US CPI Prep

On Wednesday the 11th of December, at 08:30 ET, the BLS is set to release the latest US CPI report for the month of November.

Here are some views on what to expect.

Overview

Estimates subject to change

For headline US CPI YoY, median forecasts see it moving up to 2.7% from 2.6%.

According to a survey of 44 qualified economists, the highest estimate is 2.8%, while the lowest sees it at 2.6%

For US CPI MoM, the median forecast sees it moving up to 0.3% from 0.2%.

The highest estimate is 0.3%, and the lowest is 0.2%.

For US Core CPI YoY, median forecasts see it remaining unchanged at 3.3%.

The highest estimate is 3.3%, the lowest is 3.2%.

Core MoM is also expected to remain unchanged at 0.3%. The highest estimate is in line with the median view of 0.3%, the lowest is 0.2%.

General Expectations

If CPI comes in higher than expected, meaning inflation is higher than anticipated, we would be likely to see strength in the dollar and bond yields, and weakness in stocks, as traders decrease their bets on Fed rate cuts, on the assumption that the Fed may need to keep interest rates higher for longer to make sure that inflation is falling back to target.

If inflation comes in lower than expected, we would expect to see weakness in the dollar and bond yields and strength in stocks, as traders solidify/increase their bets on further Fed rate cuts.

Commentary

Wells Fargo

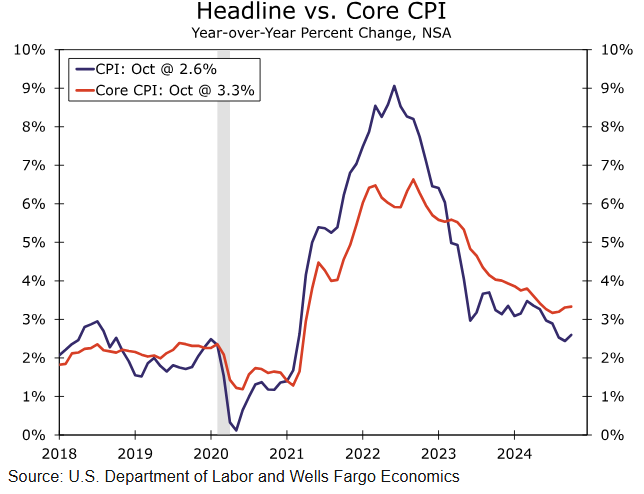

Progress on the inflation fight has started to stall.

Consumer prices rose 0.2% over October, pushing the year-over-year change up to 2.6%. Excluding food and energy, the core CPI rose 0.3% for a third straight month, with the three-month annualized rate of 3.6% running faster than the 12-month rate of 3.3%.

True, inflation has gotten to a better place over the past year, and some key sources of inflationary pressure, such as an overheated labor market, continue to dissipate.

However, the disinflationary momentum is fading, and new headwinds (e.g., the potential for tariffs and tax cuts) have emerged that make the final leg of inflation’s journey back to the Fed’s 2% target look increasingly difficult.

The stubborn picture of inflation that has surfaced over the past few months is unlikely to be altered by the November CPI report.

We expect headline CPI to advance roughly 0.25% over the month and 2.7% over the past year.

Gas prices moved up in November after having provided a deflationary tailwind in five of the past six months, and food inflation similarly looks to have firmed up.

Excluding these more volatile components, we forecast the core index also rose around 0.25%, which would keep the 12-month change stuck in the narrow range of 3.2%-3.3% for a sixth straight month.

While core services inflation should ease modestly relative to its recent trend, the two-month streak of price increases for core goods is likely to extend to three in another sign that goods deflation is subsiding.

Deutsche Bank

The print, combined with last week’s jobs report, will be key to whether the central bank delivers another cut at the upcoming meeting, with futures currently pricing in a 68.4% probability of it doing so [chances are higher since this note was released].

In terms of forecasts, our US economists expect headline CPI growth to pick up to +0.3% (+0.2% in October), in line with the median forecast on Bloomberg, and see core printing +0.32% (+0.3%).

The PPI report will follow on Thursday and our economics team forecast the headline to grow by +0.3% MoM (+0.2%).

Bank of America

We forecast core CPI inflation decelerated slightly to 0.2% m/m (0.23 unrounded) in November after three consecutive 0.3% m/m prints. As a result, the y/y rate should tick down a tenth to 3.2%.

The expected moderation should be due in large part to a decline in airfares following three consecutive robust increases.

The details of the report should also suggest that upside risks to inflation remain limited for the time being. A key factor behind our forecasted deceleration in core inflation is an expected decline in airfares.

After surging in each of the last three months, we expect airfares to fall by 1% m/m, which will be a swing in the contribution to core inflation from +3bp to -1bp. This is a volatile category, and we do not think a decline would be indicative of weaker demand but rather a function of mean reversion.

Aside from airfares, we expect core goods prices to be little changed on the month (+0.02%) owing to an increase in used cars.

Outside of used cars, we see core goods prices falling given an improving demand and supply backdrop.

Meanwhile, core services should cool slightly reflecting the fall in airfares and more moderate shelter inflation.

From a fundamental standpoint, we do not see material upside risk to inflation.

The labor market has rebalanced, supply constraints have largely subsided, and inflation expectations remain anchored.

That said, progress on inflation should stall next year given our expected changes to tariffs, and fiscal and immigration policies.

Previous Release

On November 13th at 08:30 ET, the BLS released the US CPI report for the month of October.

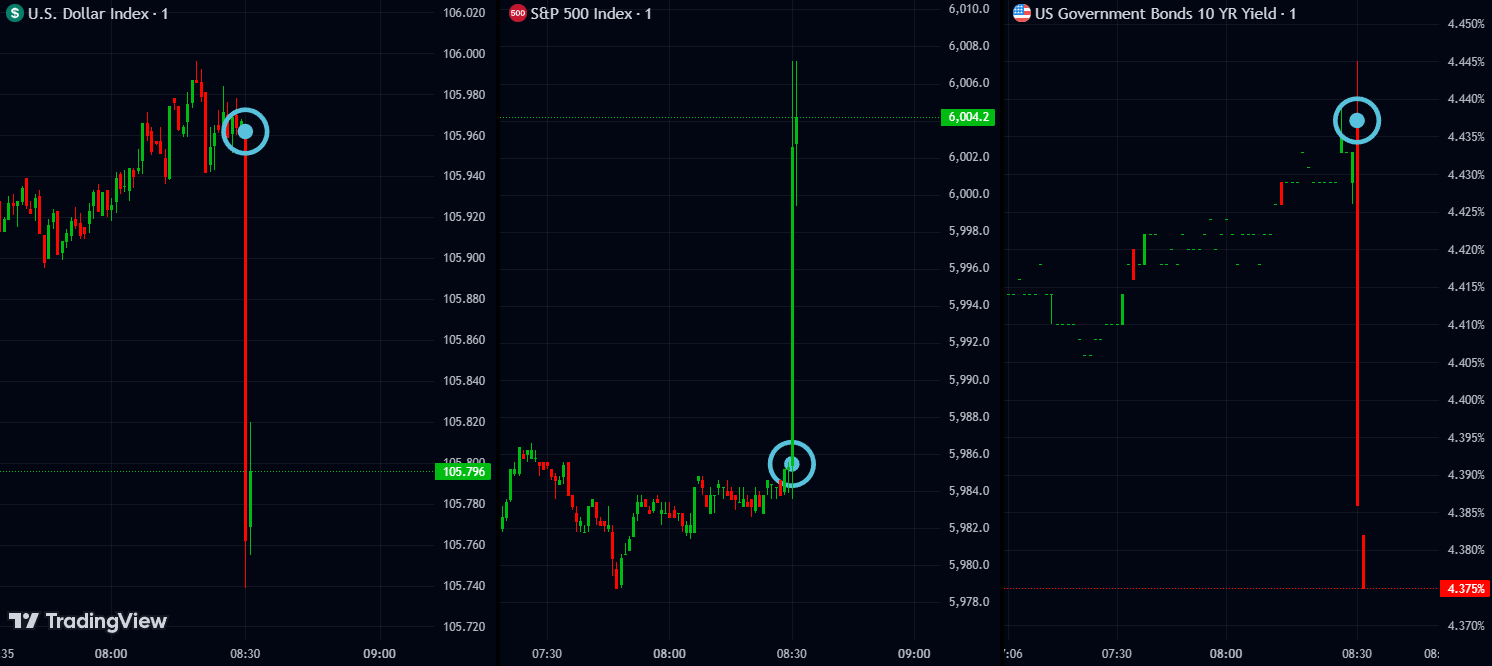

Headline CPI YoY came in as expected at 2.6%, up from the prior 2.4%.

Headline MoM came in unchanged and as expected at 0.2%.

Core YoY came in unchanged and as expected at 3.3%, and Core MoM also came in unchanged and as expected at 0.3%.

This caused weakness in the dollar and bond yields, and strength in the S&P 500.

Although inflation ticked up modestly in this report, it still came in as expected.

Traders expected inflation to come in higher than expected in this report, so these as-expected numbers were a sigh of relief.

Supercore MoM CPI came in lower than the previous at 0.314% from 0.404%, which helped the sentiment around this release, as traders increased their bets on Fed rate cuts.