BoE Interest Rate Prep

Commentary:

ING: The Bank of England to keep rates on hold, but faster cuts are coming. With services inflation still elevated, the Bank of England is treading more carefully towards lower interest rates than the Federal Reserve, and that suggests the committee will vote for no change this month. That could start to change, however, assuming signs of lower wage/price expectations begin to show through in the official numbers

Goldman Sachs: We continue to expect the BoE to vote 7-2 to maintain Bank Rate at 5.00% at tomorrow’s (19th September) MPC meeting.

BofA: We expect the Bank of England (BoE) to vote 7-2 to keep the Bank Rate unchanged at 5.0% at its meeting next week with risks are for a more dovish voting pattern (6-3). Alan Taylor replaces Jon Haskel (hawk) but his views are relatively unknown. We suspect he votes with the majority but there is a risk that he dissents. The BoE delivered a hawkish cut in August with the minutes noting: “We will not cut rates too much or too quickly”, and the decision was finely balanced, pointing to a BoE not rushing to cut rates again very soon due to inflation persistence risks.

Unicredit: The Bank of England’s Monetary Policy Committee (MPC) will likely leave the bank rate unchanged at 5.00% today. This comes after the committee narrowly voted 5-4 for a 25bp cut at its August meeting. This time, we expect the vote to be 7-2 in favor of no change, with Swati Dhingra and Dave Ramsden probably dissenting in favor of back-to-back rate cuts. In August, BoE Governor Andrew Bailey said the MPC would not cut rates “too much or too quickly”. While this statement is vague, we interpret it to mean that the committee was, at the time, not minded to cut the bank rate again in September. Recent macro data has largely been in line with BoE expectations and is unlikely to have changed the committee’s mind. At this meeting the MPC will also announce its target for reducing its stock of UK government bonds over the next twelve months.

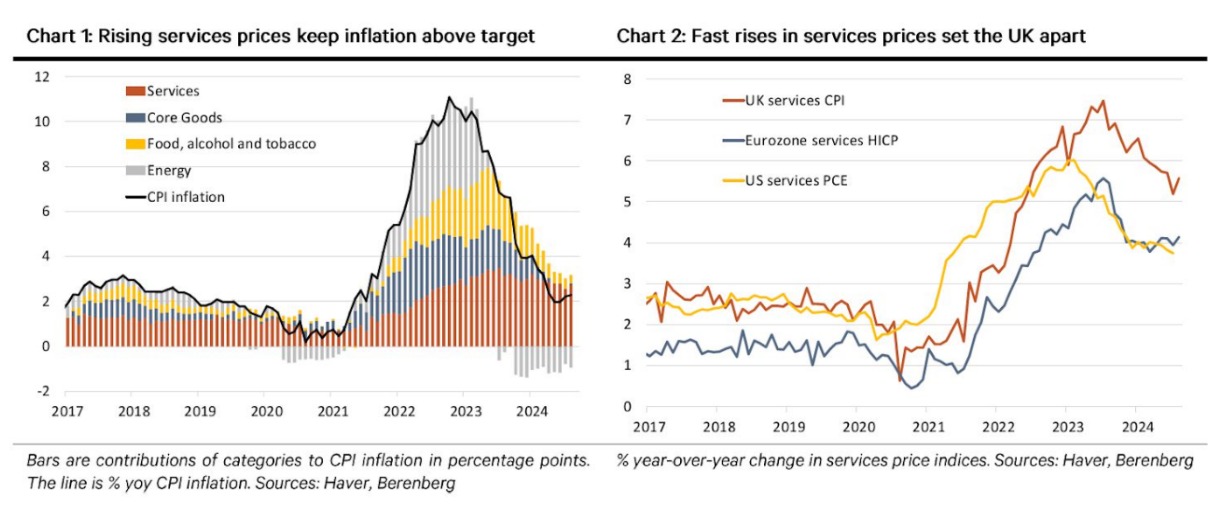

CACIB: Yesterday, UK headline CPI inflation came in at 2.2% YoY in August – unchanged from July and in line with market expectations. Also as expected, the core inflation print re-accelerated to 5.6% YoY from 5.3% previously. The data was seen as corroborating the market and our view that the BoE will keep the bank rate unchanged at today’s policy meeting. That being said, we also expect the MPC forward guidance to continue to signal further easing ahead, provided the economic and inflation outlook evolves as expected.

Berenberg: The surge in services prices is more pronounced in the UK than in the other major economies, which explains why we think that UK interest rates will only be lowered gradually. The latest increase in services prices of 3.7% YoY in the US (July) and 4.1% in the Eurozone (August) are substantially lower than the UK’s 5.6% rate (see Chart 2.) Despite some evidence of labour market cooling, we expect the BoE to keep Bank Rate on hold at 5% tomorrow. That would make it an outlier after the ECB cut last week and the Fed lowers rates this evening.

Probability:

Traders slightly pare bets on BoE cuts, seeing 48bps by year end. – September 18th

UK rate futures point to a roughly 28% chance of a BoE quarter-point rate cut on Thursday after UK inflation data, down from the previous 37%. – September 18th

UK interest rate futures show 34% chance of BoE rate cut in September, down from around 40% on Wednesday – August 15th

Berenberg Tables:

Previous Reaction:

BoE Bank Rate Actual 5% (Forecast 5%, Previous 5.25%) [August 1st 2024]