BoE Interest Rate Prep

ING: Last week’s budget has made life more complicated for the BoE. A rate cut is all but certain, but the combination of extra fiscal stimulus and a volatile US election aftermath means officials won’t want to comment on its next steps. A December rate cut has become less likely, although a lot hinges on the two inflation reports we get before Christmas.

MUFG: A slower pace of BoE rate cuts should remain supportive for a stronger pound by keeping rates on offer in the UK relatively higher for longer than in other major economies. The main downside risk for the pound is posed by a continued sell-off in the Gilt market especially if it starts to be driven more by the long-end of the curve reflecting a further loss of confidence in the UK government’s fiscal consolidation plans.

Morgan Stanley: We see an 8:1 vote for a 25bp cut. We no longer expect a December cut but assume Governor Bailey will contextualize the OBR’s hawkish assessment of the Budget, messaging a continued gradual removal of restrictiveness.

Citi: Fiscal news could weigh on any dovish impetus from the MPC, they will likely cut by 25bps Our economists don’t expect material changes to guidance, data-dependence should be reiterated.

Probability:

Traders add to BoE rate-cut bets, seeing 31bps of easing by December – November 6th

UK rate futures point to 86bps of interest rate cuts by BoE by end of 2025 vs 82 bps on Tuesday – November 6th

Traders add to BoE rate bets; fully price 4 cuts by end of 2025 – November 1st

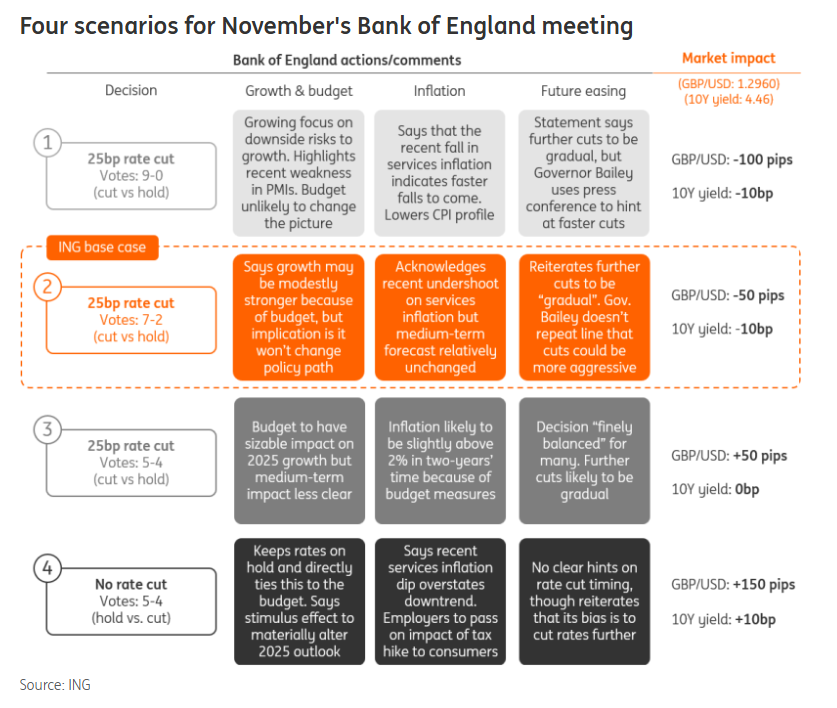

ING’s Four Scenarios:

Previous Reaction: