US Nonfarm Payrolls Prep

On Friday the 5th of July, at 08:30 ET, the BLS is set to release the employment situation report for the month of June.

Here are some views on what to expect.

Overview

For Nonfarm Payrolls, the median forecast is 190K.

According to a survey of 24 economists, the highest estimate is 237K, and the lowest is 165K.

For the Unemployment Rate, the median forecast is 4%.

The highest estimate is 4.1%, while the lowest is 3.9%.

General Expectations

When it comes to employment reports at this stage in the economic cycle, the markets and the Federal Reserve see high employment as a potential upside risk to inflation and can feed into the higher for longer narrative for US interest rates.

Therefore, if you see Nonfarm Payrolls come in higher than expected, and the Unemployment Rate come in lower than expected, you could see some weakness in US stocks and strength in the dollar, as markets push back their bets for US interest rate cuts.

On the other hand, if employment were to show signs of cooling off, with Nonfarm Payrolls lower than expected and the unemployment rate higher than expected, this could mean that bets for rate cuts from the Fed could be pushed forward, as it represents the potential for a downside move in inflation, and also shows that the job market may need to be stimulated by Fed rate cuts to stop it from falling too far.

This repricing would likely result in strength for US stocks and weakness in the dollar.

Commentary

UniCredit

Nonfarm payrolls likely rose by around 190k in June, a slower pace than the three-month average of 249k. Private sector payrolls probably rose by 160k. A range of indicators of labor market tightness have eased and point to lower labor demand, while initial and continuing jobless claims have picked up somewhat.

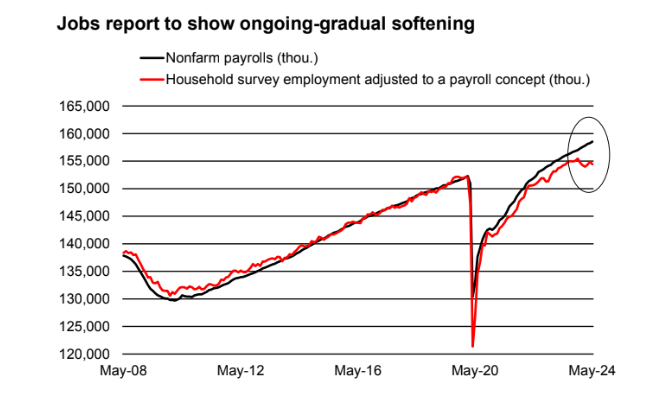

The unemployment rate likely held at 4.0%, reflecting ongoing weakness in household survey employment, which fell by a large 408k in May (see chart). We think payrolls may be overstating employment gains due to the unreliability of the US Bureau of Labor Statistics’ birth-death model around turning points.

Average weekly earnings growth likely slowed to 0.3% mom in June, from 0.4% in May, as the labor market came into better balance.

Morgan Stanley

June payrolls are to slow to 210k because of the softening demand for and supply of labor.

We forecast no change in the unemployment rate at 4.0%. AHE is to rise 0.3%M, slowing to 3.9%Y.

Wells Fargo

Hiring has yet to meaningfully lose steam.

Nonfarm payrolls rose by 272K in May, nearly 100K more than expected by forecasters. While robust job gains have coincided with general economic resilience to the Fed’s tightening cycle, strong headline prints in recent months mask some broader signs of labor market cooling.

The ongoing slip in job openings and deteriorating perceptions of job availability suggest that labor demand is not what it once was a year or two ago.

Additional weakening is evident in the unemployment rate creeping up to 4.0% in May, the highest reading since January 2022, and rising continuing claims for unemployment.

Household employment, once adjusted to match the scope of nonfarm payrolls, has fallen in three of the past five months.

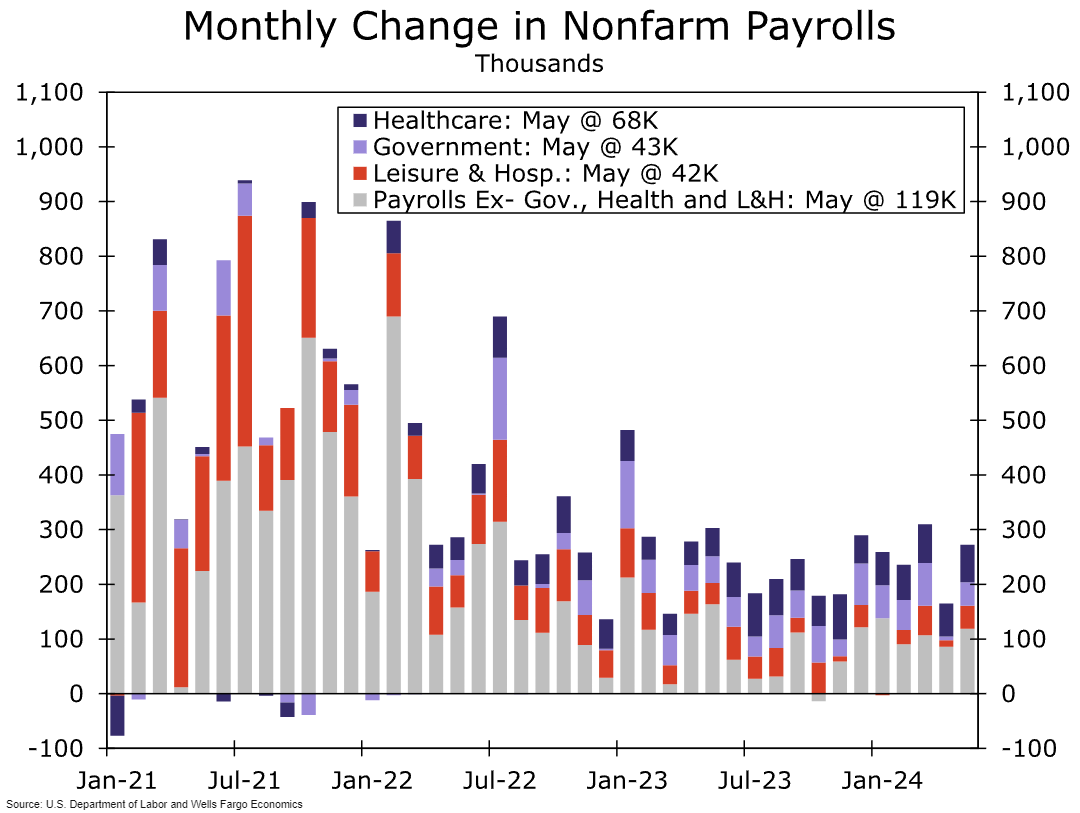

Digging deeper, two-thirds of nonfarm payroll gains over the past year have stemmed from only three industries: government and healthcare, which are less cyclically sensitive, and leisure & hospitality, which is still trying to find its footing after the pandemic.

These sectors are likely to remain significant contributors in the short term, but fading tailwinds are apt to reduce overall job growth in the months ahead. We expect 200K payrolls were added on net in June.

Meanwhile, we estimate that the unemployment fell back to 3.9% and average hourly earnings advanced 0.3% over the month.

Goldman Sachs

In terms of payrolls, our economists are below consensus on the headline looking for 140k (mkt 190k) as they note that Big Data measures continue to indicate a below-normal pace of job creation during the spring hiring season, and their layoff tracker is also edging higher from low levels.

They also assume a 50k drag from payback effects. They estimate that the unemployment rate was unchanged at 4.0%, reflecting higher household employment offsetting a 0.1pp rebound in labour force participation to 62.6% and estimate AHE will rise 0.35% (mom sa), which would lower the year-on-year rate by 13bps to 3.95% (touch above consensus).

Previous Release

On June 7th at 08:30 ET, the BLS released the Nonfarm Payrolls report for the month of May.

US Nonfarm Payrolls came in higher than expected, at 272K, on expectations of 180K, and the downwardly-revised prior of 165K.

However, despite Nonfarm Payrolls coming in higher than expected, the Unemployment Rate also came out higher than expected at 4%, on estimates and a prior of 3.9%.

(It is not uncommon for there to be disparities between Nonfarm Payrolls and the Unemployment Rate, as the Unemployment Rate is compiled through household surveys, while Nonfarm Payrolls are compiled through corporate payroll data.)

This caused strength in the dollar and US government bond yields and weakness in US stocks, as markets overlooked the higher Unemployment Rate in favor of the high Nonfarm Payrolls print, which they saw as an upside risk to inflation, feeding into the higher for longer interest rate narrative, which was reflected in the repricing in US interest rate futures, which showed reduced chances of an Interest Rate cut in September following this release.