US CPI Prep (24th October)

On Friday, the 24th of September, the BLS is set to release the US CPI September report, which was delayed due to the ongoing US government shutdown.

Here are some views on what to expect.

Overview

US CPI for September

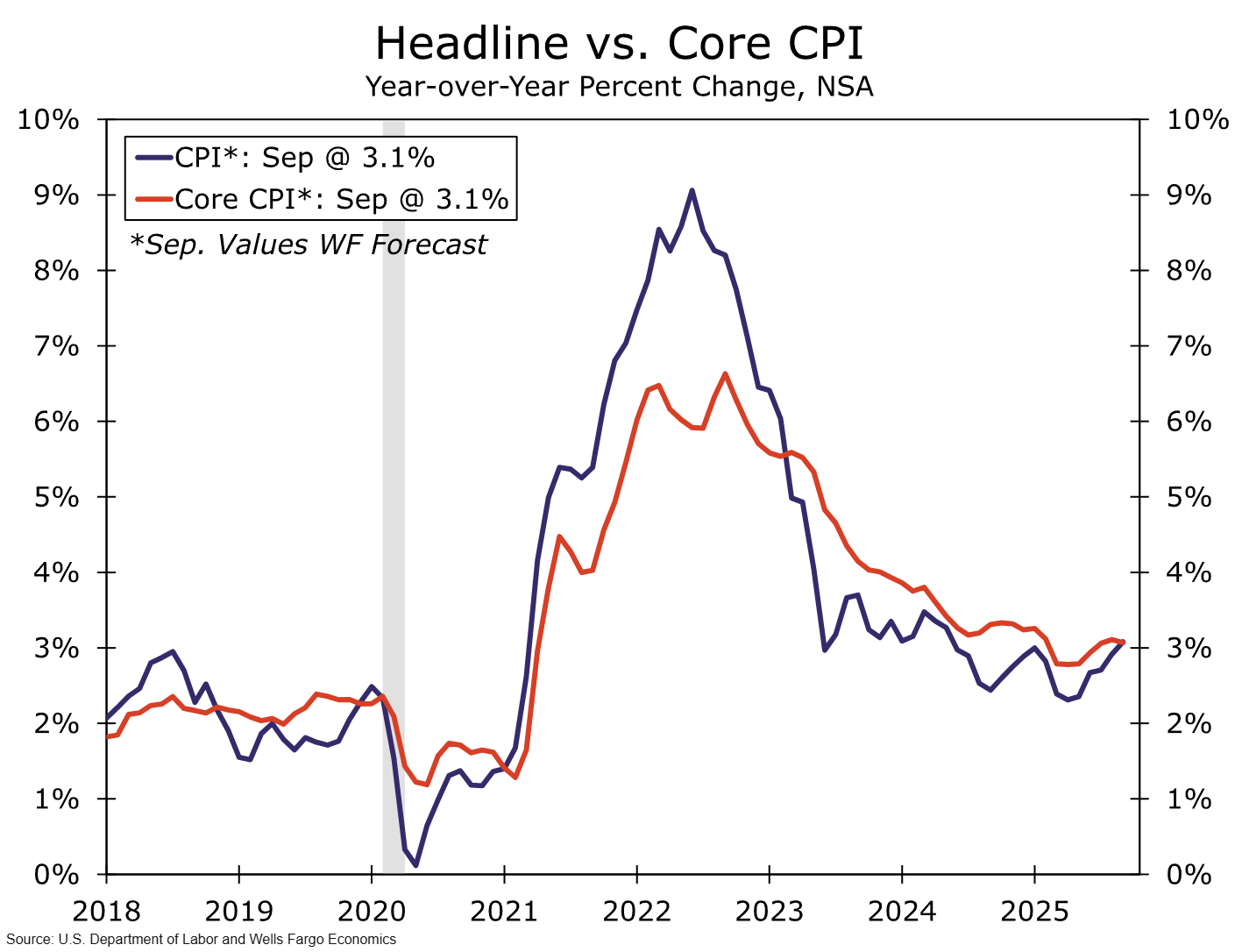

YoY – Forecast: 3.1% | Prior: 2.9% | Range: 3.2% / 2.9%

MoM – Forecast: 0.4% | Prior: 0.4% | Range: 0.5% / 0.2%

Core YoY – Forecast: 3.1% | Prior: 3.1% | Range: 3.2% / 3%

Core MoM – Forecast: 0.3% | Prior: 0.3% | Range: 0.4% / 0.2%

General Expectations

US Stocks

If CPI comes in higher than expected, equities may experience headwinds, particularly in sectors sensitive to input costs and margins.

If CPI comes in lower than expected, it could boost equities, especially in growth and consumer-oriented sectors, by reducing inflation and interest-rate risk.

US Dollar

A stronger-than-expected inflation print may strengthen the USD, as markets anticipate tighter monetary policy.

A weaker-than-expected inflation print may weaken the USD, due to expectations of a more accommodative policy stance.

Government Bonds

Higher inflation may lead to higher bond yields (lower bond prices), as investors demand compensation for inflation risk.

Lower inflation may lead to lower yields (higher bond prices) as inflation concerns ease and rate-cut expectations gain traction.

Federal Reserve Policy

A persistent inflationary surprise would likely prompt the Federal Reserve to maintain tighter policy for longer, delaying rate cuts.

A softer inflation reading could open the door to a more dovish stance, increasing the probability of rate cuts or slower normalization.

Commentary

Wells Fargo

The September Consumer Price Index will be released next Friday, October 24, nine days after it was originally scheduled.

This report may be the only fresh, federal government data that FOMC members will get to digest before their meeting at the end of this month.

Although the BLS is running on an exceptionally lean staff, we are not concerned about the data quality of this upcoming report.

Data for September were likely collected in full before the government shutdown began on October 1.

That said, if the shutdown drags on, subsequent reports may either be based on partial data or skipped entirely, depending on data quality.

Nevertheless, inflation pressures persist. CPI rose at a 2.9% annual rate in August, the fastest pace since January.

An acceleration in core goods inflation kept core CPI even hotter at 3.1%. ~

We expect these underlying trends remained intact in September and next week’s report will underscore stalled progress on inflation. We estimate the headline CPI advanced 0.4% over the month, which would push the year-over-year rate to a 16-month high of 3.1%.

Similarly, we forecast the core CPI rose by 0.3% for the third consecutive month amid the ongoing transmission of tariff-related cost pressures.

If realized, this uptick would hold the year-over-year core rate steady at 3.1%.

Bank of America

While the shutdown continues to affect most official data, the BLS will publish the September CPI report next week, because it is needed to calculate the Social Security cost-of-living adjustment.

Headline and core inflation likely rose by 0.3% MoM as tariffs continue to put pressure on goods prices.

The YoY rates for headline and core inflation should be little changed at 3.0% and 3.1%, respectively.

If our forecast is correct, the inflation data are unlikely to sway the Fed’s next policy decision one way or the other.

Crédit Agricole

Though the employment side of the mandate has been gaining in importance, inflation will be in focus next week, given the rescheduled release of September CPI, which is being compiled during the shutdown, given its importance for determining the cost-of-living adjustment for Social Security payments.

Here, we expect a relatively firm month of data, with headline rising 0.4% MoM to result in the YoY pace ticking up to 3.1% from 2.9% and core rising 0.3% MoM to see the YoY pace holding steady at 3.1%.

If our forecast is on track, it would leave the three-month annualised pace of core CPI at right around 4.0%, double the Fed’s target.

Even if part of this would come down to tariffs, it is still not an ideal development, and we remain of the view that the inflation side of the mandate will eventually regain the upper hand for the Fed, limiting the amount of easing delivered compared to what the market is pricing.

Previous Release

On September 11th at 08:30 ET, the BLS released the August CPI report.

US CPI YoY Actual 2.9% (Forecast 2.9%, Previous 2.7%)

US CPI MoM Actual 0.4% (Forecast 0.3%, Previous 0.2%)

US Core CPI YoY Actual 3.1% (Forecast 3.1%, Previous 3.1%)

US Core CPI MoM Actual 0.3% (Forecast 0.3%, Previous 0.3%)

This caused general weakness across asset classes, with downside in the dollar and government bond yields, and a whipsaw that led to weakness in US stock indices.