BoE Interest Rate Prep

Commentary:

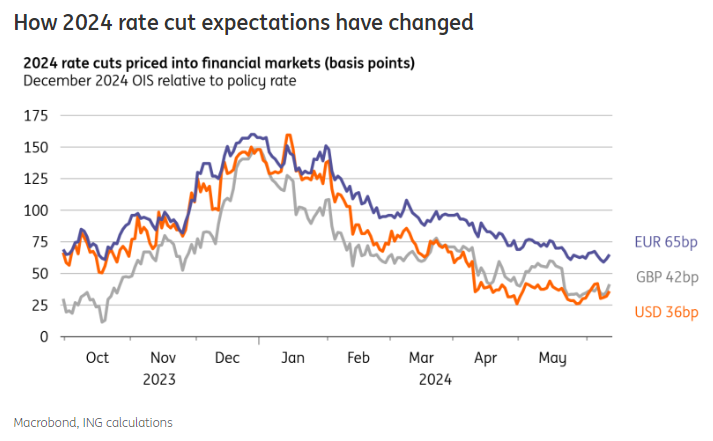

ING: Our takeaway from the last meeting in May was that June’s decision would be on a knife-edge, and that calculation probably hasn’t changed as much as markets might think. Governor Andrew Bailey, we felt, sounded like he would have voted for a rate cut in May had his committee been more on board with it. Still, our base case is a pause this month.

Societe Generale: We have pushed back our estimated timing of the first rate cut to August due to the stickier-than-expected April services inflation numbers. We have also reduced the total amount of cuts for this year to 50bp. Beyond this year, we are sticking to one 25bp cut a quarter, with the terminal rate at 2.5%.

BNY Mellon: The Bank of England will likely dash any hopes the ruling Conservative party had of a pre-July 4 election rate cut – they canceled on the election call any speeches and are pushing to remain neutral in politics. Markets now expect easing later rather than sooner, pricing a roughly 40% chance of an August quarter point move and a 70% chance in September with pay and services inflation sticky.

BofA: We expect the Bank of England (BoE) to vote 7-2 to keep the Bank Rate unchanged. Guidance to show continued data dependence. Sticky inflation and wage data mean there is not enough evidence to cut rates yet.

HSBC: The market and the consensus among economists is unanimously for no change in policy. Our economists expect the vote to be 7-2 (with dissenting votes for a cut). The likely key for GBP is the tone of policy guidance. The market currently views the outcome of the August MPC meeting as a 50:50 call as to whether a 25bp cut is delivered. We suspect the chance of a cut is higher than this.

Morgan Stanley: Rates would be kept on hold next week, with messaging and the vote split (7:2) unchanged. Post-elections, the MPC would guide the market towards an August cut. This is our base case.

UniCredit: We expect the MPC to vote 6-3 to leave the bank rate unchanged at 5.25% when it announces its monetary policy decision today, with one more member voting for a cut than at the May meeting. Although Governor Andrew Bailey previously said a rate cut in June was “neither ruled out nor a fait accompli”, it now looks likely that caution will prevail.

ING’s Rate Expectations (As of June 14th):

Previous Reaction:

BoE Bank Rate Actual 5.25% (Forecast 5.25%, Previous 5.25%) [May 9th 2024]