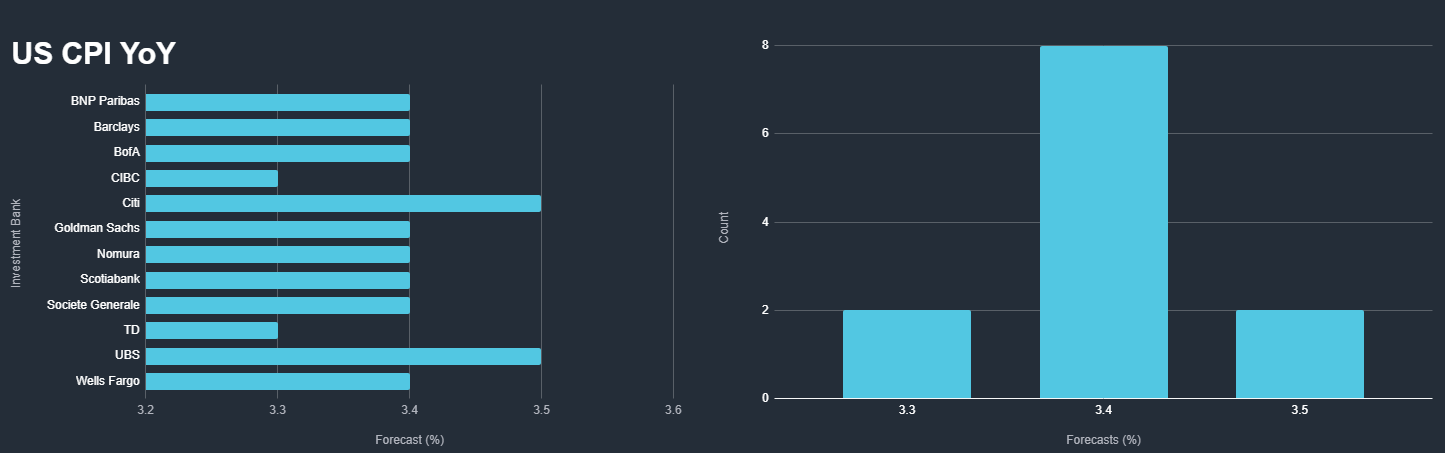

For US CPI YoY, the median forecast is 3.4%, down from the prior of 3.5%. According to a survey of 44 economists, the highest forecast is 3.5%, and the lowest is 3.2%.

As for CPI MoM, from a survey of 61 qualified economists, the median forecast is 0.4%, unchanged from the prior 0.4%, the highest estimate is 0.4%, and the lowest is 0.3%.

Here are the expectations from some of the largest investment bank forecasters.

Commentary

UniCredit

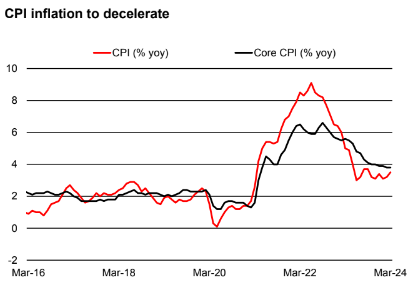

We expect headline CPI inflation decelerated to 0.3% MoM in April from 0.4%.

In yearly terms, we expect a decline to 3.4% YoY from 3.5%.

Gasoline prices likely contributed about 0.1pp to MoM inflation. We see upside risks to our forecast for headline inflation.

We also see core CPI inflation slowing down to 0.3% MoM from 0.4% MoM (3.6% YoY from 3.8% YoY).

Housing prices likely rose another 0.4% MoM, but inflation is likely to gradually soften in the coming months, as indicated by market rents.

We expect used-car prices fell again, while car insurance prices likely rose at a slower pace after the sharp rise in March.

While consistent with an ongoing disinflationary process, the core CPI print would remain too high for the Fed’s liking, even when translated into core PCE inflation (the Fed’s preferred measure).

Morgan Stanley

While Wednesday’s report will be critical for the timing of the first cut, regardless of the print, we remain confident that inflation will trend lower over the year, making the question when, not if, the Fed will cut.

If our forecast is right, the April print on Wednesday will not represent a sea change.

We expect core CPI to be 0.29%M with a glacial decline in rent inflation, core goods prices falling a touch, and mild reversion of the upside surprise in services inflation.

If we are wrong, the market will likely adjust the implied timing of the first cut earlier or later, but we do not think that the path for the year is likely to change much.

Where the signal is greatest, it points to disinflation. And where the data suggest upside risk, they are the noisiest. A key component to watch on Wednesday will be rents.

Housing inflation comprises 40% of core CPI and 18% of core PCE, so wherever housing inflation goes, the whole index will likely follow.

By now, most folks in markets know that the BLS takes current rents and essentially spreads those price changes over a couple of quarters. Current readings on rents have been very weak, so a continued fall in the official statistics for the rest of the year seems clear.

Indeed, despite the surge in immigration over the last year and this, multifamily vacancies are approaching historical highs. In housing inflation lies the clearest signal for the path of inflation – and that path is lower.

Wells Fargo

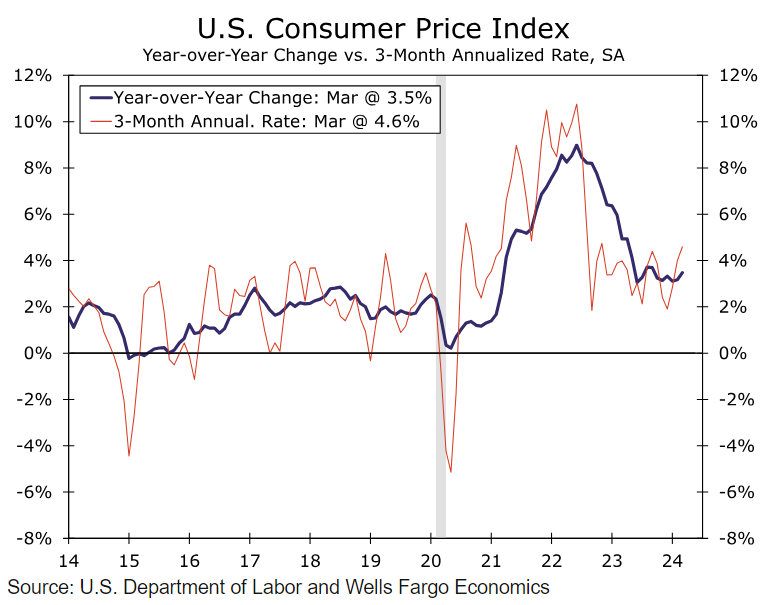

The trend lower in inflation was interrupted in the first quarter, fanning fears of a renewed acceleration in price growth that would encourage later and less easing from the Federal Reserve this year.

We expect to see some renewed progress in April, though the data will remain consistent with only a slow journey back to 2%.

Specifically, we suspect the CPI rose by 0.4%, which would leave overall prices running at nearly a 5% three-month annualized rate.

Progress in lowering core inflation, however, likely resumed.

Excluding food and energy, we estimate prices rose 0.3%, which would push the year-over-year rate down to 3.6%, a three-year low.

While inflation has been stubborn in recent months, we do not believe the underlying trend is re-accelerating.

Supply chain pressures are not easing as rapidly as a year or two ago, but they are not building either.

Shelter inflation looks set to moderate further this year, while services ex-housing inflation should benefit from tamer growth in goods-related input costs and gradual loosening in the labor market.

Bank of America

For the April CPI report, we forecast headline CPI rose by 0.3% m/m.

Based on our forecast, the y/y rate should tick down to 3.4%. The main factor behind our expectation for a relatively firmer headline CPI print is energy prices.

Meanwhile, we expect core inflation to also print at 0.3% m/m.

This would be a noticeable moderation from the 0.37% m/m 1Q average. However, it will not be enough of a moderation to provide much confidence to the Fed in our view.

Previous Release

On April 10th at 08:30 ET, the BLS released the US CPI report for March.

Across the board, CPI was higher than expected.

Headline YoY CPI came in at 3.5%, above expectations for 3.4% and the previous 3.2%, while MoM was 0.4%, higher than expectations of 0.3%, and unchanged from the prior.

The ‘Core’ CPI readings, which strip out volatile food and energy components, were also higher than expected.

Core CPI YoY was 3.8%, above expectations of 3.7% and unchanged from the prior, while MoM was 0.4%, higher than expected 0.3%, and unchanged from the prior also.

As pictured above, this release caused strength in the dollar and US government bond yields, and weakness in the S&P 500.

This is because it feeds into the narrative that some Fed officials had warned of – a stalling in inflation’s progress to the 2% target. This caused markets to price in the ‘higher-for-longer’ interest rate narrative, to give rates more time to work on bringing inflation back to target.