US Nonfarm Payrolls Prep

On Friday the 7th of June at 08:30 ET, the BLS is set to release the latest Nonfarm Payrolls report, representing the month of April.

Here are some views on what to expect.

Overview

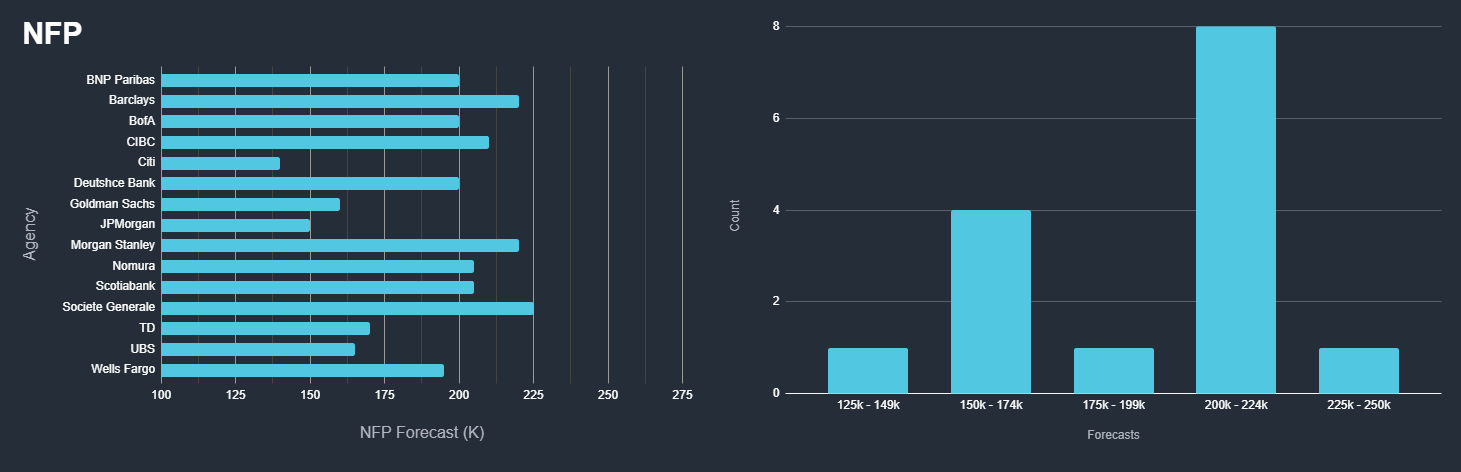

For Nonfarm Payrolls, median analyst expectations see a gain of 186K

According to a survey of 65 economists, the highest estimate is 258K, and the lowest is 120K.

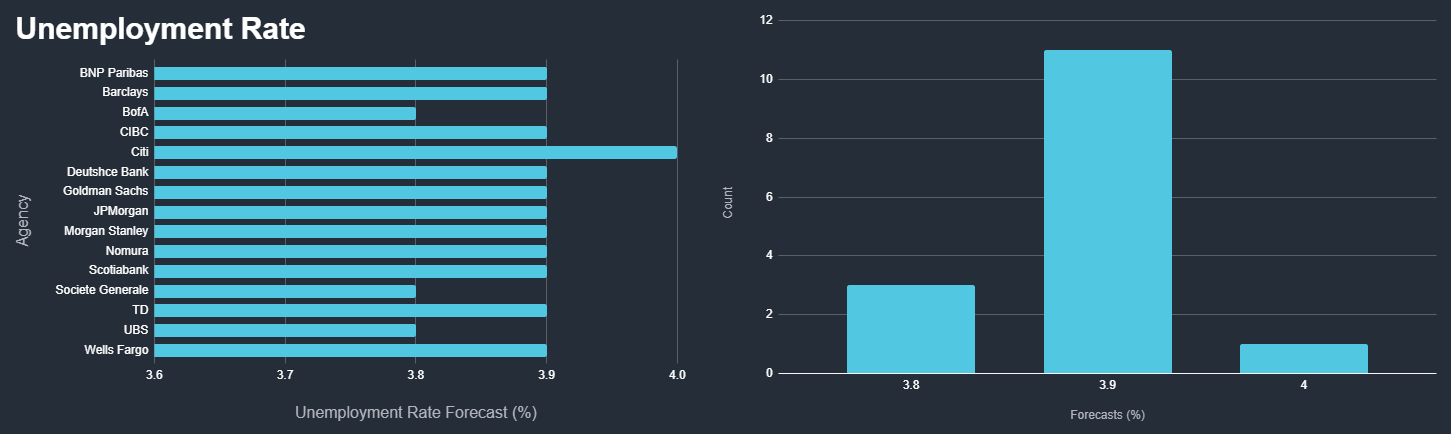

For the Unemployment Rate, the median forecast is 3.9% with the highest estimate at 4% and the lowest at 3.8%

Estimate ranges are subject to change

Here are some views from the forecasters at some of the largest investment bank forecasts.

Commentary

Wells Fargo

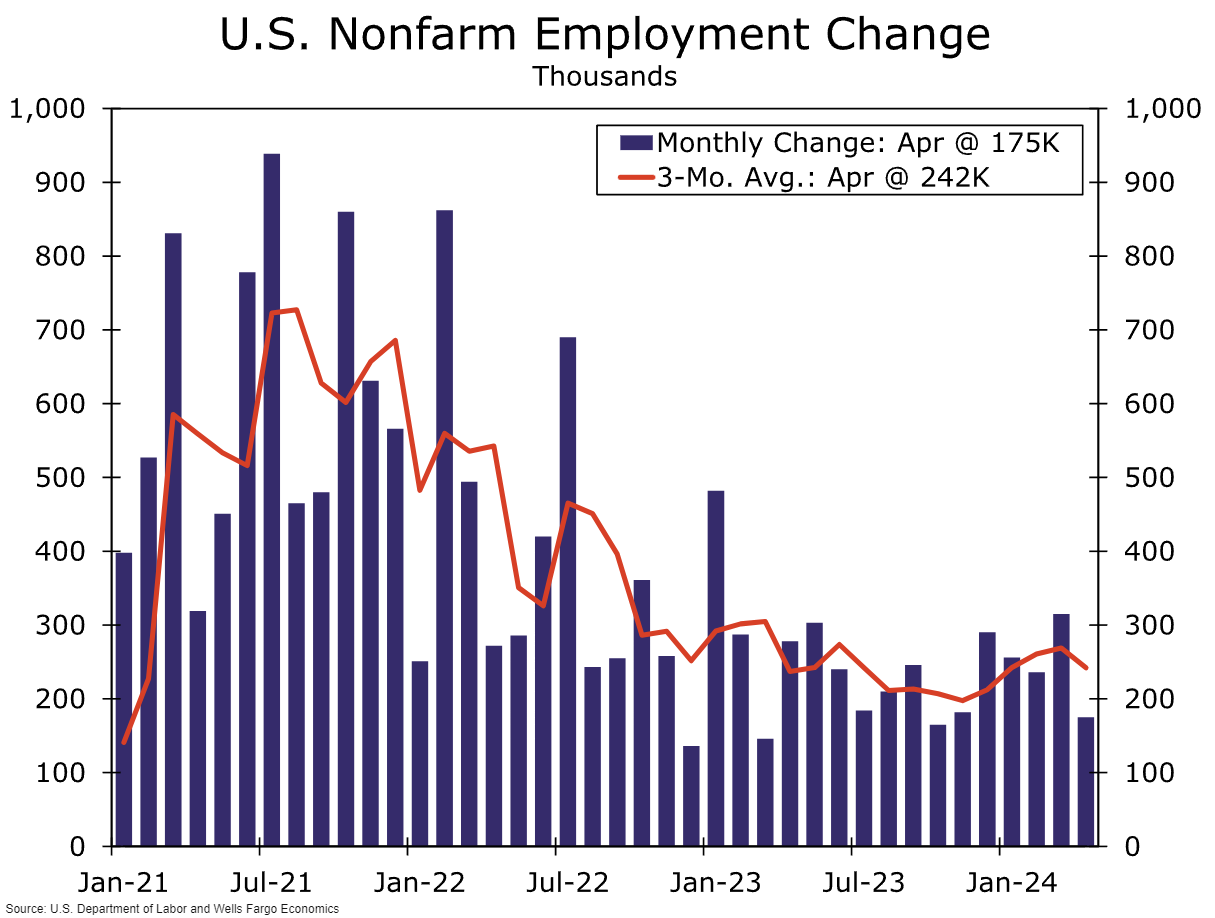

Nonfarm payrolls accelerated in Q1, rising at an average monthly pace of 269K compared to average monthly growth of 213K in the second half of 2023.

Strong job growth and upside surprises in the inflation data led the FOMC to put its plans for rate cuts on hold until at least the second half of the year.

Job growth came back down to Earth to start Q2, with employment rising by 175K in April.

We think the pace of job growth over the next few months will look more like the April pace, and we forecast a 195K increase in nonfarm payrolls in May.

April saw steep slowdowns in leisure & hospitality and government hiring relative to each sector’s recent trends. Leisure & hospitality employment expanded by 5K in April compared to a 25K average monthly pace in Q1, while government hiring rose by 8K compared to the Q1 average of 62K.

We expect a partial bounceback in these sectors will help boost hiring in May relative to April, but ebbing labor demand should still keep employment growth below the robust pace registered in Q1.

We look for the unemployment rate to hold steady at 3.9% in May.

Bank of America

We think strong employment growth in laggard industries can persist this year, albeit to a lesser extent.

We expect payrolls to increase by around 170k per month in 2024. Job growth should then slow to an average of 100k in 2025.

We also expect the participation rate to be rangebound at 62.6-62.7% across our forecast horizon.

As a result, we only see a small and gradual increase in the unemployment rate, with a peak of 4.1% in 4Q 2025.

UniCredit

We expect nonfarm payrolls to have risen by 180k in May, after rising by 175k in April.

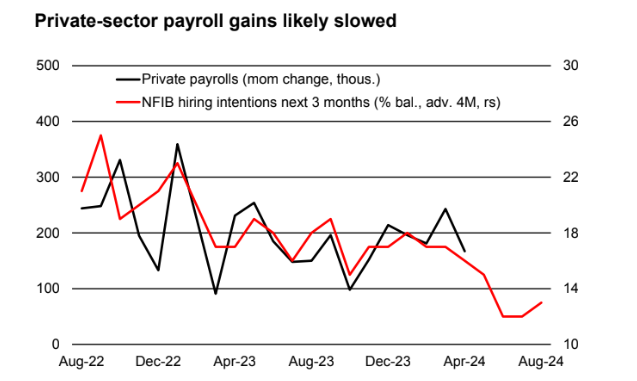

Private-sector payrolls likely rose by 150k, which would be a smaller gain than their increase of 167k in April.

While layoffs have remained low, surveys point to a slowdown in private-sector hiring.

The unemployment rate probably held at 3.9% for May, with employment gains roughly in line with that required to absorb population growth (an estimated 180k per month, given higher immigration).

With the labor market moving into better balance, average hourly earnings growth likely rose 0.2-0.3% mom. This would leave the yoy rate unchanged at 3.9%, with risks skewed to the downside. This is still a bit above the 3- 3.5% range that most Fed officials judge to be consistent with meeting the Fed’s 2% inflation target over time.

Societe Generale

We expect non-farm payrolls to show more than 200k added workers for May.

The key message from this gain would still be one of strength in absolute numbers.

Our belief is that fewer

industries are contributing to the gain, with healthcare and government workers responsible for the lion’s share. These sectors are among the largest in terms of payrolls, so even modest increases in job growth contribute meaningfully to the monthly figure.

Previous Release

On May 3rd at 08:30 ET, the BLS released the latest Nonfarm Payrolls report representing the month of April.

NFP came in lower than expected, 175k on estimates of 240k, the prior was revised up to 315k from 303k.

The Unemployment Rate came in higher than expected, at 3.9% on estimates of 3.8%.

This caused weakness in the dollar and in US government bond yields, and strength in US stocks, as the cooling down in the April employment situation was seen as a downside risk to inflation, which helped push forward bets on Fed rate cuts this year.