US CPI Prep

On Wednesday the 12th of June, at 08:30 ET, the BLS is set to release the latest US inflation print representing the month of May.

Here are some views on what to expect.

Overview

The median expected US CPI YoY to remain unchanged from the prior at 3.4%.

According to a survey of 20 economists, the highest estimate is 3.5%, and the lowest is 3.3%.

As for Core CPI YoY, the median forecast is 3.5%, down from the prior 3.6%

The highest estimate is 3.6%, the lowest is 3.5%, where the majority of estimates are placed.

General Market Expectations

NOTE: This is based on historical information and fundamental knowledge, and is not guaranteed.

Data should be taken in its totality.

US Equities

If CPI data comes in higher than expected, you could expect weakness in US stocks, as this feeds into the narrative of ‘higher for longer’ US interest rates, which keeps borrowing costs high for corporations and can impact profits, as well as the supply of credit to consumers, it can also apply pressure on demand from the consumers, as their dollars do not go as far with higher prices, which can force austerity.

The opposite is also true, if CPI comes in lower than expected, this will push forward bets on Fed rate cuts this year, increasing the chances of borrowing costs coming down, allowing for more growth potential for US companies, and relieving price pressures on consumers, making way for strength in US stocks.

Dollar $

In the event of higher CPI, the dollar is likely to see some strength in reaction to this, as it implies rates will need to stay higher. Higher rates can lead to higher government bond yields, and with US government debt yielding higher, the local currency strengthens as well, as participants can get greater interest on their dollar investments.

The opposite is also true, a lower-than-expected inflation reading could likely weaken US treasury yields as it could push forward expectations on US interest rate cuts this year, which would be likely to cause the dollar to weaken.

Commentary

UniCredit

We expect headline CPI inflation eased to 0.1% mom in May from 0.3% in April. In yearly terms, the inflation rate probably edged down to 3.3%, but it’s a close call between 3.3% and 3.4%. Gasoline prices will likely subtract 0.15pp from the mom reading.

Core inflation will likely come in at 0.3% mom for a second consecutive month, although is likely to show easing to two decimal places. In annual terms, it will probably decelerate to 3.5% yoy from 3.6%.

Even when converted into core PCE inflation (the Fed’s preferred measure), it would likely still be a bit too high to make the Fed confident that inflation is sustainably moving down to 2%.

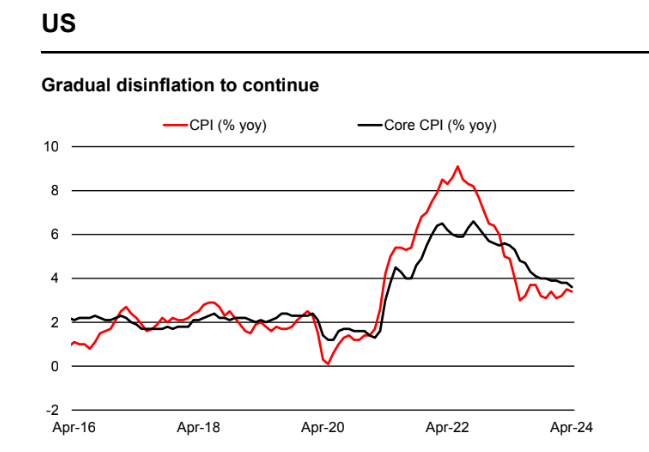

Regarding core inflation drivers, the main upward contributions are likely to again come from housing and non-housing core services (particularly car insurance), but gradual disinflation is likely. Used car prices probably fell again.

Wells Fargo

Inflation will be back in the spotlight next week with the release of May’s CPI report on Wednesday.

We anticipate the report to provide additional evidence that inflation is returning to a cooling trend after flaring up in Q1.

Although food prices likely picked up slightly, lower oil prices should translate to a decline in energy prices during the month, helping yield a soft reading on the headline.

Goods prices likely fell again, driven by declines in vehicle, apparel, recreation and household goods prices.

Meanwhile, services prices look to have increased for a second straight month amid the slow moderation in shelter costs and other services inflation.

Altogether, we estimate that the headline CPI increased 0.1% during May, which would amount to a 3.3% year-over-year rise.

In terms of core CPI, we look for a 0.3% monthly gain and a 3.5% year-over-year increase.

As of this writing, our forecasts for headline and core CPI are generally consistent with the Bloomberg consensus.

The results of May’s CPI release are not likely to have a meaningful impact on the outcome of the FOMC meeting next week, although Fed officials will no doubt be paying close attention.

Morgan Stanley

We forecast core CPI inflation at 0.28%M in May (3.5%Y) on lower services inflation.

Data in line with our expectation point to May core PCE at 0.22%M from 0.25%M in April. We expect headline CPI at 0.146%M due to negative energy inflation.

Bank of America

After averaging 0.4% m/m in January through March, inflation took a small step in the right direction in April with core Consumer Price Inflation (CPI) and Personal Consumption Expenditure Inflation (PCE) both decelerating to 0.3% m/m (core PCE inflation was 0.26% rounded to two decimals).

We think May follows suit and our forecast is for core and headline CPI inflation rising by 0.3% (0.30% to two decimals) and 0.1% m/m. This would leave core and headline up 3.6% and 3.4% y/y, respectively, both unchanged from April levels. We look for core goods prices to increase slightly changed on the month, while services inflation should show some modest improvement but remain sticky at 0.4% m/m.

Previous Release

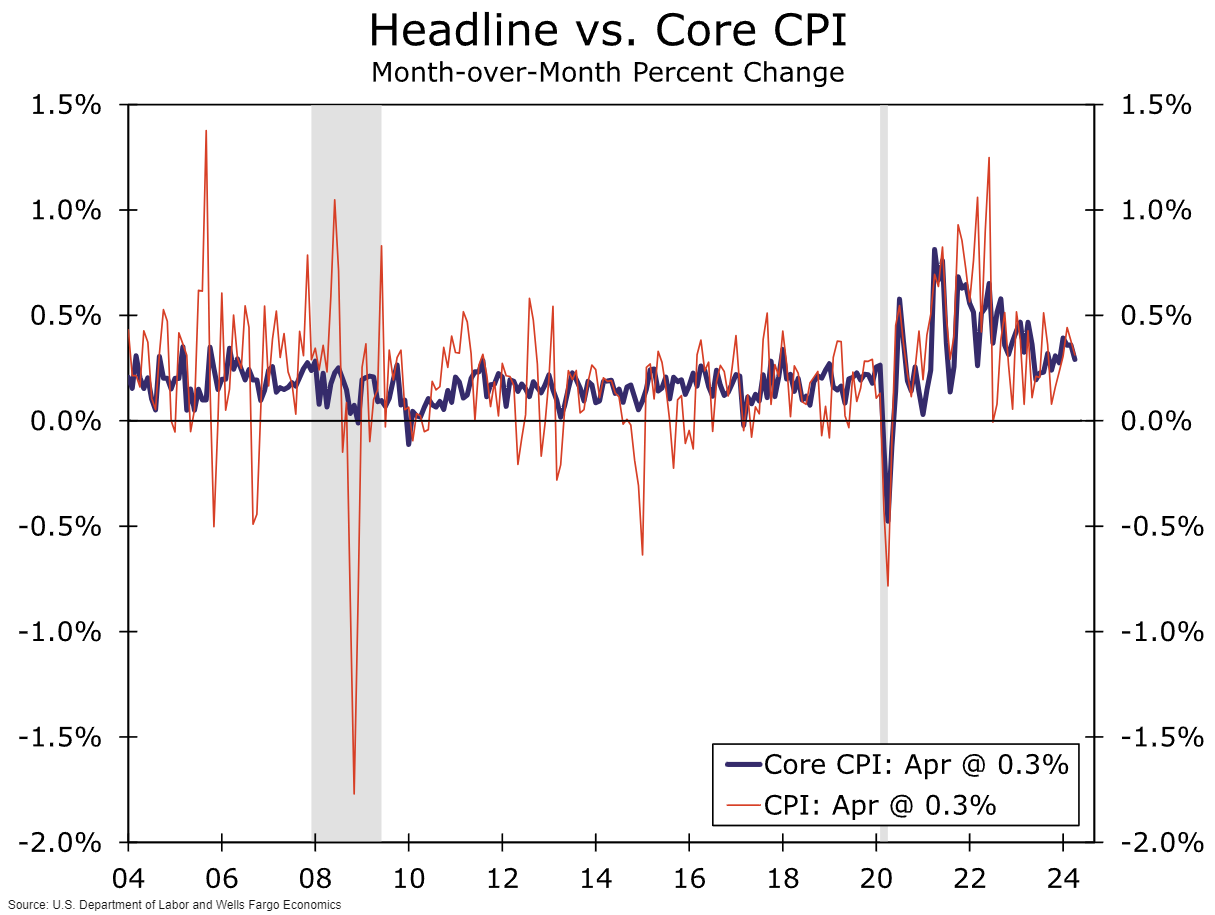

On May 15th at 08:30 ET, the BLS released the April CPI numbers.

CPI YoY came in at 3.4%, as expected, and down from the previous 3.5%.

Core CPI YoY came in at 3.6%, also as expected, and also down from the previous 3.8%.

CPI MoM came in lower than expected, at 0.3% on a median forecast of 0.4%.

This caused weakness in the dollar and US government bond yields, and strength in the S&P 500, as it showed inflation was cooling down, fighting fears of inflation progress stalling that was prominent at the time of release.

This also pushed forward bets on Fed rate cuts for this year, as inflation continuing it’s descent implies that US interest rates do not have to stay high for as long as previously thought.