BoE Interest Rate Prep

Commentary:

ING: Expect the Bank of England to use Thursday’s decision to reiterate that rates need to stay restrictive for an extended period of time, a signal that it’s too early to contemplate policy easing. We expect the first rate cut to come in August. Since February’s meeting, we’ve had data showing both wage growth and services CPI falling, largely as the Bank had forecast back in February, and importantly we’ve seen further signs that firms’ price and wage expectations for coming months are cooling. Whether or not that’s enough to convince Mann and Haskel to drop their rate hike votes isn’t clear. We wouldn’t be totally surprised if at least one of those committee members still votes for a rate hike this month.

Barclays: This week’s UK January labour market data were soft across the board. Wage growth slowed especially in the private sector, in addition to loosening labour market quantities, which produced a further fall in the V/U ratio. Next week, we expect UK inflation to decelerate 0.5pp on both headline and core CPI, to 3.5% y/y and 4.6% y/y, respectively. Easing should be seen across services, core goods and food, all aided by base effects. The latter should contribute to a string of declines in UK CPI and core CPI over the next four months.

Based on these data (the MPC will have CPI at hand when they meet), we think the BoE will hold the Bank Rate at 5.25% in a three-way vote split and maintain a cautious tone. We do not expect any changes to key guidance from the MPC, though a particularly weak inflation print could lead it to soften its language further. Beyond next week, the evidence is building that disinflation is sufficiently embedded for cuts to come in June.

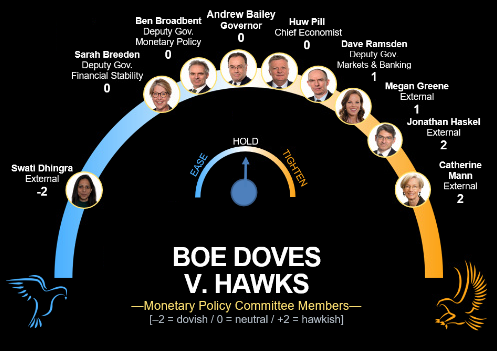

BofA: We don’t expect much excitement. There hasn’t been enough data since the last meeting for us to gain a lot more confidence that the improvement in inflation is persistent. We expect the BoE to stay on hold next week with a 1-7-1 vote, with Haskel switching from a hike to a hold. We would not rule out a second vote for a cut. We expect no changes to guidance. Surprises in next week’s CPI print may tilt the communication slightly, but shouldn’t be a deal breaker.

The minutes should reflect the continued need for more confidence but smaller tail risks. The emphasis from here is likely to still be on sticky services inflation, ongoing and upcoming wage negotiations and the pass-through of the imminent increase in the national living wage. As a reminder, we remain convinced that the BoE will keep the Bank Rate on hold at 5.25% until August, with a cutting cycle of 25bps per quarter from there.

Goldman Sachs: For this year, our economists expect five cuts, while the market is pricing only 3. Then they expect the BoE to continue cutting until it reaches its terminal level in 2Q ’25 at 3%, 225bps below current levels.

JPMorgan: This week’s UK labor market report was softer than expected but continued to show broad signs of resilience. Barring a large surprise in the upcoming February CPI report, we don’t expect recent developments to have shifted the debate much further at next week’s MPC’s meeting. The BoE is set to stay on hold, and we look for unchanged guidance and minimal changes in the vote. We continue see the UK as the last major European central bank to cut, starting in August.

MUFG: We are not convinced that the BoE will signal at next week’s MPC meeting that it is moving closer to cutting rates. Further evidence of slowing core and services inflation alongside moderating wage growth will be required to give the BoE more confidence that they can start to cut rates.

Societe Generale: While some key data have eased since February, it won’t be enough to convince the majority of MPC members that inflation is on a sustained path back to 2%. Recent statements from MPC members and the fact that key April wage data will be released after the May meeting have led us to push back our projection of a first rate cut from May to June.

Unicredit: The Bank of England’s Monetary Policy Committee (MPC) will likely keep the bank rate unchanged at 5.25% when it publishes its policy decision on Thursday, 21 March. We expect the vote to be split three ways, with six members voting for no change, one member (Swati Dhingra) voting for a 25bp cut, and two members (Jonathan Haskel and Catherine Mann) voting for a 25bp hike, in what would be a repeat of the February vote.

RBC Capital Markets: We expect the Bank of England to keep Bank Rate unchanged at 5.25% at its meeting today. The last MPC meeting featured significant changes to its guidance. Even though the MPC will have to soften its messaging as the point where it begins to deliver an expected first rate cut nears, we don’t think enough has changed since the last forecast round for that to begin now (see Exhibits 1 and 2).

That, as well as the absence of new MPR forecasts and post-meeting press conference, leads us to think that a major shift in rhetoric won’t be forthcoming at this meeting. Similarly, we think the vote split will remain 1-6-2 in favour of a hold with Jonathan Haskel and Catherine Mann continuing to vote for increase in Bank Rate.

The March meeting is not associated with a quarterly Monetary Policy Report, so there will be no new set of macro projections. But the MPC minutes will provide insights into the MPC’s assessment of recent macro data and the government’s Spring Budget.

BoE Voting Member Split:

ING’s Market Pricing:

Previous Reaction:

The previous release of the figure saw little movement in GBP.

BoE Bank Rate Actual 5.25% (Forecast 5.25%, Previous 5.25%) [February 1st 2024]