US Nonfarm Payrolls Prep

At 08:30 ET on Friday the 1st of November, the BLS releases the latest US Emplyoment Situation report, with Nonfarm Payrolls and the Unemployment Rate for October.

Here are some views on what to expect.

Overview

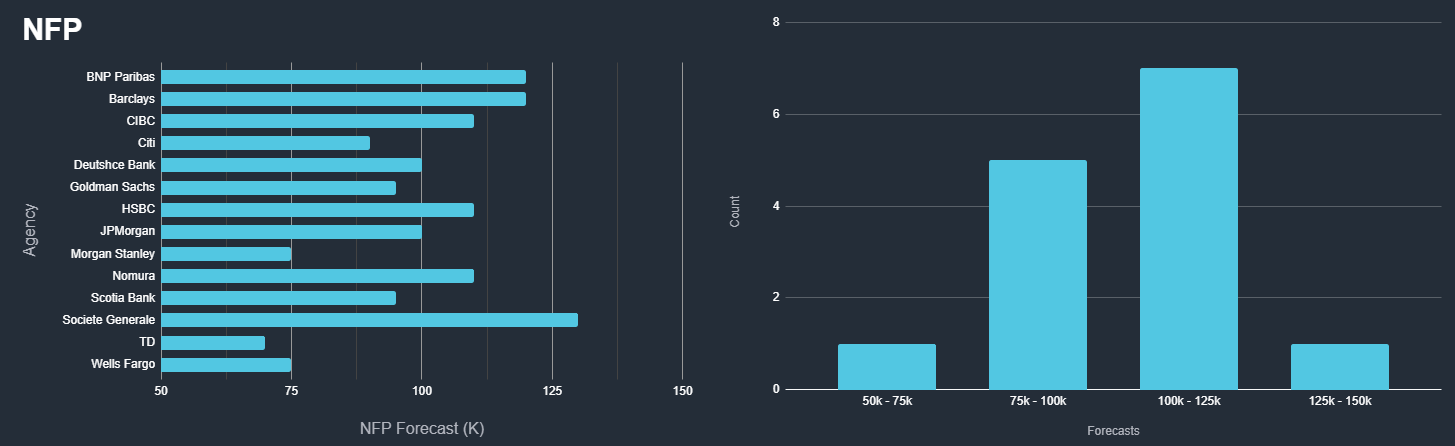

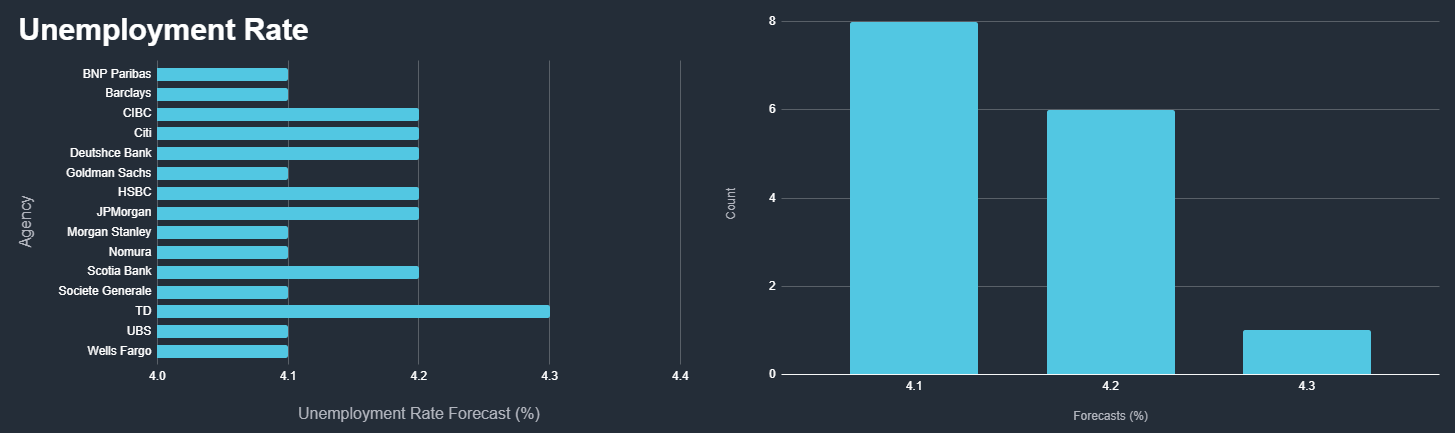

Median expectations see US Nonfarm Payrolls moving down to 110K from 254K previously.

According to a survey of 55 qualified economists, the highest estimate is 180K, and the lowest is -10K.

As for the Unemployment Rate, the median forecast sees the Unemployment Rate remaining unchanged at 4.1%.

The highest estimate is 4.3%, the lowest is 4%

General Expectations

The US nonfarm payrolls is the most highly monitored employment indicator by both traders and policymakers.

Employment has been in focus since the Nonfarm Payrolls report on August 2nd, which showed an unexpected weakening in the labor market, and prompted FOMC officials to pay greater attention to the employment situation.

Since then, markets have been reacting to employment reports for their effect on the broader economy, as opposed to its impact on monetary policy.

With that being said, if Nonfarm Payrolls comes in higher than expected, and the Unemployment Rate comes in lower than expected, there would likely be strength across the US assets (US stocks, dollar, and government bond yields) as it decreases the likelihood of recession/broader economic slowdown, increasing the chances for a soft landing.

If NFP comes in lower than expected, and the Unemployment Rate comes in higher than expected, We would expect weakness across the US stocks, dollar, and government bond yields.

This would solidify the bets of a broader economic slowdown, which increases the chances of a hard landing/recession and would prompt the Fed to move faster and harder in terms of policy response to react to the slowdown in the jobs market.

Keep in mind that the markets will be balancing between the data’s effect on the future of monetary policy, and its effects on the broader economy, which can cause variations/volatility in the reactions, especially in the equity market.

Commentary

Morgan Stanley

We forecast payrolls at 75k, dragged down by hurricanes (-40k), strikes (-35k), and seasonal factors (-20k). We put the underlying pace, excluding those effects, at 170k. We expect the unemployment rate stalls at 4.1%.

The workweek was pushed down and average hourly earnings up (0.4%) by the storms.

The noise in this month’s payrolls will likely decrease their significance for the November FOMC.

The unemployment rate will be a clearer signal. A storm-related rise in those employed but “not at work because of bad weather” does not boost the unemployment rate; and strikers are counted as employed.

Recent payroll reports were strong. We expect continued demand strength but less support for employment growth from labor supply.

Recent immigration data show declines in crossings, putting downward pressure on labor supply and keeping the unemployment rate low.

Hurricane Helene reached the US on September 26, before the start of the payroll survey period, and the reopening has been slow: its effect on payrolls was probably maximized.

However, it mostly hit sparsely populated areas. We estimate it will subtract 35k from payrolls.

Hurricane Milton reached land late in the survey period, on October 9. Most of the affected were probably employed during the survey period, but it also hit a more populous area—we expect a 5k drag.

The true storm effects will be difficult to ascertain in the payrolls data until state data are available two weeks after the employment report. The Boeing strike affects 33k aerospace workers.

A more diffuse strike involving 5-10k in payrolls at various hotels could also have an effect. Strikers are counted as employed in the household survey; their absence from work does not boost the unemployment rate.

Seasonal factors are a downside risk. They allow for rapid NSA payroll growth in October and subtracted 591k from NSA payrolls last October. October payroll growth last year was well below the surrounding trend, at 98k vs 165k in the prior three months and 187k in the following three months. We are allowing for a 20k downward bias this October.

Wells Fargo

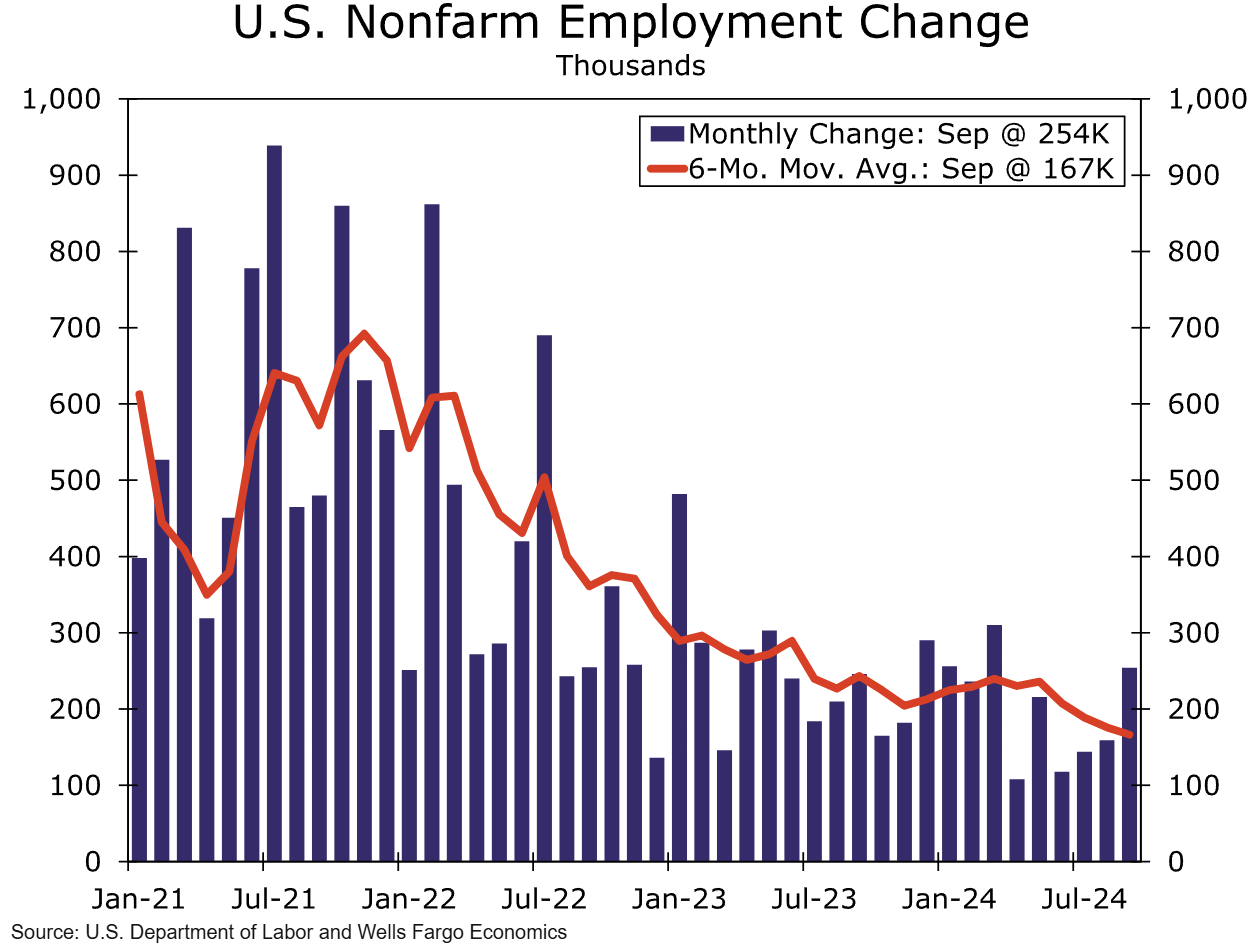

The September jobs report bucked the cooling trend at play in the labor market and allayed concerns that the jobs market was rapidly deteriorating.

Employers added the most jobs since March, revisions to the prior two months were positive for a change, and the unemployment rate ticked down to a four-month low of 4.1%.

It will be difficult to get a clean read from the October jobs report on whether employment conditions are firming up as much as the September report implied.

The ongoing strike at Boeing has sidelined 33K union workers and led to furloughs for some non-union workers. In addition, payrolls are likely to be depressed from the devastation caused by hurricanes Helene and Milton, the latter of which made landfall during the survey week.

As a result, we look for nonfarm payrolls to slow sharply in October.

The unemployment rate should be more insulated—although not entirely immune—from these events.

Striking workers are still considered employed in the household survey, although furloughed workers are not. Similarly, workers absent from work due to weather are still counted as employed, although workers at businesses destroyed would not. We look for the unemployment rate to be unchanged in October at 4.1%.

While the October payroll print will likely understate the current position of the jobs market, we continue to see strains under the surface that point to the jobs market softening further in the near term.

Hiring remains narrowly concentrated among industries, average weekly hours point to businesses using existing workers less intensely, and consumers see a dwindling number of job opportunities.

The cooler backdrop should keep a lid on average hourly earnings growth, which we expect to rise 0.3% in October.

Unicredit

The impact of Hurricanes Helene and Milton and a strike at a large aircraft manufacturer will have temporarily weighed on October payroll data.

Absences from work due to bad weather are only included in payrolls if pay is received for any part of the pay period including the 12th of the month.

Workers who strike for the whole reference period (about 30k) are not counted in payroll data.

We expect a rise of just 100k in nonfarm payrolls for October, but uncertainty is very high.

The unemployment rate is likely to be less affected by the factors mentioned above, since it is compiled from a household survey, where a worker on strike for the whole reference period is counted as employed but not at work due to a labor dispute, and a worker who is absent from their job for weather-related reasons is counted as employed whether or not they received pay during the period.

We expect the unemployment rate to have edged up to 4.2%.

Deutsche Bank

This week’s marquee release – October employment – is likely to be impacted by Hurricane Milton, which hit Florida during the survey week for nonfarm payrolls.

Our headline (+100k forecast vs. 254k previously) and private (+75k vs. 223k) payroll projections reflect a 44k drag from striking workers (33k of which were Boeing) as well as roughly 25k negative impact from the weather.

Weather is also likely to depress hours worked (34.1hrs vs. 34.2hrs) while simultaneously pushing up average hourly earnings (+0.6% vs. +0.4%).

Wednesday’s ADP employment report (+75k vs. +143k) will provide an initial read on what the weather impact could be in Friday’s official numbers, particularly in industries such as construction.

Previous Release

On October 4th at 08:30 ET, the BLS released the last US Employment Situation report for September.

Nonfarm Payrolls came out stronger than expected at 254K, on estimates of 150K, and higher than the upwardly revised prior of 159K.

The Unemployment Rate moved down to 4.1%, when it was expected to remain unchanged at 4.2%.

This caused strength across the US assets (dollar, stocks, and bond yields) as it pushed back against fears of a broad economic slowdown in the US.

The equity reaction was slightly less pronounced, as traders also weighed this against the decreased chances of deeper rate cuts from the Fed, which is seen as bearish for stocks.