US CPI Prep

On Wednesday the 15th of January, at 08:30 ET, the BLS is set to release the latest US CPI report for the month of December.

Here are some views on what to expect.

Overview

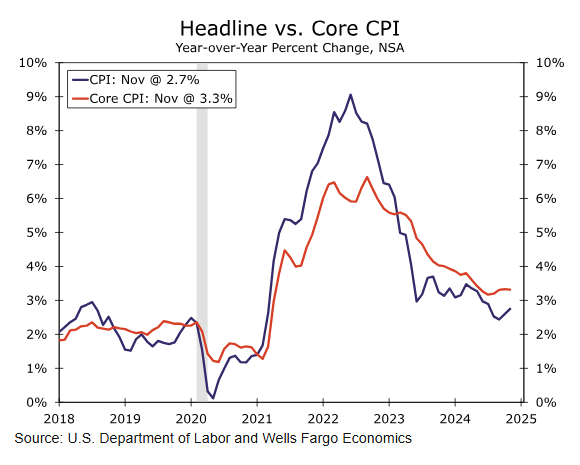

The median expectation for headline US CPI YoY is 2.9%, up from the prior 2.7%.

According to a survey of 38 qualified economists, the highest estimate is 3%, and the lowest is 2.6%.

Headline US CPI MoM, the median expectation is 0.3%, from the prior 0.3%.

The highest estimate is 0.4%, and the lowest is 0.2%.

Core CPI YoY has a median expectation of 3.3%, expected to remain unchanged from the prior 3.3%.

The highest estimate is seen at 3.4%, the lowest is 3.2%.

Core CPI MoM has a median forecast of 0.2%, the prior was 0.3%.

The highest estimate is 0.3%, the lowest was 0.2%.

General Expectations

If CPI comes in higher than expected, we would expect to see weakness in US stocks, and strength in the dollar and government bond yields, as this would cause markets to pull back further on bets for further Fed interest rate cuts, as rates may need to stay higher for longer in this environment to make sure inflation is coming sustainably down to the Fed’s target.

If CPI came in lower than expected, we would expect strength in US stocks, and weakness in the dollar and government bond yields, as this would indicate that inflation is continuing to come down to the Fed’s target, which could increase the likelihood that the Fed can move forward with further interest rate cuts.

Commentary

Bank of America

We forecast both headline and core CPI inflation to remain at 0.3% m/m in December, although there is a risk that the core could round down to 0.2%. The y/y rate should tick up a tenth to 2.8% for headline and remain unchanged at 3.3% for core. Meanwhile, we expect a strong retail sales report for December, with the ex-autos and core control categories coming in at 0.6% and 0.5% m/m, respectively.

Wells Fargo

We are approaching another speed bump on the road to 2% inflation. Solid increases in energy and food prices at the end of 2024 underpin our forecast of a 0.4% monthly gain in the Consumer Price Index in December. If realized, the annual rate of inflation will tick up to a five-month high of 2.9%. Excluding food and energy, we suspect the core CPI will post a relatively tepid 0.2% monthly increase. A cooling in vehicle price growth and a decline in hotel prices should help to keep core inflation in check. On a year-ago basis, the core CPI is expected to hold steady at 3.3% in December.

While both headline and core inflation are down relative to December 2023, the CPI has largely trended sideways since the summer. The lack of additional progress has tilted the Federal Reserve’s focus back toward the price stability side of its mandate.

JPMorgan

We forecast the consumer price index (CPI) to have risen 0.4% (0.44% to two decimal places) in December, which would be the firmest monthly gain since August 2023. Elevated growth on the month for both energy and food prices are partially responsible. Despite the price of gasoline at the pump actually cooling slightly in December, a strong seasonal correction should have contributed to a large increase in the CPI energy price category on the month. Meanwhile, food prices have moved up sizably for a range of items, most notably eggs as avian flu continues to constrain supplies. In part as a result of these factors, we look for year-ago inflation of the headline index to move back up. to 3.0% from 2.7% in November.

Away from food and energy, core CPI is expected to have risen 0.3% (0.28% to two decimal places) in December, with the year-ago pace steady at 3.3%. We expect the choppy downtrend in shelter price inflation to continue, with slightly higher prints for owners’ equivalent rent and tenants’ rent than in November – at 0.28% and 0.24% last month, respectively – but still their lowest monthly readings over the prior half-year and consistent with further deceleration of their still-elevated over year-ago inflation rates as shelter inflation continues its gradually normalization following an extended period of strong price growth that has largely mirrored the moves in various home price indexes, albeit with a lag of a year or more. Additionally, industry data point to a fairly firm 0.6% rise in lodging prices for December.

Previous Release

On December 11th at 08:30 ET, the BLS released the US CPI report for the month of November.

Headline CPI YoY came in as expected at 2.7%, up from the prior 2.6%.

Headline MoM came in as expected at 0.3%.

Core YoY came in as expected at 3.3%, and Core MoM also came in as expected at 0.3%.