ECB Interest Rate Prep

Sentiment:

BofA: We expect no changes to rates or guidance from the ECB in the press release. We would expect the statement to acknowledge that the incoming information has broadly confirmed the Governing Council’s previous assessment of the medium-term inflation outlook. But we would also expect it to flag that domestic price pressures remain strong and are keeping services price inflation high and that data since the June meeting has not necessarily the provided clarity needed to take an additional step. Beyond that, we also expect the wording on the path ahead to be unchanged, emphasising the data-dependence and meeting-by-meeting approach to determining the appropriate level and duration of restriction.

In other words, we would expect the ECB to be as neutral as possible. Only data outperforming forecasts would offer the proof needed to move in July. We have not had a lot of new information since June to increase our conviction on this. And the releases We did not surprise, at least not in the right direction. For now, there is no reason to be unhappy about market pricing and this is likely to be reflected in the statement and press conference next week, which will probably try to be as neutral as possible.

Deutsche Bank: Our European economists expect the central bank to stay on hold.

ING: When the European Central Bank meets on Thursday, the main, if not only goal will be to have a gentle start to the holiday season and to avoid sending markets on a rocky summer road.

There hasn’t been a lot of important data releases since the ECB’s June meeting. If anything latest data have pointed to weaker growth, lower headline inflation but still sluggish core and services inflation. In more detail, dropping confidence indicators in June and weak hard data for May underline that the eurozone’s economic recovery has lost steam. The ECB’s June projections had eurozone growth returning to potential already in the second quarter of this year. This is a scenario that has become less likely in recent weeks. As regards inflation, the drop in headline inflation was broadly in line with the ECB’s June projections. However, core inflation came in slightly higher than the ECB’s forecast. Also, core inflation remains sticky and official ECB comments since the June meeting suggest that the ECB’s focus is shifting towards exactly this domestic inflation. Clearly related to this are wage developments. Latest data from the ECB’s wage tracker showed an increase in wage growth in June. While the ECB’s June projections include a small acceleration of wage growth over the summer, latest developments and anecdotal evidence of new union demands puts the expected gradual slowing of wage growth after the summer at risk.

JPMorgan: The ECB is almost certain to stay on hold next week while describing incoming data as “broadly confirming”its inflation outlook. With staff inflation projections incorporating market expectations of further cuts this language would signal it is on track for a September ease.

Morgan Stanley: The ECB will keep rates on hold in July. From its perspective, more data is needed to confirm the assumed (and projected) timely return of inflation to target. This confirmation comes in two parts: The degree of alignment of actual inflation prints with the short-term forecast and

the alignment of overall macroeconomic data with the narrative of continued disinflation. On both counts more data is needed, the ECB will focus on July and August inflation as well as on wage and productivity data. All of which will be available in time for the September meeting. Continued progress on the road to 2% will likely be signalled. We don’t expect specific messaging on the French elections.

UniCredit: The ECB will most likely leave monetary policy unchanged today, and we do not expect any meaningful discussion about a second rate cut yet. Stickiness in services prices, fast wage growth and a resilient labor market argue against back- to-back rate reductions. While the ECB remains data-dependent, most members of the Governing Council (GC) appear to have been “guiding” the market to expect live rate discussions when new macroeconomic forecasts are published. The next round of projections will be published alongside the ECB’s 12 September meeting.

Money Market Pricing & Comments:

July 11th: Traders lift ECB easing bets after US CPI, seeing 20bps in September.

July 4th: ECB Accounts: Some members felt that the data available since the last meeting had not increased their confidence that inflation would converge to the 2%.

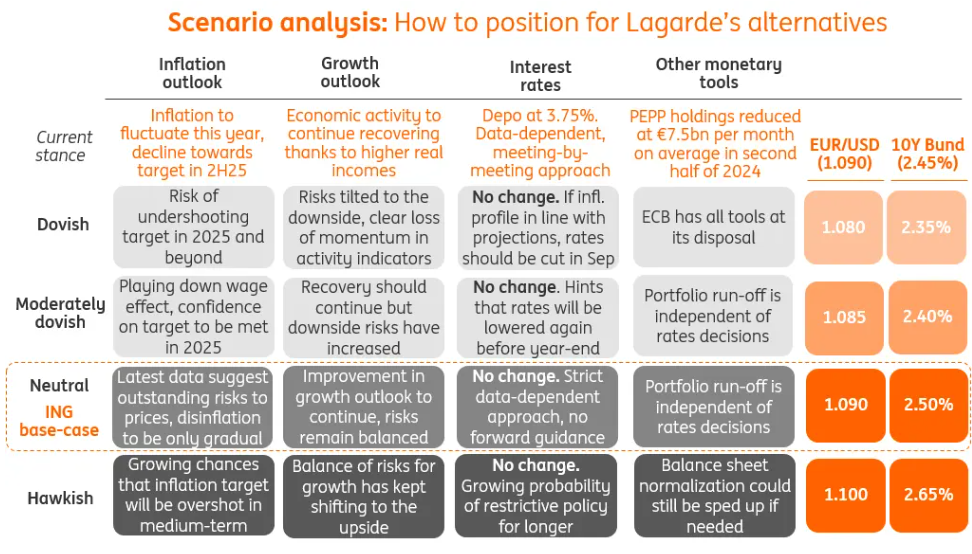

ING Cheat Sheet:

Prior Release:

ECB Interest Rate Actual 4.25% (Forecast 4.25%, Previous 4.50%) – June 6th 2024