US Nonfarm Payrolls Prep

On Friday the 6th of December at 08:30 ET, the BLS releases the latest Employment Situation report representing November.

Here are some views on what to expect.

Overview

For Nonfarm Payrolls, the median forecast sees it moving up to 200k from the prior 12k.

According to a survey of 67 qualified economists, the highest estimate is 270k, and the lowest is 155k.

For the Unemployment Rate, the median forecast is 4.1%, which would be the same as the prior 4.1%.

The highest estimate is 4.3%, the lowest is 4%

General Expectations

The US Nonfarm Payrolls is the most highly monitored employment indicator by both traders and policymakers. Employment has been in focus since the Nonfarm Payrolls report on August 2nd, which showed an unexpected weakening in the labor market, and prompted FOMC officials to pay greater attention to the employment situation.

Since then, The dollar and the bond markets have been reacting to employment reports for their effect on the broader economy, and it’s to its impact on monetary policy, however, equity markets are more torn between reacting to both dynamics, which can cause more volatile reactions.

With that being said, if Nonfarm Payrolls comes in higher than expected, and the Unemployment Rate comes in lower than expected, there would likely be strength across in the dollar and government bond yields, and a mixed/whipsaw reaction in US stocks, as it decreases the likelihood of recession/broader economic slowdown, increasing the chances for a soft landing, but at the same time also means the Fed does not need to rush rate reductions in order to stimulate the job market.

If NFP comes in lower than expected, and the Unemployment Rate comes in higher than expected, we would expect weakness in the dollar and government bond yields and a more mixed/whipsaw reaction in US stocks.

This would solidify the bets of a broader economic slowdown, which increases the chances of a hard landing/recession and would prompt the Fed to move faster and harder in terms of policy response to react to the slowdown in the jobs market.

Commentary

Wells Fargo

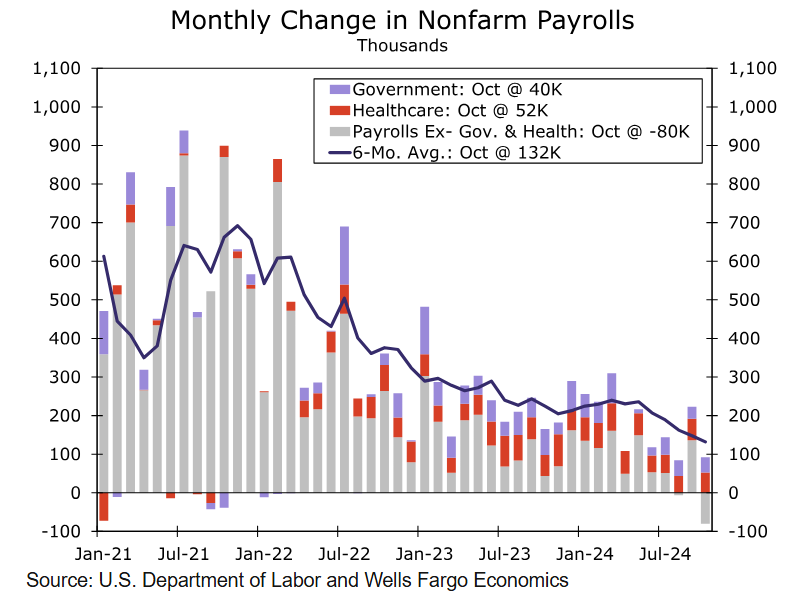

Noise in the October jobs report from Hurricanes Helene and Milton as well as multiple strikes meant that the mere 12K rise in nonfarm payrolls was taken with a large grain of salt. However, through the temporary distortions, the report showed signs of continued softening in the labor market. Job growth in August and September was revised down by a cumulative 112K, suggesting September’s stellar employment report was not as strong as previously believed, hiring was primarily driven by the healthcare and government sectors, and the unemployment rate, which is much less influenced by the hurricanes and strikes, rose by nearly one-tenth of a percentage point on an unrounded basis.

We expect hiring bounced back in November, with payrolls rising by 230K. The conclusion of a number of strikes, most notably at Boeing, should boost hiring by roughly 40K for the month. We also look for payrolls to be lifted by the resumption of normal business operations in the Southeast after the disruptions caused by the recent hurricanes. That said, the lowest survey response rate in more than 30 years along with the historical trend for upward revisions following major hurricanes suggests that some of the storm-related rebound could show up in the monthly revisions, rather than November’s headline number.

Through the monthly swings of nonfarm payrolls, we expect the November employment report to reiterate that while the labor market remains solid in an absolute sense, the softening trend in employment conditions has yet to cease. That message is likely to come through more clearly from the unemployment rate, which we look to rise to 4.2%. The cooler backdrop should keep a lid on average hourly earnings growth (AHE). We expect AHE to rise 0.3%, which would lead the year-over-year rate down to 3.9%.

Societe Generale

We anticipate a significant increase in non-farm payrolls of 185,000 in November. If this projection is realized without major revisions to previous months, the three-month average gain would settle at 140,000 per month. There is considerable uncertainty regarding the underlying strength of non-farm payrolls, and we believe that it is moderating, as indicated by the three-month trend in the accompanying chart. At 140,000 per month, it may not have fully recovered. We estimate that around 170,000 new jobs per month are needed to stabilize the unemployment rate. The end of the Boeing strike is expected to result in the return of about 40,000 workers to the payrolls. However, workers who lost their jobs due to the hurricanes may take longer to return.

The weekly jobless insurance reports show that the number of individuals receiving unemployment benefits remains elevated since the hurricanes, providing a reason to anticipate

a moderate rebound following the 12,000 worker gain in October. We expect the unemployment rate to increase to 4.2% in November after holding steady at 4.1% for the previous two months and falling from 4.3% in July. In October, the unemployment rate was recorded at 4.145%. The likelihood of rounding up when moderate employment gains are

anticipated is high. Wages are likely to post a 0.3% month-over-month increase. The trend in wages indicates a 3.7%- 3.9% increase. After a 0.4% gain in October, a more moderate gain is expected in November, aligning with mean-reversion expectations.

CIBC

We anticipate a significant increase in non-farm payrolls of 185,000 in November. If this projection is realized without major revisions to previous months, the three-month average gain would settle at 140,000 per month. There is considerable uncertainty regarding the underlying strength of non-farm payrolls, and we believe that it is moderating, as indicated by the three-month trend in the accompanying chart. At 140,000 per month, it may not have fully recovered. We estimate that around 170,000 new jobs per month are needed to stabilize the unemployment rate. The end of the Boeing strike is expected to result in the return of about 40,000 workers to the payrolls. However, workers who lost their jobs due to the hurricanes may take longer to return. The weekly jobless insurance reports show that the number of individuals receiving unemployment benefits remains elevated since the hurricanes, providing a reason to anticipate a moderate rebound following the 12,000 worker gain in October. We expect the unemployment rate to increase to 4.2% in November after holding steady at 4.1% for the previous two months and falling from 4.3% in July. In October, the unemployment rate was recorded at 4.145%. The likelihood of rounding up when moderate employment gains are

anticipated is high. Wages are likely to post a 0.3% month-over-month increase. The trend in wages indicates a 3.7%- 3.9% increase. After a 0.4% gain in October, a more moderate gain is expected in November, aligning with mean-reversion expectations.

Previous Release

On November 1st at 08:30 ET, the BLS released the US employment situation report representing the month of October.

US Nonfarm Payrolls came out at 12k, below estimates of 100k, and the revised prior of 223K.

The Unemployment Rate was 4.1%, unchanged.

This caused weakness in the dollar, and whipsawing/weakness in the S&P 500

This move in the markets was not sustained though.

Keep in mind, the low Nonfarm Payrolls number was cited by the BLS as being related to temporary factors, linked to the tropical storms in the US, and strike action within Boeing.

Fed officials since this release have cited this as being ‘noise’, stating that the unemployment rate in this report shows the employment situation during this reporting period, ex temporary factors, being near unchanged.