US NFP Prep

On Friday the 10th of January at 08:30 ET, the BLS releases the latest Employment Situation report representing November.

Here are some views on what to expect.

Overview

For Nonfarm Payrolls, the median forecast, the median expectation is for it to move down to 160K from 227K.

According to a survey of 459 qualified economists, the highest estimate is 205K, and the lowest is 120K.

As for the Unemployment Rate, the median expectation is for it to remain unchanged at 4.2%.

The highest estimate sees it at 4.4%, the lowest sees it coming in at 4.1%

General Expectations

The US Nonfarm Payrolls is the most highly monitored employment indicator by both traders and policymakers.

Markets have been reacting to employment reports for their effect on the broader economy, as well as their potential impact on monetary policy, though with the current backdrop of rates being in focus since the last FOMC meeting, we expect the markets will respond to any changes in Interest Rate Futures that may come from this release.

With that being said, if Nonfarm Payrolls come in higher than expected, and/or the Unemployment Rate comes in lower than expected, we would be likely to see weakness in US stocks and strength in the dollar and government bond yields, as this would indicate that the jobs market is not showing signs that could lead the FOMC to intervene with faster rate cuts.

If Nonfarm Payrolls comes in lower than expected, and/or the Unemployment Rate comes in higher than expected, we would expect to see strength in US stocks, and weakness in the dollar and government bond yields, as this could show that the jobs market is beginning to cool off more than the Fed would like, which could lead to increased chances of the US central bank stepping in to supply stimulation through steeper/faster rate cuts in order to make sure the jobs market does not cool down too much.

Keep in mind that the markets will be balancing between the data’s effect on the future of monetary policy, and its effects on the broader economy, which can cause variations/volatility in the reactions.

Commentary

Wells Fargo

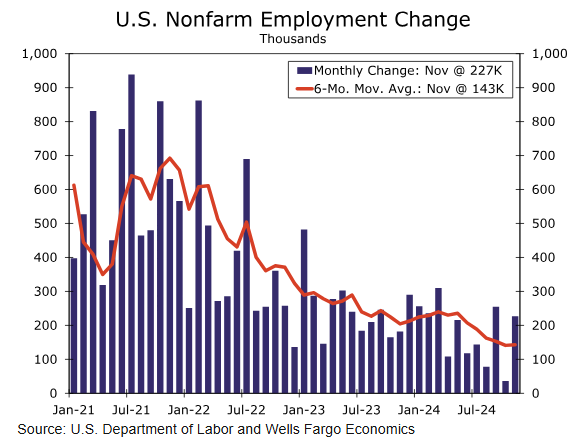

We expect payroll growth for December to revert to its recent trend. Bad weather and worker-strikes have caused volatility in the recent monthly hiring figures. For example, hiring received a boost in November as employers added 227K net new jobs during the month after adding just 36K jobs the month prior due to these one-off factors. In cutting through recent volatility, the job market has clearly moderated in the last year. Over the past six months, nonfarm payroll growth has averaged around 140K per month. At the start of the year that metric was running closer to 220K. The breadth of hiring has also narrowed with only a few industries being responsible for a bulk of hiring in recent months.

Virtually all labor data are consistent with moderation, but what has grown more clear since the summer months is that the deceleration in the labor market is non-linear. In other words, it’s not a straight-shot lower. Hiring may be decelerating, but it’s not collapsing. And while businesses aren’t looking for as many workers as they were, they’re not exactly laying off workers in droves either. The number of workers who filed an initial claim for unemployment insurance the week of December 14 (which is the survey week corresponding to the December nonfarm payroll report) fell and remains in line with recent levels. Worker participation has softened somewhat in recent months as the upward trend among prime-age workers (those age 25-54) is showing signs of leveling off in another indication of a cooling jobs market—something we’ll be watching in the upcoming release.

This slow-but-steady descent in hiring is part of the recent shift in the Fed’s tune at its December policy meeting. Chair Powell emphasized in the post-meeting press conference that the Committee does not feel it needs to see a further softening in the labor market in order to quell inflationary pressure. This is because despite the past two monthly pops in average hourly earnings, wage growth has continued to moderate by most measures and isn’t exerting nearly as much pressure on consumer prices. To that end, we expect to see a more trend-like monthly gain in wage growth (~0.2%) in December. Further, as the broad economy continues to hold up and consumers keep spending, it’s hard to imagine a broadening out in layoffs consistent with a recession-like pullback in growth. This is to say, the Fed still has some cover on the employment-side of its mandate to focus on stomping out recent stickiness in inflation by taking a slower approach to reducing policy.

We expect to see the pace of hiring move back in line with its recent run rate toend the year. As we think about how hiring is set to progress in the new year, we expect softer demand for new workers and slower growth in the labor supply to lead to a moderation in the pace of monthly net hiring to around 125K and for the unemployment rate to hover around 4.3% next year.

CA CIB

The jobs report will be the next big one for the Fed, though we believe there is a very high bar to avoid a pause in January. Following swings the last couple of months due to hurricanes and strikes, we expect December nonfarm payrolls to come in at +145k, between the soft +36k print in October and the +227k jump in November. If on track, this would result in a three-month moving average of +136k, indicating a labour market that has clearly cooled, but not fallen off a cliff. Elsewhere in the report, we look for average hourly earnings to rise 0.3% MoM, taking a step down from 0.4% in each of the past two months, though this would leave the YoY pace unchanged at 4.0%. We also expect the unemployment rate to be unchanged at 4.2%, with this metric having been better insulated from the noise that has plagued NFP the past couple of months in other labour market data, job openings have declined notably over the past few years, but only to a level that remains above the number of unemployed people. In November, the consensus expectation is for a little changed reading a bit above 7.7m, which would again keep the vacancy-to-unemployment ratio above 1x, even if it has come down from a peak of around 2x.

Overall, we think the data points to a labour market that has normalised, but remains in an ok spot overall, with cooling taking place in a relatively gradual and orderly fashion thus far. The Fed stands ready to react to further cooling as needed, but has noted that it sees downside labour market risks as having diminished, and barring a notably weaker report than anticipated, we think the Fed remains on track to keep rates on hold in January. This is especially the case as the overall economy remains resilient, even if there are some pockets of weakness, with services leading the charge. We expect this to remain the case in December, with ISM services bouncing back to 53.5 after dipping more than expected to 51.2 in November, to remain solidly in expansionary territory.

Black Rock

We get U.S. payrolls for December this week. Wage growth remains elevated due to an unexpected rise in immigration, in our view. While wage pressures have cooled some as immigration has slowed, they remain above the level that would allow inflation to fall to the Fed’s 2% target. Given the risk of resurging inflation from potential trade tariffs and the immigration slowdown continuing, market expectations of only two more Fed policy rate cuts in 2025 now seem reasonable, we think.

Previous Release

On December 6th at 08:30 ET, the BLS released the US employment situation report representing the month of November.

US Nonfarm Payrolls came out at 227k, above estimates of 220k, and the revised prior of 36K.

The Unemployment Rate came out at 4.2%, above estimates of 4.1%, and the prior of 4.1%.