ECB Interest Rate Prep

Sentiment:

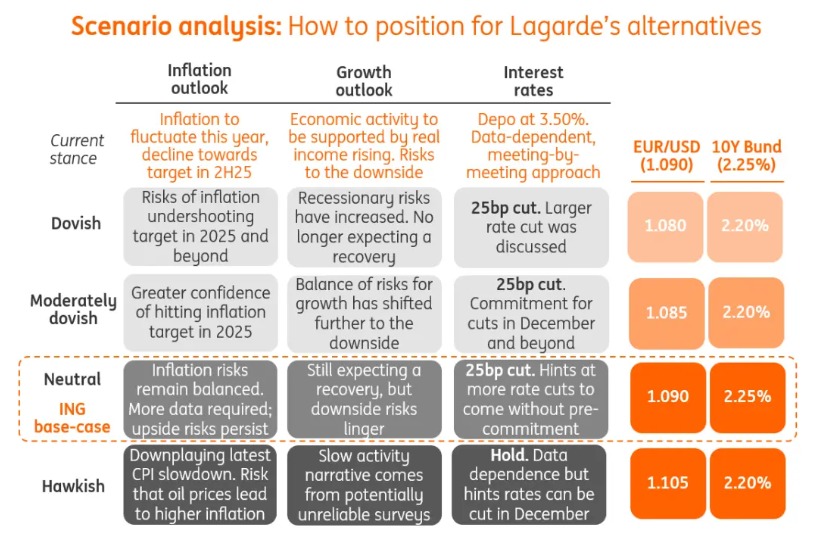

ING: The market is pricing a 25bp ECB rate cut today with a 97% probability. We doubt the ECB will disappoint those expectations, but we see upside risks to the short end of the EUR rates curve today. This is because the market now virtually prices a 25bp rate cut at each of the next six meetings and we do not believe the ECB is ready to capitulate and support faster easing (some 50bp cuts) towards the neutral rate near 2.00/2.25% for the deposit rate.

Unicredit: Today the ECB will probably cut its deposit rate by a further 25bp, to 3.25%. This would be the first back-to-back cut in this cycle, reflecting the latest downside surprises in both growth and inflation data. Three factors seem to have convinced the Governing Council (GC) to depart from a gradual rate descent at a pace of 25bp per quarter. First, the September PMIs signaled renewed weakness in activity, ongoing severe pressure on the manufacturing sector and rising risks to the resilience of the labor market. Most members of the GC now seem to think that downside risks to the ECB’s growth forecast (which was published just a month ago) are already materializing. Second, headline inflation in September decelerated more than the ECB had expected. Third, several other central banks (including the Fed with its bold 50bp cut) have recently adopted more dovish stances, signaling a shift in the balance of risks surrounding the outlook for inflation and growth. Despite the accelerating pace of cuts, ECB President Lagarde’s rhetoric is unlikely to be dovish. In our view, she will try to convey the message that data dependence works in both directions – therefore, no guidance is likely to be provided for the December meeting and beyond. We expect 25bp cuts at consecutive meetings until March. The pace of easing will likely slow once the deposit rate reaches 2.5%, a level that the majority of the GC seem to regard as broadly neutral. We expect the deposit rate to reach a terminal level of 2% in September 2025

Goldman Sachs: We expect the ECB to deliver a 25bp cut in October, after which we expect sequential 25bp cuts until the policy rate reaches 2% in June 2025.

BofA: We recently changed our ECB call to a rate cut in October, followed by back-to-back cuts of 25bp each, taking the deposit rate back to 2.00% by June 2025, a quarter earlier tha our previous forecast. We also brought forward the two additional cuts we had initially expected in 2026. We now expect quarterly cuts in September and December 2025 to a terminal rate of 1.50% (an unchanged level, but six months earlier). Next week, in line with the new call, we expect the ECB to cut all policy rates by 25bp. As justification for the cut, we would expect the statement (and ECB’s President Lagarde during the press conference) to highlight that recent developments have strengthened their confidence that inflation will return to target in a timely manner. We would be surprised if the decision were unanimous, given recent ECB speak, but there should be an ample majority for it. We think that after the cut next week, data will continue to push the ECB to cut at every meeting until June 2025. Why do we say push? Because we don’t think they are yet ready to take or signal that decision.

CACIB: We will not deny that the probability is (very) high that the ECB will cut its rates by 25bp at Thursday’s meeting. Not only does the market pricing point to a probability above 90% – let us not put too much trust in the wisdom of Mr Market – but most

governing council members have not fought against this pricing, and sometimes they have supported it. On top of that, all 50 economists polled expect the ECB to cut by 25bp at this meeting (and their change of mind cannot only be linked to the change in market pricing… or can it?). So yes, the ECB is likely to cut its rates by 25bp.

Deutsche Bank: Our European economists expect a 25bps rate cut following recent lower-than-expected inflation prints as well as weaker growth.

JPMorgan: Downside surprises in the September PMI and HICP report should make an ECB cut straight-forward at next week’s meeting, and their guidance should also lack a strong commitment around December action. However, the emergence of significant downside risks in Germany makes continued action the likely outcome.

Money Market Pricing & Comments:

October 8th: The ECB is to cut the deposit rate by 25bps in Oct and Dec, say 68 of 75 economists – Poll.

The ECB is to cut the deposit rate to 2.00% by the end of 2025, poll medians show (2.50% in September poll) – Poll.

ING Cheat Sheet:

Prior Release:

ECB Interest Rate Actual 3.65% (Forecast 3.65%, Previous 4.25%) – 17th October 2024