US Nonfarm Payrolls Prep

On Friday the 2nd of August at 08:30 ET, the BLS is set to release the US Employment Situation report for the month of July.

Here are some views on what to expect.

Overview

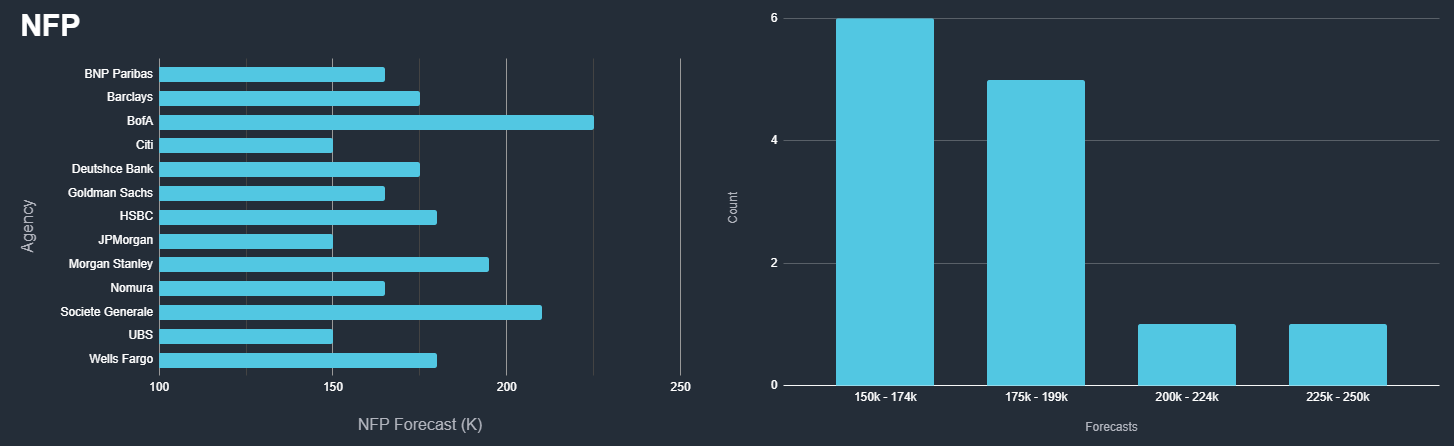

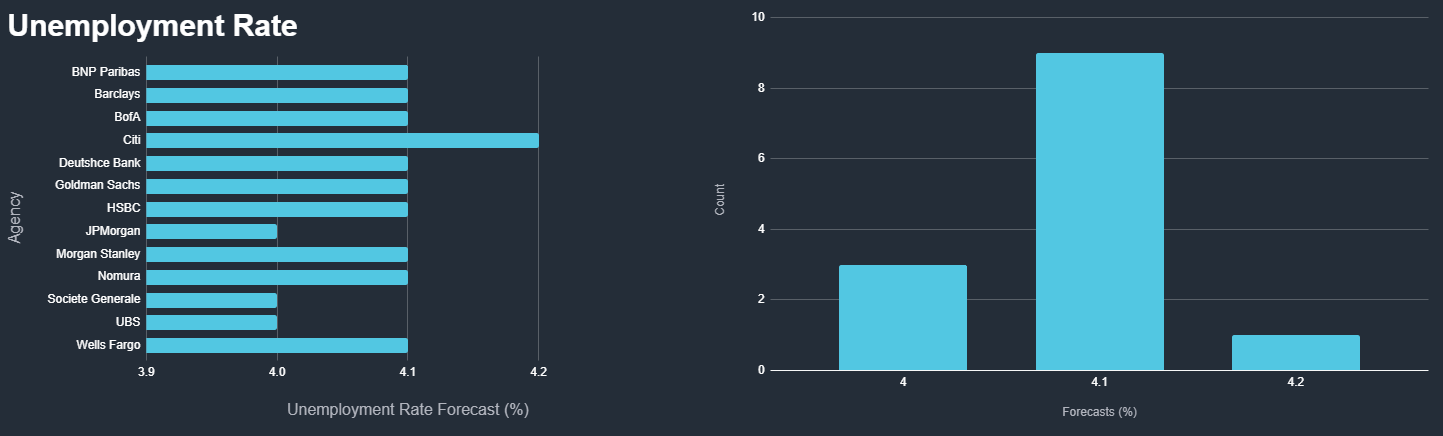

For Nonfarm Payrolls, the median forecast is 175K.

According to a survey of 58 economists, the highest estimate is 225K, and the lowest is 70K.

For the Unemployment Rate, the median forecast is for the rate to remain unchanged at 4.1%.

The highest estimate is 4.2%, the lowest is 4%.

General Expectations

The FOMC seems to have been focussing on the employment side of its dual mandate recently, with lots of the rhetoric used referring to employment’s effect on monetary policy.

Numerous FOMC officials have said in recent months that an unexpected or sudden weakening in the jobs market ‘could warrant a policy response’.

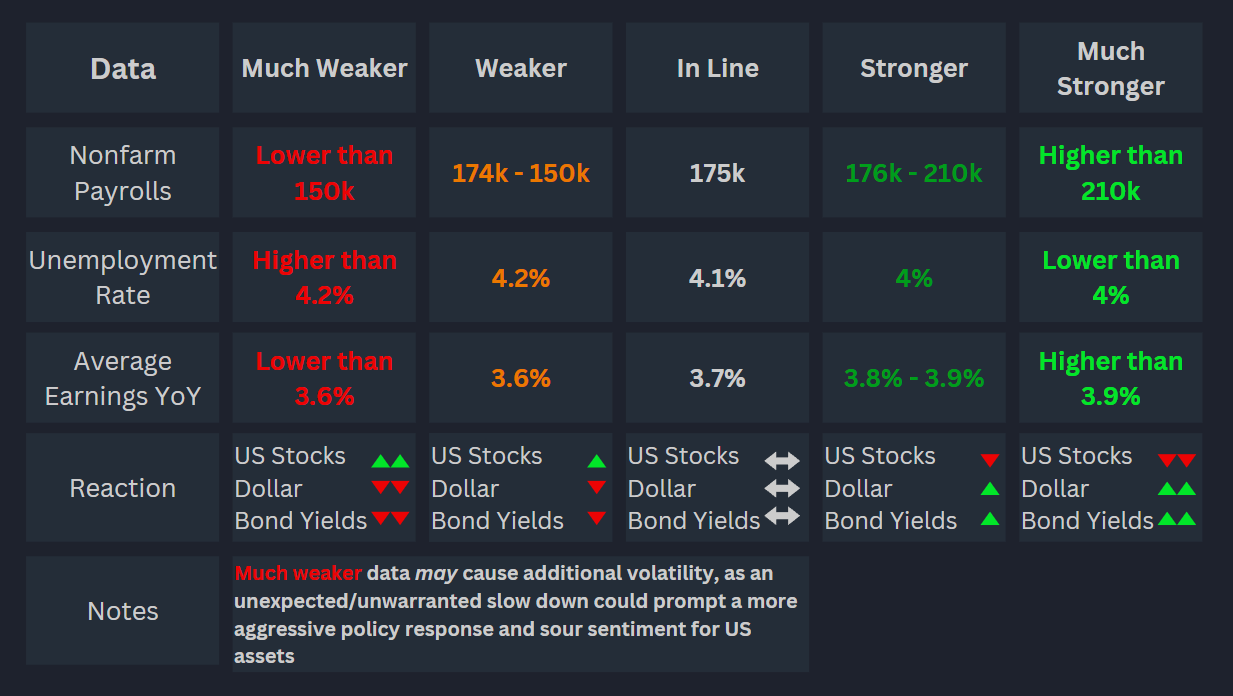

This implies that a large weakening in the Nonfarm Payrolls report could cause the Federal Reserve to take action and reduce interest rates to stimulate the job market.

Markets solidifying bets on a rate cut in September could cause strength in US stocks and weakness in the dollar, however, it is interesting that equity traders recently welcomed economic data that bolstered market bets on a rate cut in September, but not earlier.

Policy easing usually benefits corporate America, but rushing to reduce borrowing costs may have the opposite effect on sentiment. It could signal that officials are concerned about a larger economic slowdown.

This means that a cooler-than-expected read could be bullish for stocks, however at this point, with the Fed paying special attention to the labor market, if it were to come in considerably lower than expected, this could shock the markets and the Federal Reserve into acting quickly to stop an unwarranted economic slowdown, which could put fear into risk assets and cause weakness in equities.

If the data comes in higher than expected, it could reduce bets on a rate cut in September, the repricing of which would be reflected in the markets, as it could cause weakness in US stocks and strength in the dollar.

Ultimately, toward the end of this tightening cycle, we are at a delicate point. And this could cause some volatility when it comes to market reactions to this data.

Commentary

Unicredit

We forecast a rise in nonfarm payrolls of 180k in July, a slower pace than the 206k rise in June and the three-month average increase of 177k.

While this would still be a solid pace, in part due to labor force gains, we continue to think the BLS’s birth-death model overestimates payroll gains.

Weekly continuing jobless claims figures have continued to rise.

The unemployment rate likely held at 4.1% in July after three consecutive increases.

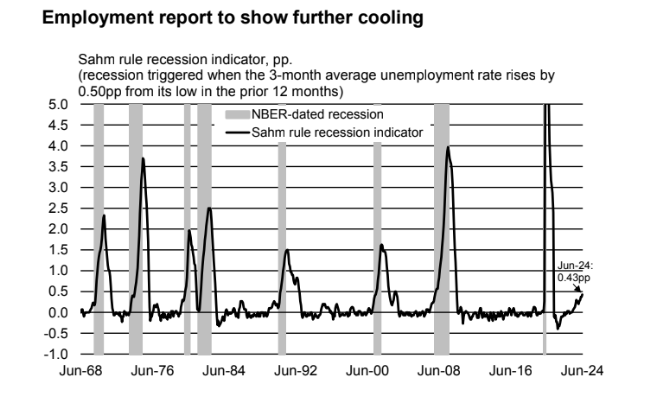

We would not be surprised if the unemployment rate rose by two decimal places, which could trigger the Sahm rule, which has historically coincided with a recession.

With the labor market coming into better balance, average hourly earnings likely rose 0.3% mom, with downside risks.

Such a rise would likely take the year-on-year rate down 0.2pp to 3.7%, which is slightly above the 3-3.5% range that most Fed officials judge to be consistent with meeting the Fed’s 2% inflation target over time.

Morgan Stanley

Our forecast that payrolls slow to 195k in July reflects slower public-sector employment.

We expect that private payrolls reaccelerated from 136k in June to 155k in July, still some modest slowing from their 174k per month year-to-date average gain.

There are important downside risks from Hurricane Beryl, from seasonal factors, and from teacher employment.

JPMorgan

We expect that payrolls rose 150k in July and that the unemployment rate held steady at 4.1%. We anticipate that there could be some drag from Hurricane Beryl, which made landfall in Texas as a Category 1 hurricane on July 8th, during the July payroll survey week (the week including the 12th of the month).

Absent hurricane effects we wouldn’t expect much change from the recent trend in payrolls, which depending on the way you cut them have mostly stabilized since the first half of 2023 or are still gently decelerating.

Payrolls have risen by 177k, 222k, and 218k per month over the trailing 3, 6, and 12-month period, respectively, and absent the hurricane our forecast would be nearer to 175k. Any hurricane impact should be concentrated in private payrolls.

Not surprisingly there is a large range of variation in historical effects and it is challenging to pinpoint how much of a drag Beryl will have on job growth, so the effect could be larger than the roughly 25k we have assumed.

In addition to the impact on employment, weather events often reduce hours worked.

Hourly earnings also tend to be biased up because employees who miss work are more likely to be in lower-paid industries, such as leisure and hospitality.

Consequently, we assume that the workweek fell to 34.2 after three consecutive months of staying at 34.3 and that average hourly earnings will rise by 0.4%m/m, a tenth of a percent more than we would have assumed absent the hurricane.

Wells Fargo

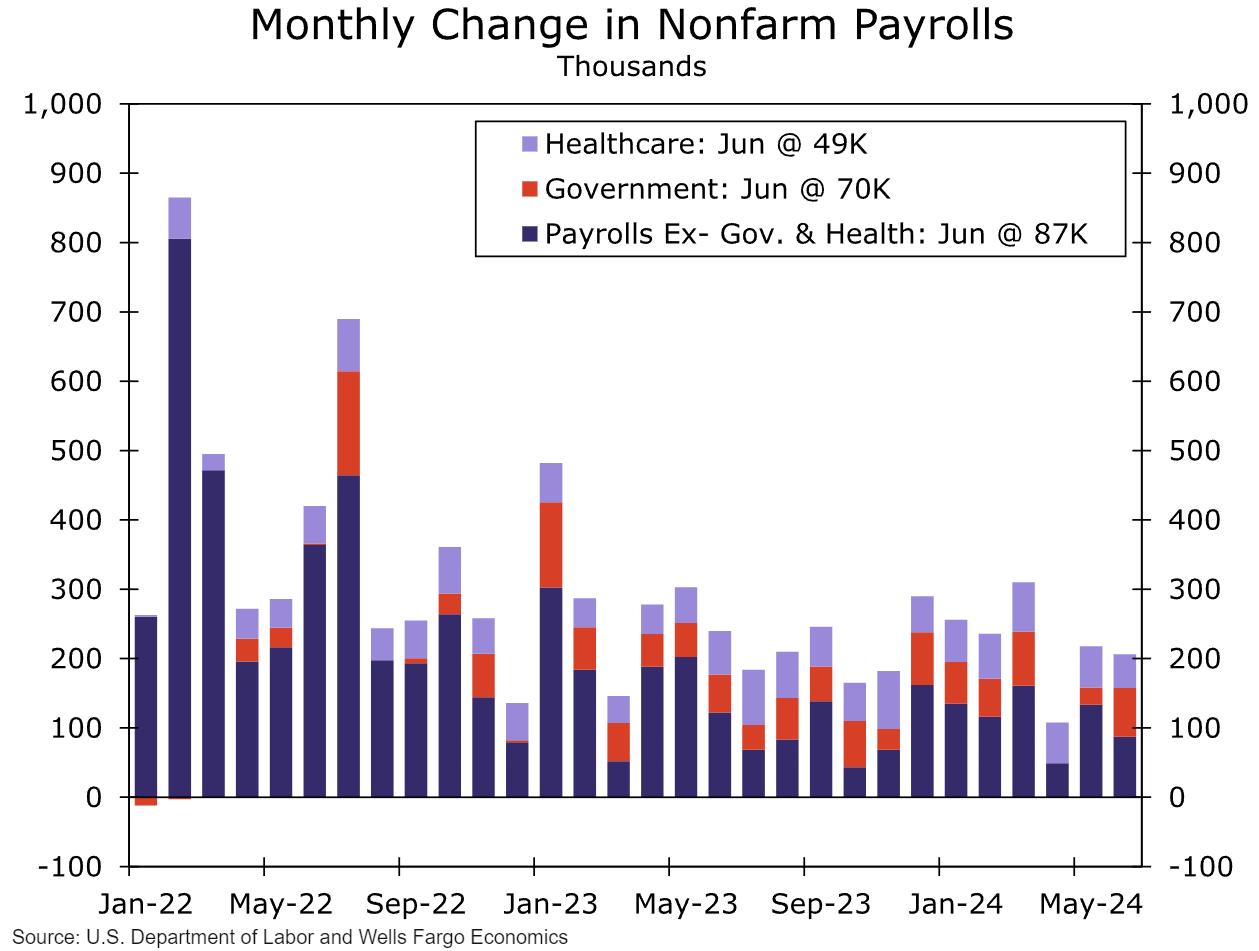

Another upside surprise to payrolls in the last employment report masked a more troubling message about the jobs market.

While job growth remained north of 200K, gains over the prior two months were revised down substantially (-111K on net), and June’s increase was overwhelmingly concentrated in the less cyclically sensitive sectors of government and healthcare. In the clearest sign the labor market is cooling, the unemployment rose to 4.1%, nearly half a point higher than at the start of the year.

The 180K increase to payrolls we expect in July would still be a respectable gain but would underscore that, directionally, the jobs market is deteriorating.

By a range of measures, including the unemployment rate, quit rate, level of temporary help workers, and small business hiring plans, the labor market is not only softer than a year or two ago but weaker compared to its pre-pandemic state.

Wage pressures have cooled as a result.

We look for average hourly earnings to rise 0.3% in July, which would bring the year-over-year rate to more than a three-year low of 3.7%.

The unemployment rate is likely to remain unchanged at 4.1%, which would bring it within a whisker of crossing the Sahm Rule threshold historically associated with the economy being in a recession.

Previous Release

On July 5th at 08:30 ET, the BLS released the US Employment Situation report for June

Nonfarm Payrolls came in moderately higher than expected at 206k, on the forecast of 190k, but lower than the upwardly-revised prior of 218k.

The Unemployment Rate came in higher than expected, ticking up to 4.1%, when it was expected to remain unchanged at 4%

The mixed picture with Nonfarm Payrolls in this report meant attention had turned to the Unemployment Rate, which came in higher than expected, causing slight weakness in the dollar and US government bonds, and slight strength in the S&P 500.