US Interest Rate Prep

On Wednesday 18th of December at 14:00 ET, the FOMC is set to release the results of their latest monetary policy meeting.

Here are some views on what to expect.

General Expectations

Markets and median analyst expectations expect the FOMC to cut rates by 25 bps, from 4.75% to 4.5%.

In the unlikely event that rates are left unchanged, we would expect a large amount of weakness in US stocks, and strength in the dollar and government bond yields, as pricing in for the expected rate cut is undone and reversed.

But If the 25 bps cut is realized, attention will turn to the rate statement and the Summary of Economic Projections.

If the rate statement is more hawkish (underlines uncertainty about the strength of the jobs market and inflation return to target), this could indicate to the markets that the pace of rate cuts may slow down, which would be likely to cause weakness in US stocks, and strength in the dollar.

If the rate statement is more dovish (underlines increased confidence in inflation return to target, and satisfaction in the strength of the jobs market) this could confirm that the Fed can go ahead with further rate cuts, which would be likely to strengthen US stocks and weaken the dollar and government bond yields.

If the Summary of Economic Projections is more hawkish (increased inflation expectations, with potentially decreased employment and decreased growth forecasts as well) we would expect this to cause weakness in US stocks, and strength in the dollar and government bond yields, as it would serve to decrease the amount of Fed rate cuts that are priced in by the markets for next year.

If the SEP is more dovish however (decreased inflation expectations, stable labor market expectations, and increased growth expectations) we would expect strength in US stocks, and weakness in the dollar and government bond yields.

Commentary

Wells Fargo

Fears about a US recession in 2024 were unfounded.

Real GDP appears to have expanded at roughly a 2.4% annual pace on a Q4/Q4 basis even as the labor market has cooled off, as evidenced by the rise in the unemployment rate from 3.7% in November 2023 to 4.2% in November 2024.

Headline and core PCE inflation slowed further over the past year. The former fell from 3.0% to 2.3%, while the latter declined from 3.4% to 2.8%.

The FOMC refrained from cutting the federal funds rate for most of the year, but starting in September, the Committee initiated the easing cycle with a 50 bps rate cut.

The FOMC followed that with a 25 bps reduction in the fed funds rate in November, and next week’s FOMC meeting seems likely to result in another 25 bps move.

Beyond the rate cuts, the Federal Reserve also has reduced the size of its balance sheet by roughly $845 billion over the past 12 months through its quantitative tightening program.

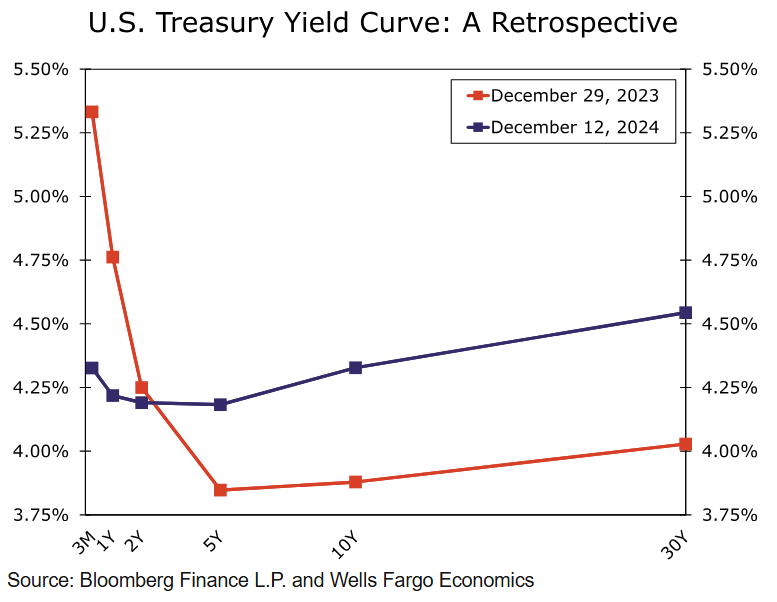

Against this backdrop, what have US interest rates done? At the very front-end of the yield curve, yields have fallen sharply, in line with the decline in the federal funds rate that has occurred.

However, further out the curve, yields have risen this year despite the FOMC’s rate cuts.

This fact serves as a sharp reminder that policy rate cuts do not necessarily result in lower long-term interest rates.

The Federal Reserve’s QT may have played a small role in the higher long-term interest rates, but we suspect other factors played a bigger role.

The prospects for a “hard landing” for the US economy have declined relative to one year ago, and it appears increasingly likely that structural factors such as faster productivity growth and higher public debt are putting upward pressure on r-star and, by extension, longer-term yields.

Looking ahead to 2025, we expect next week’s FOMC meeting to include signals from policymakers that the pace of rate cuts will be slower going in the year ahead.

We project three 25 bps rate cuts from the FOMC next year, and financial markets are priced for a similar outcome.

These rate cuts may put some additional downward pressure on shorter-term rates, similar to what occurred this year, but we do not anticipate a major decline in longer-term interest rates.

Our forecast for the 10-year Treasury yield at year-end 2025 is 4.00%, not too much below the current spot rate of 4.37%.

Goldman Sachs

The FOMC is likely to lower the target range for the fed funds rate by 25bp to 4.25-4.5% on Wednesday.

We expect the main message of the December meeting to be that the FOMC anticipates that it will likely slow the pace of rate cuts going forward, and we have revised our forecast for 2025 to eliminate a cut in January.

We continue to expect cuts in March, June, and September next year, and now expect a slightly higher terminal rate of 3.5-3.75%.

We had kept a January cut in our forecast because we had expected the Fed leadership would want to see a more convincing stabilization in the labor market than we have seen so far, and we continue to think that a January cut is a closer call than market pricing suggests for this reason.

But comments from Fed officials have pointed clearly to a desire to slow the pace soon.

One reason is that unemployment has undershot and inflation has overshot the FOMC’s projections, though neither surprise is quite as significant as it appears.

We also see two other possible reasons.

First, Fed officials might prefer to be cautious in light of uncertainty about the new administration’s policies, especially possible tariff increases.

Second, Fed officials increasingly appear to be even more open-minded about rethinking the neutral rate than we had expected, which argues for starting to move more cautiously sooner as they seek the right stopping point.

The key question for the statement and press conference is the relative emphasis put on slowing the pace versus on decisions remaining meeting-by-meeting and data-dependent.

We expect to hear both messages, including an addition to the statement that nods toward a slower pace.

We expect the median dot to show 3 cuts in 2025 to 3.625%, 2 cuts in 2026 to 3.125%, and a flat path in 2027 at 3.125%, each of which would be 25bp higher than in September.

We also expect the median longer run or neutral rate dot to rise 0.125pp to 3%, continuing its slow crawl higher. We expect the economic projections to show a flat 4.2% path for the unemployment rate and a modestly higher path for inflation, reflecting the higher starting point and perhaps in some cases participants’ decisions to pencil in a modest allowance for tariff effects even at this early stage.

Both our baseline and probability-weighted Fed forecasts remain somewhat more dovish than market pricing.

One key reason is that we see the risks to interest rates from potential policy changes under the second Trump administration as more two-sided than is often assumed.

ANZ

We expect the Fed to cut the FFR policy range by 25bp at its meeting next week. Overall, based on the underlying softness in the labor market, we believe monetary policy is restrictive and thus the gradual disinflation process will continue over the course of 2025.

Our expectation for next year is that the Fed will skip rate cuts at alternate meetings and will cut rates by a cumulative 75bp in increments of 25bp.

We think a gradual approach to cutting interest rates is appropriate, based on current trends in the data. Gradualism also reduces the risk of policy misses.

In speeches since the November FOMC meeting, Chair Powell has struck a cautionary tone. Specifically, he has reiterated that the Fed is likely to proceed cautiously with future easing owing to resilience in activity, stickiness in services inflation, uncertainty about the neutral rate of interest, and heightened uncertainty over the impact of Trump’s proposed policy measures on activity and prices.

Some of those measures could be disruptive.

There wasn’t much discussion of the Fed’s balance sheet normalization strategy at the November meeting, but we expect there may be some discussion in the next meeting.

The minutes flagged the New York dealer panel survey, which suggests the Fed will end its balance sheet runoff in Q1 or Q2 2025.

The level of ample bank reserves is expected to be around US 3 tln. The New York Fed’s elasticity of the federal funds rate to reserve changes is very small now and statistically indistinguishable from zero.

This suggests reserves are abundant.

Significant upward revisions to GDP data by the Bureau of Economic Analysis in late September and more resilient than expected consumer spending are likely to result in the Fed revising up its GDP growth forecast for 2024 and 2025.

We also expect the Fed to revise up its inflation forecasts over the same period, as services inflation is proving stickier than anticipated.

Higher growth and inflation forecasts are likely to lead to a shallower easing cycle, as captured in the Fed’s dot plot.

It’s also possible the Fed may revise up slightly its forecast for the FFR’s long-run neutral rate

Deutsche Bank

We expect the Fed to cut rates by 25bp at the December meeting, completing the 100bp re-calibration indicated in the September dot plot.

However, the meeting statement, Summary of Economic Projections (SEP), and Chair Powell’s press conference will likely send a consistent signal that the Fed is set to slow the pace of rate cuts in 2025.

In addition to the rate cut, we expect a 5bp downward adjustment to the ON RRP rate, which would realign it with its historical position at the bottom of the target range.

The SEP will show meaningful revisions to the 2024 economic forecasts, with growth and inflation revised higher and the unemployment rate lower.

These revisions will generate questions about why the Fed decided to cut rates.

Next year, the median dot is likely to show three additional rate cuts, though we expect the skew to be towards less easing.

Finally, the long-run dot will likely continue its upward migration, rising to 3.1%.

Upgrades to neutral should persist, as our own estimates remain materially higher.

In Powell’s press conference is likely to emphasize that, with policy still restrictive, the Committee believed it could modestly dial back the degree of restraint.

But with a strong economy, diminished downside risks to the labor market, and evidence that inflation is stickier than anticipated, the Fed will not be in a rush to get to a highly uncertain neutral level.

Our baseline remains that a skip in early 2025 could turn into an extended pause, with the Fed having limited scope for additional easing next year.

Previous Release

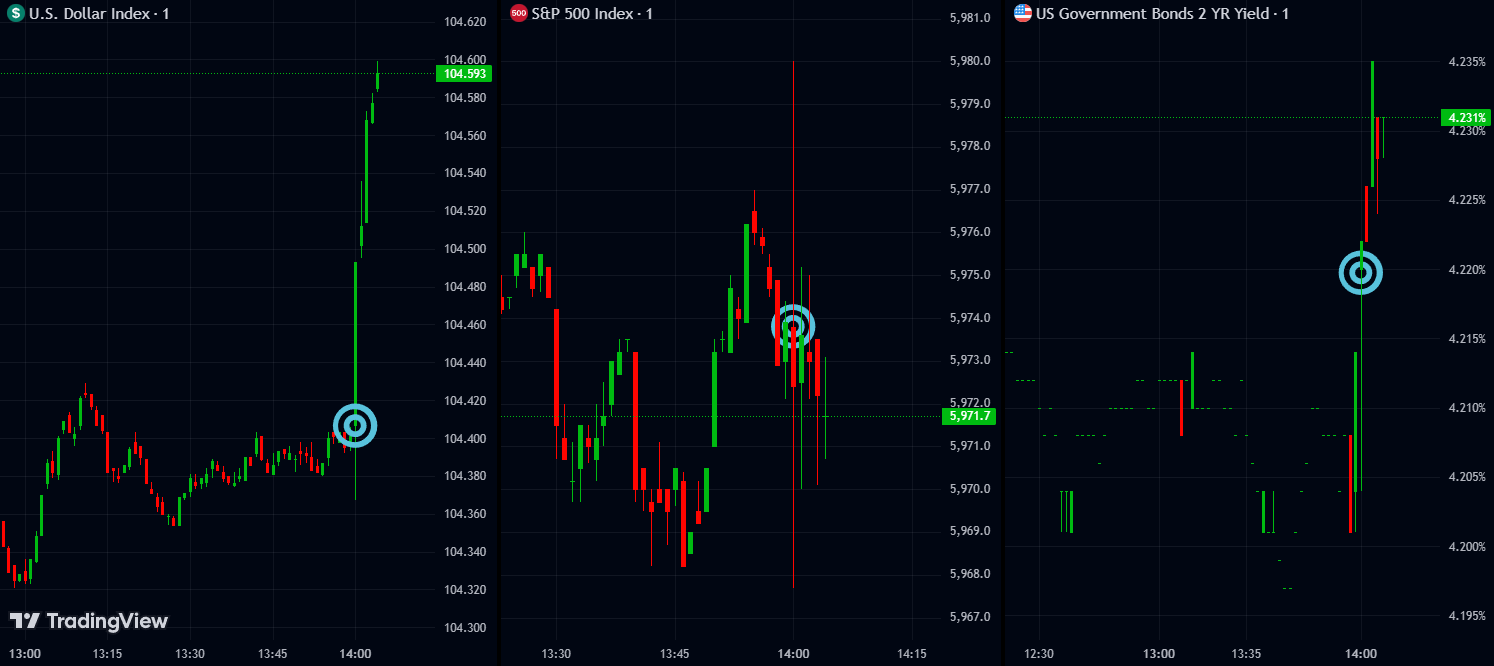

On November 7th at 2 PM ET, the FOMC cut rates by 25 bps to 4.75% from 5%, as expected.

This subsequently led to strength in the dollar and government bond yields.

Although the rate decision itself was as expected, the rate statement showed language that highlighted to traders that their confidence in inflation returning to target was not quite as strong as it was, which led to some pulling back in future Rate cut pricing at that time.