US Nonfarm Payrolls & Unemployment Rate Prep

On Friday the 4th of October at 08:30 ET, the BLS releases the latest Employment Situation report representing September.

Here are some views on what to expect.

Overview

For Nonfarm Payrolls, the median forecast sees it moving up to 150k from the prior 142k.

According to a survey of 69 qualified economists, the highest estimate is 220k, and the lowest is 70k.

For the Unemployment Rate, the median forecast is 4.2%, which would be the same as the prior 4.2%.

The highest estimate is 4.3%, the lowest is 4.1%

General Expectations

The US nonfarm payrolls is the most highly monitored employment indicator by both traders and policymakers.

Employment has been in focus since the last Nonfarm Payrolls report on August 2nd, which showed an unexpected weakening in the labor market, and prompted FOMC officials to pay greater attention to the employment situation.

Since then, markets have been reacting to employment reports for their effect on the broader economy, as opposed to its impact on monetary policy.

With that being said, if Nonfarm Payrolls comes in higher than expected, and the Unemployment Rate comes in lower than expected, there would likely be strength across the US assets (US stocks, dollar, and government bond yields) as it decreases the likelihood of recession/broader economic slowdown, increasing the chances for a soft landing.

If NFP comes in lower than expected, and the Unemployment Rate comes in higher than expected, We would expect weakness across the US stocks, dollar, and government bond yields.

This would solidify the bets of a broader economic slowdown, which increases the chances of a hard landing/recession and would prompt the Fed to move faster and harder in terms of policy response to react to the slowdown in the jobs market.

Keep in mind that the markets will be balancing between the data’s effect on the future of monetary policy, and its effects on the broader economy, which can cause variations/volatility in the reactions.

Commentary

Goldman Sachs

We estimate Nonfarm Payrolls rose 165k in September. On net, big data indicators indicate a pace of job creation above the recent payrolls trend. We assume above-trend (albeit moderating) contributions from the recent surge in immigration and catch-up hiring. We suspect August payroll growth will be revised higher, as has been typical over the last decade, though revisions so far this year have been disproportionately downward. We estimate that the unemployment rate was unchanged on a rounded basis at 4.2%, reflecting a flat labor force participation rate and firmer household employment growth. We estimate average hourly earnings rose 0.2% (month-over-month, seasonally adjusted), which would lower the year-over-year rate by 0.1pp to 3.7%, reflecting waning wage pressures and modestly negative calendar effects.

JP Morgan

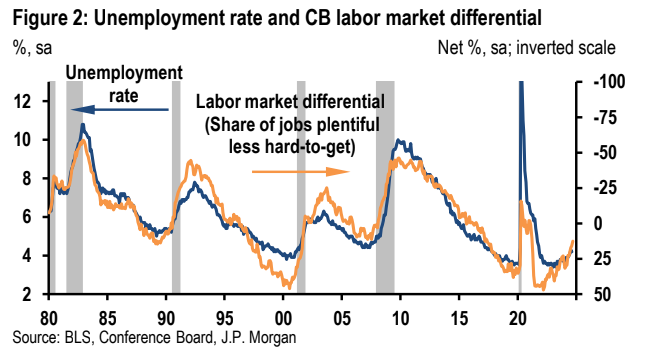

We expect that nonfarm payroll employment rose 125k in September and that the unemployment rate increased from 4.2% to 4.3%. Average hourly earnings are forecasted to rise 0.3%m/m (3.8%oya), and the workweek should be unchanged at 34.3. Job growth has slowed in recent months, rising an average of 116k over the last three months compared to 164k in the last six months and 196k in the last 12 months. The preliminary payroll benchmark suggested job gains through March will be revised down around 70k/month so it is possible that there is less slowdown here than it appears. However, we see some risk that the period after March will also eventually be revised lower in the following benchmark, given the tendency of downward revisions during periods when unemployment is rising. It is also possible that the 142k gain in August, which was higher than the 118k in June and 89k rise in July, will also be revised down: in the 18 months to May, there was a downward revision between the first and third print 14 times.

Wells Fargo

Following unexpected resiliency over the past couple of years, job growth is finally slowing. Nonfarm payroll growth has decelerated from a 250K jobs per month average in 2023 to just 116K jobs per month over the past three months. Not only has payroll growth slowed but the breadth of job gains has narrowed considerably with healthcare, leisure & hospitality and government accounting for a disproportionate share of the job gains. Several factors account for the slowdown including higher interest rates impacting purchases of big-ticket items from homes to motor vehicles to furniture. As demand has cooled, so too has pricing power and profit margins, which collectively have weighed on hiring. Furthermore, the upcoming November elections are adding greater uncertainty to the outlook which too has a dampening effect.

The 135K increase to nonfarm payrolls we expect in September would underscore that the jobs market continues to deteriorate. Business and regional surveys reported so far for the month have largely softened from August, pointing to a lower payroll print. We look for average hourly earnings to rise 0.3% in September, which would maintain the year-over-year rate at a near three-year low of 3.8%. The unemployment rate is likely to remain unchanged at 4.2%.

We continue to look for the pace of hiring to slow in the months ahead reflecting the narrow base of industries adding jobs, weak ISM readings on employment and a drop in job openings and small business hiring plans. Concerns about the labor market have increased at the Fed with officials squarely focused on the path forward. Any unexpected weakness from the employment reports released before the Nov. 7 FOMC meeting could push officials to deliver another outsized rate cut given their demonstrated willingness to respond aggressively to downside labor market risks.

Previous Release & Context

On September 6th at 08:30 ET, the BLS released the US employment situation report representing the month of August.

US Nonfarm Payrolls came out at 142k, below estimates of 165k, and the downward-revised prior of 89K.

The Unemployment Rate moved up to 4.2%, when it was expected to remain unchanged at 4.2%.

This resulted in strength for the S&P 500 and weakness for dollar and US Treasury yields, as it showed a stronger labour market than previously thought.