US Interest Rate Prep

On Wednesday 18th of September at 14:00 ET, the FOMC is set to release the results of their latest monetary policy meeting.

Here are some views on what to expect.

General Expectations

Economists and the markets largely expect the US interest rate to be reduced by 25 basis points at this meeting.

Though US interest rate futures pricing after the Retail Sales numbers the day before saw around 47 bps of easing at this meeting, indicating that the markets are pricing in a higher chance of a 50 bps cut.

This means that a 25 bps cut from the Fed would cause some of this pricing to be undone, which could cause some weakness in US stocks and strength in the dollar and bond yields.

Having said that, a cut of 50 bps would likely cause the reverse (stock weakness and strength in the dollar and yields), though perhaps not to the same degree, given the interest rate futures pricing.

Many market participants will focus on language regarding the employment situation, as well as US economic strength.

If the rate statement is seen as more dovish, including language that indicates greater confidence in inflation’s return to target, and a more optimistic tone on the future of the US labor market, then this could boost/solidify rate-cut bets for the year, which could cause strength in US stocks, and weakness in the dollar.

If it is seen as more hawkish, the inverse could be true.

This meeting will also have the release of the latest Summary of Economic Projections, which will give us updates on where Fed members view the Fed Funds Rate in the future, and the state of inflation and the economy.

Traders will be focused on the dot plot, to see where the median FOMC official sees the US interest rate by the end of this year and next year, as this can cause repricing in the US interest rate futures market, as market participants move their position to better align with the median expectations from FOMC officials.

Commentary

JPMorgan

Given the lack of a clear message from the Fed and on the economic outlook, 25bps may be the more favorable outcome.

This view is further supported by an inline CPI print and stronger Retail Sales print.

However, if CPI and retail sales miss the downside and the Fed does 25bps, then that likely keeps the market on the Recession narrative.

(NOTE: US CPI came in slightly hotter, Retail Sales mixed)

50bps would be a better outcome but it is unlikely that either CPI or Retail Sales are changing the Fed’s view despite the potential impact on markets.

Fed’s Williams and others, seem to be fine with 25bp (an interpretation shared by WSJ’s Timiraos via his account on X).

Typically, the Fed takes a ‘gradualist’ approach to easing, meaning 25bps per live meeting while reserving more aggressive cuts for economies under duress.

Wells Fargo

Through month-to-month volatility, inflation remains on a decidedly downward trend.

Meantime, the ongoing cooling in the labor market has come perilously close to being too cold, and we now see the risks to the Fed’s dual mandate as skewed toward the jobs market.

The consensus among Committee members doubtlessly will be in favor of starting the easing process, though there is debate over the magnitude of the initial cut.

Our team is anticipating a 25 bps reduction in the federal funds rate to 5.00%-5.25%.

Even so, given the marked softening in the labor market since the Committee last met at the end of July, the door to a larger 50 bps cut has been kept open, and we would not be totally surprised if the FOMC opted for the bigger move.

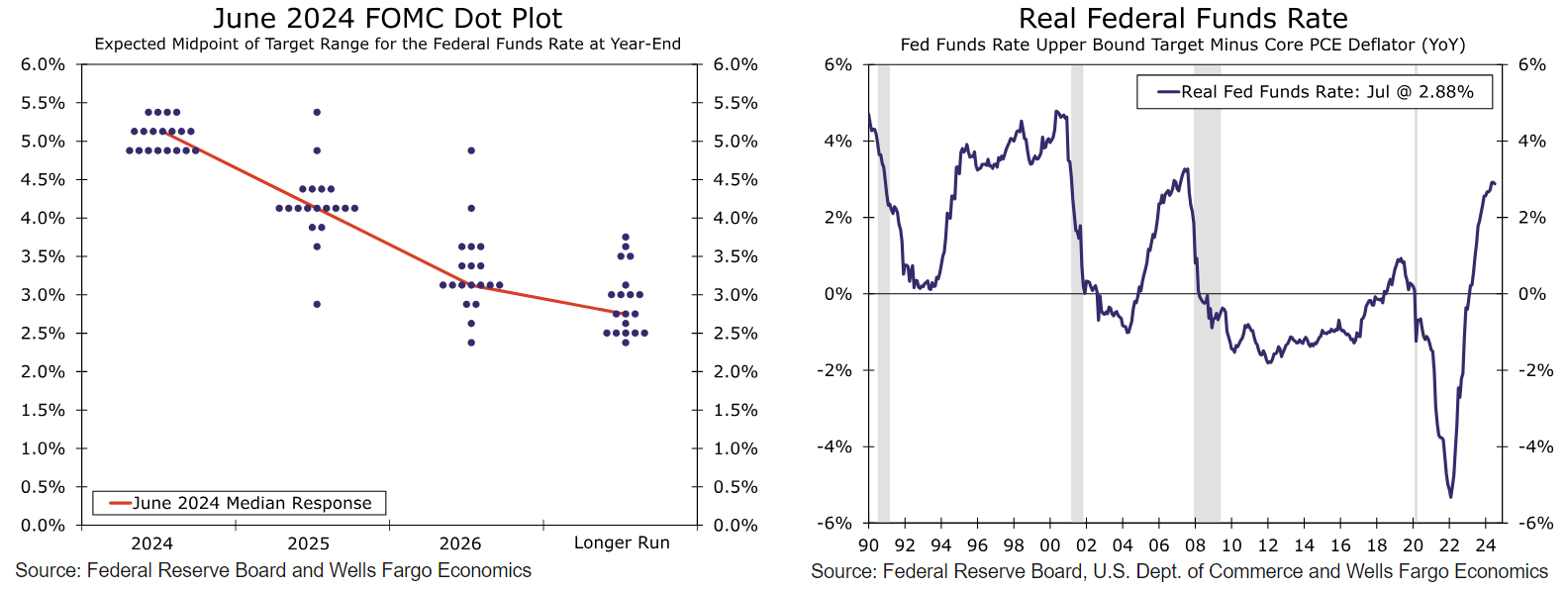

The previous Summary of Economic Projections (SEP)—published in June—showed the median FOMC member thought only one 25 bps rate cut would be appropriate by the end of this year (chart).

In the September SEP, we expect the 2024 median dot to fall to 4.625%, implying two additional 25 bps cuts this year (after an expected 25 bps cut at next week’s meeting).

The dispersion of dots is likely to be wide; we would not be surprised to see at least one dot as low as 4.125% and an upper end of the distribution at 5.125%.

For year-end 2025, we expect the median dot to fall to 3.375% (from 4.125% in June), implying 125 bps of easing next year.

Deutsche Bank

All eyes will be on the Fed this Wednesday as the FOMC cuts rates for the first time since the pandemic.

However, the magnitude of the Committee’s initial easing effort became increasingly uncertain over the course of last week.

After a stronger-than-expected CPI report shifted market pricing towards a 25bp outcome, two news articles led to a sharp repricing of market expectations towards a 50bp cut.

The first article from the WSJ’s Nick Timiraos, argued that the debate between a 25bp and 50bp cut was a “close call”, but our read was that it presented arguments more in favor of the larger reduction.

The WSJ report was followed by an FT article by Colby Smith, repeating that next week’s meeting was a “close call”, but on our read leaned against the larger action.

As we wrote last week, our proprietary DB AI tool agreed with our subjective assessment that the signal in the WSJ article was of lower conviction than in June 2022 when a similar article moved the market to price a 75bp hike.

At the time of writing, we have maintained our baseline expectation for a 25bp rate cut next week.

That said, we share our colleague Matt Raskin’s view that if we enter the meeting with market pricing close to its current stance, the Fed would likely be reluctant to surprise that much in a hawkish direction.

As such, absent a signal or development that shifts market pricing back closer to 25bps, a larger rate cut would appear more likely.

Regardless of what the Fed delivers, the communication challenges could be notable. If the Fed opts for the more cautious path of 25bps, Chair Powell will have to defend against attacks that the Fed risks falling behind the curve. We expect him to provide forceful support for the decision, including by recognizing strength in the underlying economy and a still resilient labor market – conditions that did not require more aggressive action at this meeting.

Previous Release

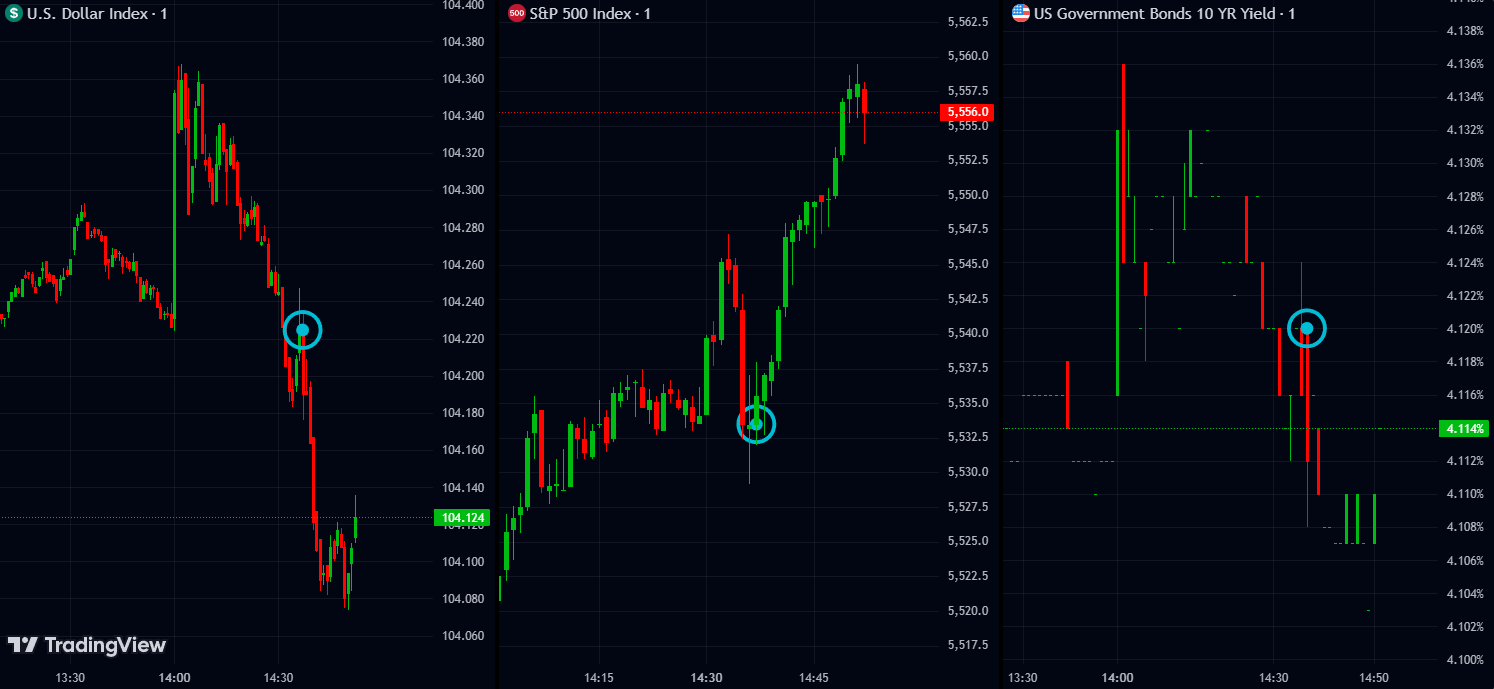

On Wednesday 31st of July, the FOMC kept rates unchanged at 5.5%, as expected.

This resulted in little change to stock indexes and the Dollar.

But in the subsequent press conference, the Fed chairman noted that “A rate cut could be on the table in September.”

This caused strength in the S&P 500 and weakness in the dollar and government bond yields, as traders increased bets on a rate cut in the September meeting.