US Interest Rate Prep (29th October)

On Wednesday, the 29th of October, at 14:00 ET, the Fed concludes its 2-day policy meeting, and makes it’s US Interest Rate decision, and releases the latest Rate Statement.

Here are some views on what to expect.

Overview

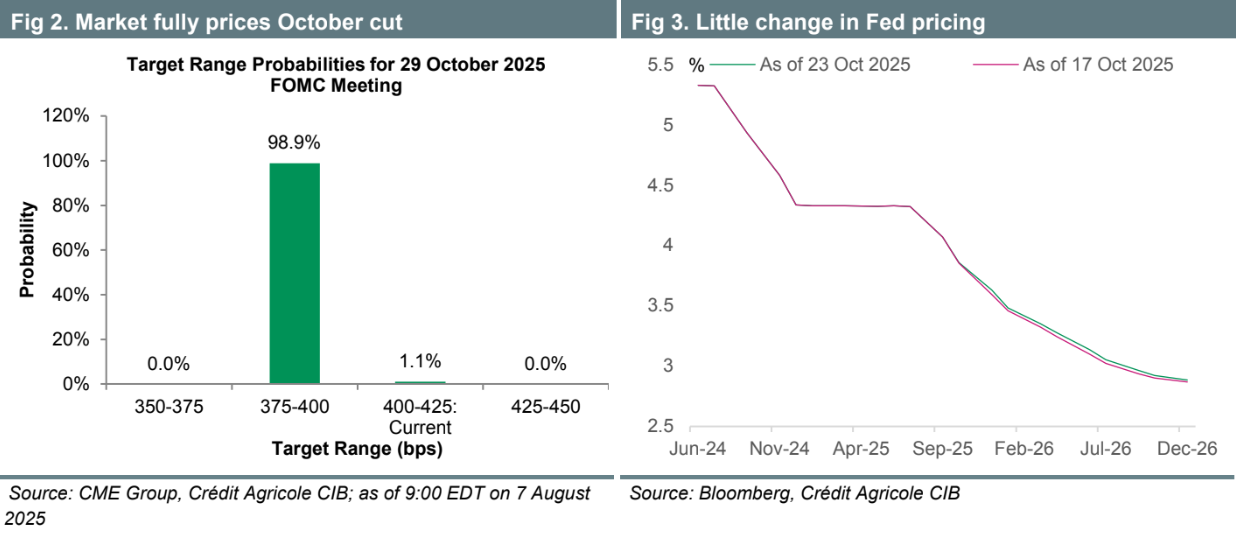

Median analyst forecasts and market pricing expect the Fed to cut rates 25 bps to 4% at this meeting.

If realised, this would mark the second consecutive rate cut from the Fed, after they cut rates for the first time this year at their last meeting in September.

Scenarios

Dovish

The Fed cuts rates by 25 bps to 4.00% and signals concern that growth momentum is fading while inflation continues to ease.

The statement highlights rising labour-market slack and subdued demand, suggesting further easing could be warranted if data weakens.

Markets would likely cheer the softer stance — equities rally, the USD falls, and Treasury yields drop as traders price in more cuts ahead.

Neutral (Base Case)

The Fed delivers the widely expected 25 bps cut to 4.00% but frames it as a “fine-tuning” move rather than the start of a new easing cycle.

Policymakers balance acknowledgement of slower growth with lingering inflation risks, maintaining a cautious, data-dependent tone.

The reaction should be muted: stocks steady, USD little changed, and bond yields hold near current levels, though short-term volatility is always expected around this release.

Hawkish

The Fed either holds at current levels or issues a statement that tempers expectations for further easing, stressing that inflation remains above target and that recent data uncertainty limits visibility.

The tone is defensive, prioritizing price stability over near-term growth risks.

Markets would read this as a surprise: equities dip, the USD strengthens, and yields rise as traders unwind bets on additional cuts.

Commentary

Bank of America

The Fed is expected to cut rates by 25bps to 3.75–4.00% and end balance sheet runoff at its October meeting. Policymakers will likely acknowledge recent economic resilience but keep their focus on supporting the labor market. With limited official data due to the government shutdown and ongoing uncertainty around employment trends, Powell is unlikely to give forward guidance beyond this meeting — reinforcing a cautious “fly-by-instruments” approach.

Crédit Agricole

The upcoming September FOMC meeting will draw significant attention, particularly due to the lack of key economic data during the ongoing government shutdown. Reports such as PCE inflation, GDP, and the employment cost index will be delayed, leaving only limited releases like consumer confidence and regional Fed surveys. The Fed is expected to deliver another 25bp rate cut in October, keeping its guidance open-ended amid uncertainty and internal divergence on the policy outlook. Policymakers are likely to reiterate that rates are not on a “pre-set course” and that no “risk-free” path exists for monetary policy.

Analysts argue that market expectations for rate cuts remain too aggressive, as the Fed will likely pause easing once inflation concerns reassert themselves later this year. Attention will also turn to the Fed’s balance sheet policy, with Chair Powell hinting that quantitative tightening (QT) could end in the “coming months.” While a formal announcement may not come in October, recent money market pressures and increased use of the repo facility suggest QT’s end is near—possibly by December, after Powell lays the groundwork at the next meeting.

ING

US September inflation was softer than expected, rising by 0.3% month-on-month /3.0% year-on-

year for headline inflation and 0.2% MoM/3.0% YoY for core (ex food & energy). The consensus forecast was for a 0.4% MoM headline print and 0.3%MoM core.

As such, we have a green light for a 25bp Fed rate cut next week, even though the core month-on-month rate (blue bars) continues to track above the 0.17% MoM rate we need to average to bring the annual rate of inflation down to the 2% target.

Previous Release

On September 17th, 2025, The Federal Reserve lowered its benchmark interest rate by 25 basis points to 4.25%, marking its first move of 2025 and aligning with broad market expectations.

The updated Summary of Economic Projections (SEP) points to a measured easing path: an additional 50bps of cuts this year, followed by 25bps in both 2026 and 2027. Growth and labor market forecasts were little changed, with policymakers projecting 1.6% GDP growth in 2025 (vs. 1.4% in June), a 4.5% unemployment rate (unchanged), and inflation ending the year at 3.0% headline, 3.1% core (also unchanged).

The statement acknowledged a cooling labor market and “somewhat elevated” inflation, noting that “downside risks to employment have risen.” The Committee reaffirmed its commitment to the 2% inflation target while highlighting elevated uncertainty and data dependence for future moves.

The S&P 500 spiked higher before erasing gains, while the dollar and Treasury yields weakened. Fed funds futures implied a 94% probability of another cut in October, up from 72%.

The Fed’s messaging left the door open to further action but underscores a cautious, incremental approach. Markets will turn next to upcoming labor and inflation data to gauge whether policymakers can deliver the projected path of cuts.