US Interest Rate Prep

On Wednesday the 12th of June at 14:00 ET, the Federal Reserve is set to announce the result of it’s latest monetary policy meeting.

The consensus is for the Interest Rate in the US to remain unchanged at 5.5%, so attention will turn to the Rate Statement, released with the Interest Rate decision, as well as the Summary of Economic Projections and the subsequent press conference from the Fed’s Chairman Powell.

Markets will be looking for clues on the Federal Reserve’s thoughts on the future path of interest rates for the US.

Here are some views on what to expect.

Commentary

Wells Fargo

FOMC members will hold their next meeting on June 11-12.

The committee is widely expected to keep the federal funds rate bound between 5.25% and 5.50%, a level at which it’s been held for nearly one year.

Our focus therefore will be on the June Summary of Economic Projections (SEP).

Most members expected 50 bps of cuts or less; however, a dovish outlier pushed the median expectation up to 75 bps.

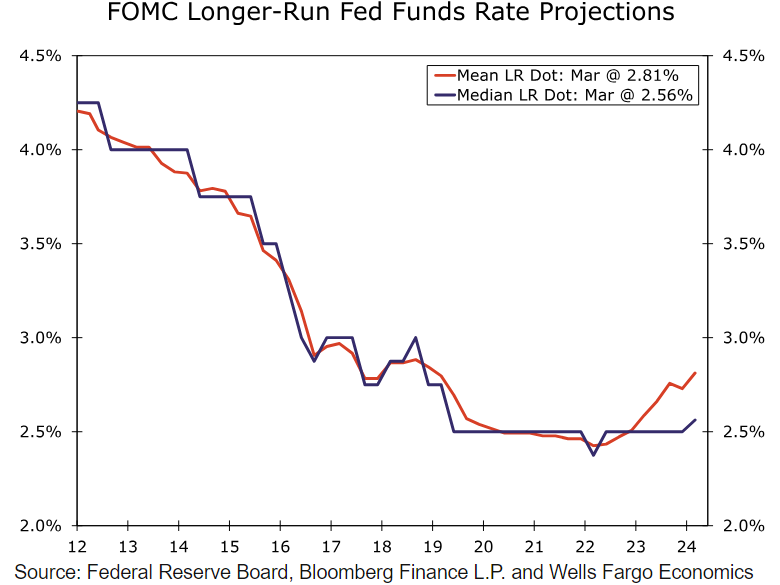

Meanwhile, longer-run interest rate estimates inched higher, surpassing 2.5% for the first time since March 2019.

Our call is for the median 2024 dot to lift to 4.875%, reflecting expectations for two 25 bps cuts this year instead of three.

That said, we would not be surprised if the median projection calls for just one rate cut.

This morning’s employment release was chock-full of mixed messages that are unlikely to sway the committee one way or another.

The May CPI is set for release the morning of June 12, but FOMC members will probably not have enough time to incorporate it into their forecasts.

Nevertheless, any new inflation data will be instructive on the trend direction of price pressures.

We look for an incremental improvement in core CPI consistent with a return to gradual descent, but doubt it will convince the committee that inflation is sustainably headed back toward 2%.

Our base case remains for the first rate cut to occur in September.

ING

The US economy has proven to be remarkably resilient to high interest rates, but there are some signs of stress.

This is particularly related to lower income households who appear to have exhausted pandemic era accrued savings and are increasingly struggling to meet loan payments.

Credit card and auto loan delinquencies are rising sharply while a record 10.5% of credit card balances are only receiving the minimum monthly payment.

This means that debt is being rapidly accumulated at an average interest rate of 22%, with the New York Fed stating that 20% of all US credit cards are now maxed out.

Given this backdrop, there is evidence of some cooling in consumer spending.

Recent inflation numbers have been better than the elevated prints seen in the first quarter, but they still remain too hot.

We have had one 0.2% month-on-month reading for the core PCE deflator, but we need to see at least two more if the Federal Reserve is to realistically consider cutting interest rates.

That won’t happen before September, but by that time we are also expecting to see weaker labour market data based on business surveys of hiring. If the unemployment rate – which has gone from a low of 3.4% to 3.9% currently – continues to move higher and breaks clearly above 4% to, say, 4.2%, that would also incentivise the Fed to start moving interest rates from a “restrictive” position to one that is slightly less restrictive.

If this is also accompanied by a clear cooling in consumer demand, we believe the Fed will cut interest rates at the September, November and December FOMC meetings.

Bank of America

At the June FOMC meeting, we see the Fed revising its outlook in favor of slower growth and firmer inflation. We think the median Fed member will project two rate cuts this year, down from three rate cuts in March, which would imply a cutting cycle that begins in September.

We think a narrow majority prefers to keep optionality for September alive should inflation cooperate. Our view is the Fed cuts once this year in December.

Recent data should give the Fed confidence that the economy is cooling, but the Fed needs more evidence of disinflation before easing.

What it needs now is time. In the press conference, Chair Powell is likely to say the committee is confident that activity and labor markets are cooling and not overheating.

The Fed has not changed its view of the fundamentals and the main message should be cuts are coming, though exactly when remains uncertain.

Powell is likely to preach patience and will emphasize the Fed is prepared to keep policy where it is for as long as needed to bring inflation down. We still think the bar for hikes – or rapid cuts – remains high.

Unicredit

Ahead of the FOMC meeting, investors have subdued rate-cut expectations for this year.

Money-market forwards are pricing in two rate cuts by year-end, a picture we think will also be reflected by the updated dot plot. A rate cut next week is not on the table, and when one considers that the Fed has four meetings left afterwards (one of which is two days after the US presidential elections), market expectations look reasonable.

Of course, if data soften enough by late July, markets could easily price in three cuts this year.

This is our baseline, as we expect more-pronounced cooling of the labor market than many analysts.

Should the Fed be unable to cut rates in July, the bar for markets to price in three cuts this year would rise considerably. Easing expectations are more pronounced for 2025, with four cuts being priced in.

Until the end of 2025, our forecasts are below forwards, and this suggests scope for strong performance, especially at the shorter tenors.

Previous Release

On May the 1st at 14:00 ET the Federal Reserve announced the results of the last policy meeting.

It came in in-line with expectations, keeping the rate unchanged at 5.5%.

After this, we saw weakness in the dollar and government bond yields, and strength in US Stocks.

This reaction is due to commentary in the rate statement, where the Fed noted that risks to achieving employment and inflation goals ‘have moved toward better balance over the past year,’ as opposed to ‘are moving into better balance’ which was the rhetoric used in the March policy statement.

This language change was enough to cause a reaction, as markets perceived the change as dovish, and in line with the narrative for more rate cuts this year, as opposed to less.