US Nonfarm Payrolls Prep

On Thursday, the 20th of November, at 08:30 ET, we see the delayed release of the US Employment Situation report for September.

Here are some views on what to expect.

Forecasts + Ranges

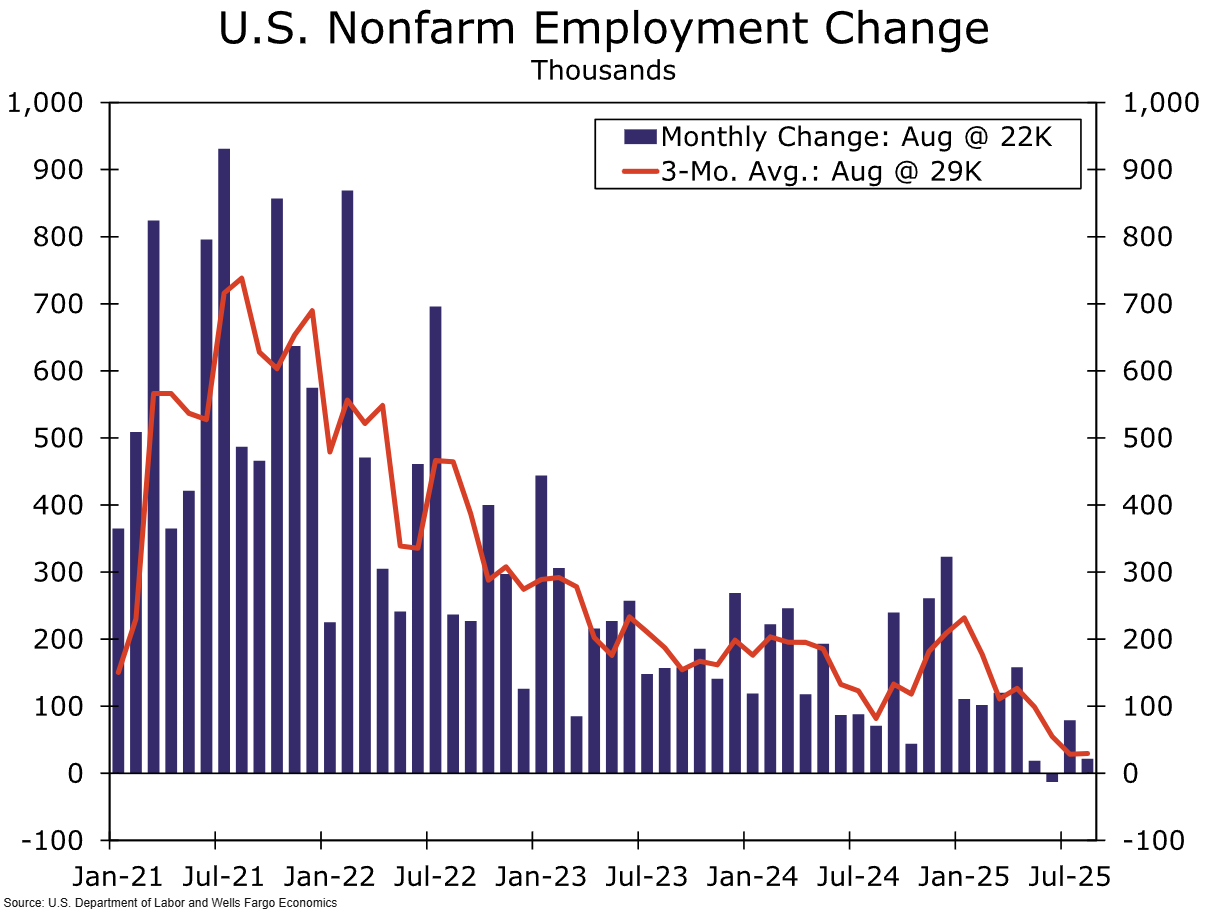

Nonfarm Payrolls – Forecast: 51k | Prior: 22k | Range: 105k / -20k

Unemployment Rate – Forecast: 4.3% | Prior: 4.3% | Range: 4.4% / 4.2%

Average Earnings YoY – Forecast: 3.7% | Prior: 3.7% | Range: 3.8% / 3.4%

General Expectations

US Stocks

A stronger-than-expected NFP print would likely boost equities, particularly cyclicals and industrials, by reinforcing hopes of still-solid consumer demand and corporate hiring. Conversely, a weak print (or disappointing wage growth) could weigh on growth-sensitive equities, raise fears of slower forward earnings, and lead to a more defensive market tone.

However, it is worth considering that lower employment numbers may increase rate cut bets from the Federal Reserve, which could add a bullish tone to the reaction.

US Dollar

If NFP comes in well above expectations, the U.S. dollar may strengthen as markets anticipate firmer growth and potentially delayed rate cuts from the Federal Reserve. On the flip side, a weak report could weaken the dollar as investors lean toward dovish monetary policy and lower growth assumptions.

US Government Bond Yields

A strong labour-market report tends to push yields higher (and bond prices lower) as the likelihood of tighter policy or fewer cuts increases. A disappointing report can have the opposite effect—yields falling as investors price in weaker growth and perhaps earlier easing.

Federal Reserve Policy

A robust NFP reading supports the case for the Fed maintaining rates or delaying cuts, given upside risks to inflation and employment. A soft reading increases pressure on the Fed to consider a looser stance or to signal rate cuts sooner, as it suggests labour slack and weaker underlying inflation risk.

Commentary

Wells Fargo

We expect the report to show employers added 45K net new jobs in September, and for the unemployment rate to remain at 4.3% when rounded. Alternative labor market data have continued to paint a mixed picture where the jobs market is not improving, but not falling apart either. Private-sector job growth remained sluggish through October, and real-time unemployment rate estimates suggest it has only gradually crept higher over the past two months. Despite recent job cut announcements from large companies and an uptick in Challenger-reported cuts, state-level jobless claims suggest layoffs are shooting higher on a widespread basis.

Even as the September nonfarm report will be somewhat dated, it may be the final full employment report the Fed has in hand ahead of its December monetary policy meeting. One thing we’ll be watching closely is the unemployment rate. After some volatility in recent months, we expect labor force participation to be little changed in September as soft demand and supply challenges persist. While this should keep the unemployment rate steady, the risks are tilted toward an increase to 4.4% with some potential giveback in the household survey employment measure. If realized, that would put the rate above the FOMC’s central tendency estimates of “full employment,” keeping the heat turned up at the Fed to cut rates at its final meeting of the year. This is still our base case outcome, though market pricing has come off a bit in the absence of traditional data and more hawkish Fed speak. We ultimately expect continued labor market cooling and fairly-contained inflation pressure will lead the Fed to cut.

Bank of America

After a weak summer in the job market, we expect September payrolls to rise by 65k, above consensus expectations. All eyes will be on a possible upward revision to August.

Additionally, we expect the unemployment rate to remain at 4.3% with stable income growth, reducing concerns around a demand-driven labor slowdown.

Previous Release

On September 5th at 08:30 ET, the BLS released the US Employment Situation report for August.

Nonfarm payrolls came in lower than expected, at 112k on estimates of 75k.

The Unemployment rate ticked up to 4.3% from 4.2%, as expected.

This caused weakness in the dollar and government bond yields, and strength in US stocks, as traders increased bets on Fed rate cuts in order to stuimulate a weakening job market.