US Interest Rate Prep

On Wednesday 31st of July at 14:00 ET, the FOMC is set to release the results of their latest monetary policy meeting.

Here are some views on what to expect.

General Expectations

Markets and economists are widely anticipating US interest rates to remain unchanged at 5.5%.

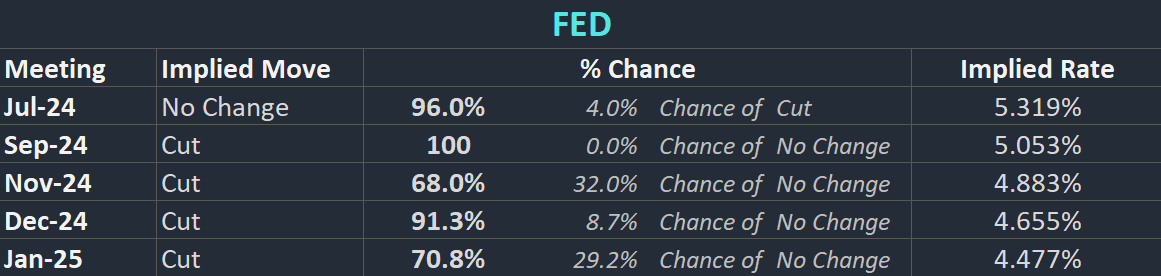

US Interest Rate futures pricing at the beginning of the week (Monday 29th July) implies a 96% chance of no change at this meeting and a 100% chance of a rate cut at the September meeting.

US Interest Rate futures pricing at the beginning of the week (Monday 29th July) implies a 96% chance of no change at this meeting and a 100% chance of a rate cut at the September meeting.

If realised, attention will instead turn to the Rate Statement, and the subsequent press conference from Fed’s Chair Powell.

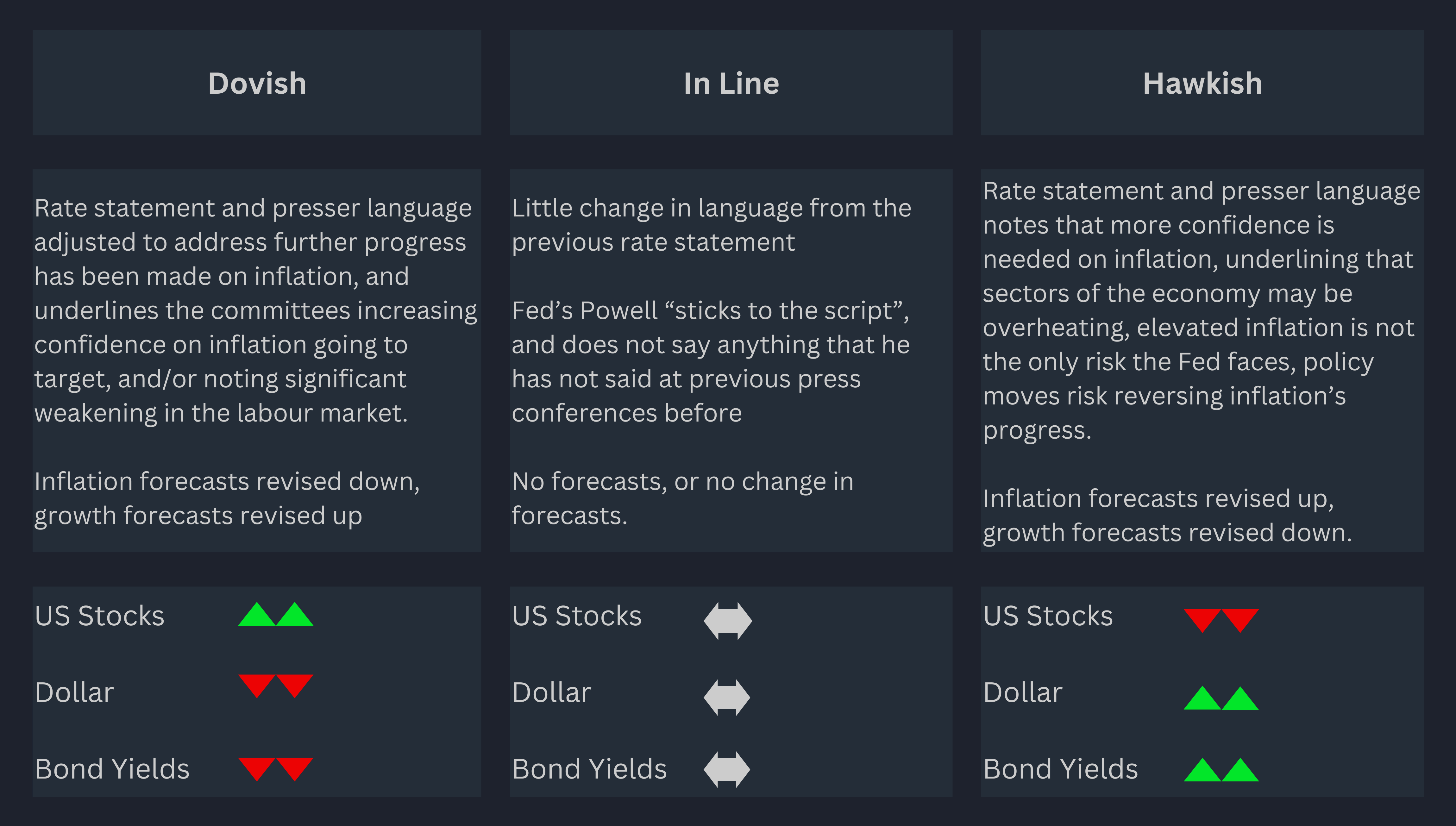

In the rate statement and the presser, the markets will be seeing if the messaging has a more hawkish or a more dovish tone.

A more hawkish tone could include rhetoric that points to less interest rate cuts this year than anticipated. This could be things like “more confidence needed in inflation return to target”, “bumps in the road”, “certain sectors remain headwinds to inflation”, etc.

More hawkish messaging like the examples above would be likely to cause weakness in US stocks and strength in the dollar.

A more dovish tone would increase/solidify bets on rate cuts this year, and this would include language like “we have greater confidence on inflation returning to target”, “inflation will continue to moderate”, “The employment situation is cooling”, etc.

More dovish messaging like the examples above would be likely to cause strength in US stocks and weakness in the dollar.

Commentary

JPMorgan

Despite a few high-profile calls for the Fed to start cutting next week, that does not appear to be in the cards. Rather, we look for casing to commence in September provided the incoming data continue to align with the Committee’s expectations.

This is likely to be signaled by some modest changes to the statement language as well as Chair Powell conceding that the Fed is gaining greater confidence that inflation is on a path back to 2%.

But we still expect him to stress data dependence (and thus avoid describing the first cut as “consequential”), as well as suggest decisions will be made meeting by meeting and to avoid giving any sense of the expected pace of easing. The days of explicit calendar guidance are likely behind us.

Elsewhere in the statement, the characterization of the labor market is likely to remain, with “strong” job gains and “low” unemployment.

On inflation, the statement could drop “modest” from the characterization of further progress, given the softer pace of core PCE inflation over the past few months.

The June reading came right in line with our 0.18% forecast, with similar monthly readings for the supercore and market-based core measures.

Even with some upward revisions to the May print, the year-ago core inflation rate held steady at 2.6% while the three-month annualized rate slipped to 2.3%.

Looking at the split into housing, supercore, and core goods, all three have decelerated recently.

Unicredit

On Wednesday, the Fed is expected the keep the fed funds rate at 5.25-5.50%, unchanged since last July. With no economic projections to be released at this meeting, the speech by Fed Chair Powell will be in the spotlight.

Recent data have been supportive for the Fed. The ISM Manufacturing Index, the ISM Non-Manufacturing Index and CPI all came in lower than expected, while the unemployment rate rose from 4% to 4.1%.

Market expectations on the Fed’s next moves have moved accordingly, with investors currently pricing in almost 75bp of rate cuts for this year and 100bp for 2025.

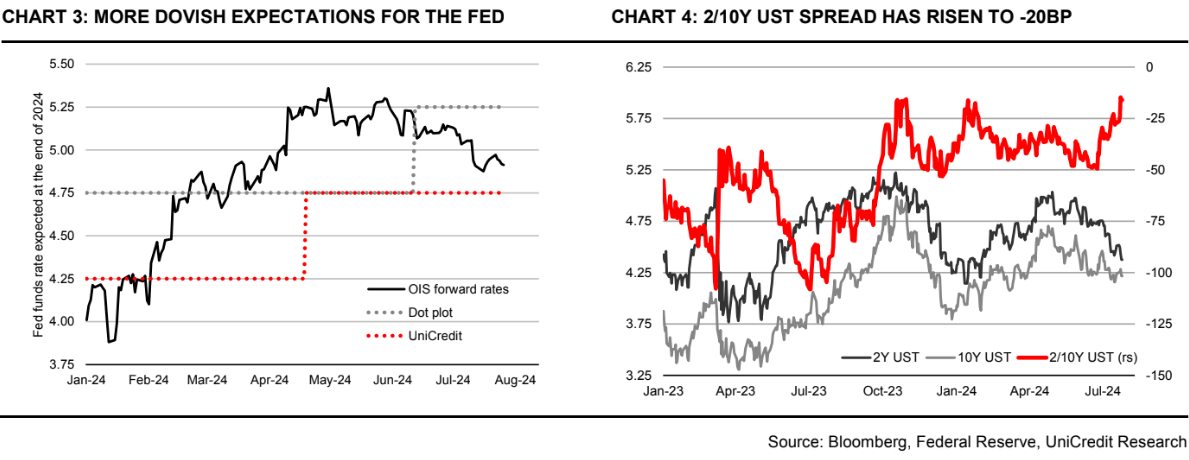

While what is priced in is not far from our predictions (we expect 75bp of cuts in 2024 and 125bp in 2025) current OIS forward rates appear to be more dovish than the June dot plot, which indicates just 25bp of rate cuts for this year and 100bp for the next.

It will be interesting to hear from Mr. Powell whether he sees the recent repricing as too optimistic or (more likely in our view) that the dot plot reflects an outdated economic picture.

Morgan Stanley

We expect the FOMC to remain on hold, but open the door to a September rate cut. We expect the FOMC statement to acknowledge the considerable progress in inflation and rising risks to the labor market. In the press conference, we expect Chair Powell to add to the signal that the Fed is close to lowering its target rate, but not go so far as committing to a cadence of cuts.

Wells Fargo

We don’t expect any policy changes to be announced at next week’s meeting, but we do expect the Committee to signal rate cuts are coming as early as its next meeting in September.

The FOMC will likely note that it has seen material improvement on inflation in recent months, but that it is also attentive to labor market risks.

Let’s start with inflation.

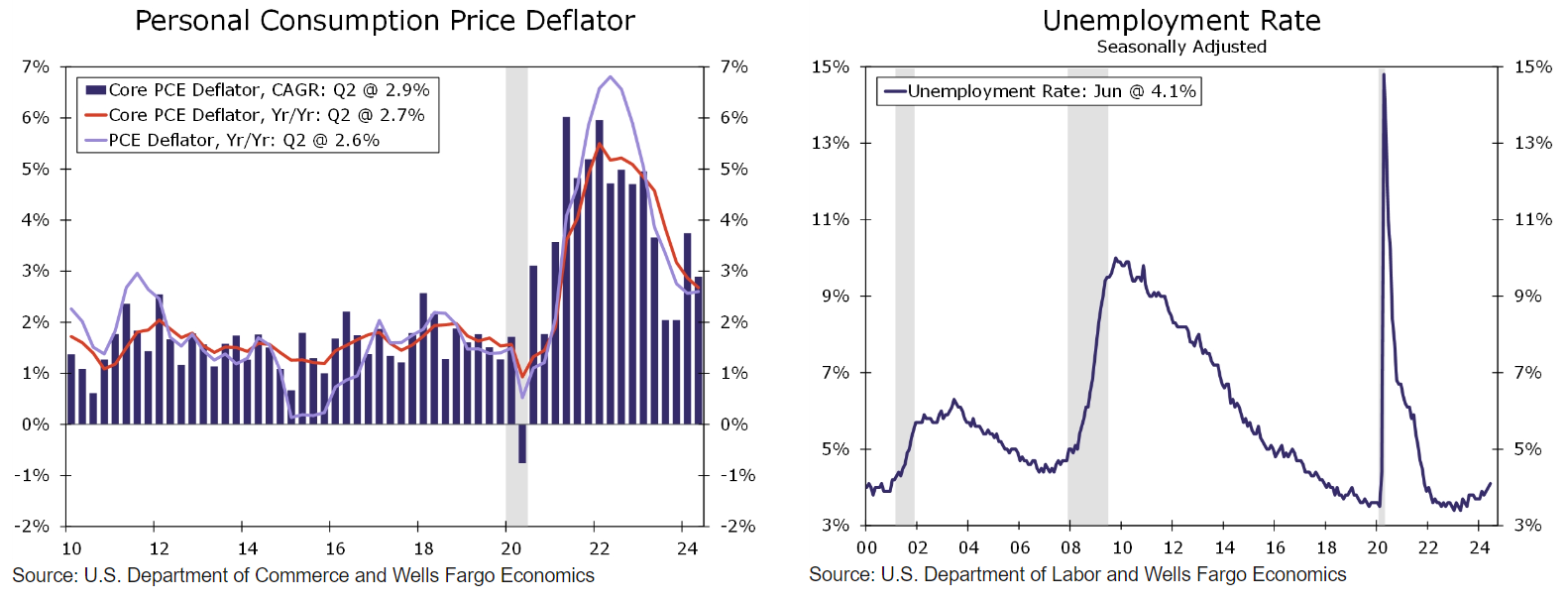

As we had anticipated, the Q1 bounce in consumer inflation looks to be nothing more than a bump in the road.

The core PCE deflator decelerated to a 2.7% annualized rate in Q2 after accelerating to 3.7% in Q1.

At the same time, the year-ago pace of inflation continued to drift lower, with the core reaching its lowest rate since the first quarter of 2021. The job might not be done on inflation, but the year-ago rate has been falling for two years, and we’re now closer to the target.

This brings us to the labor market.

Employers are still adding jobs at a sturdy pace, but nearly all other labor market data have moderated.

Job growth has narrowed with government and healthcare accounting for a majority of recent monthly gains, the ratio of open jobs to unemployed workers is again consistent with pre-pandemic levels and businesses are continuing to lay off temporary workers.

Perhaps most concerning is that the unemployment rate has drifted up by a worrying degree (chart).

Previous Release

On Wednesday the 12th of June at 14:00 ET, the FOMC kept rates unchanged at 5.5%, as expected.

At this meeting, the FOMC released the latest Summary of Economic projections alongside the Rate Statement.

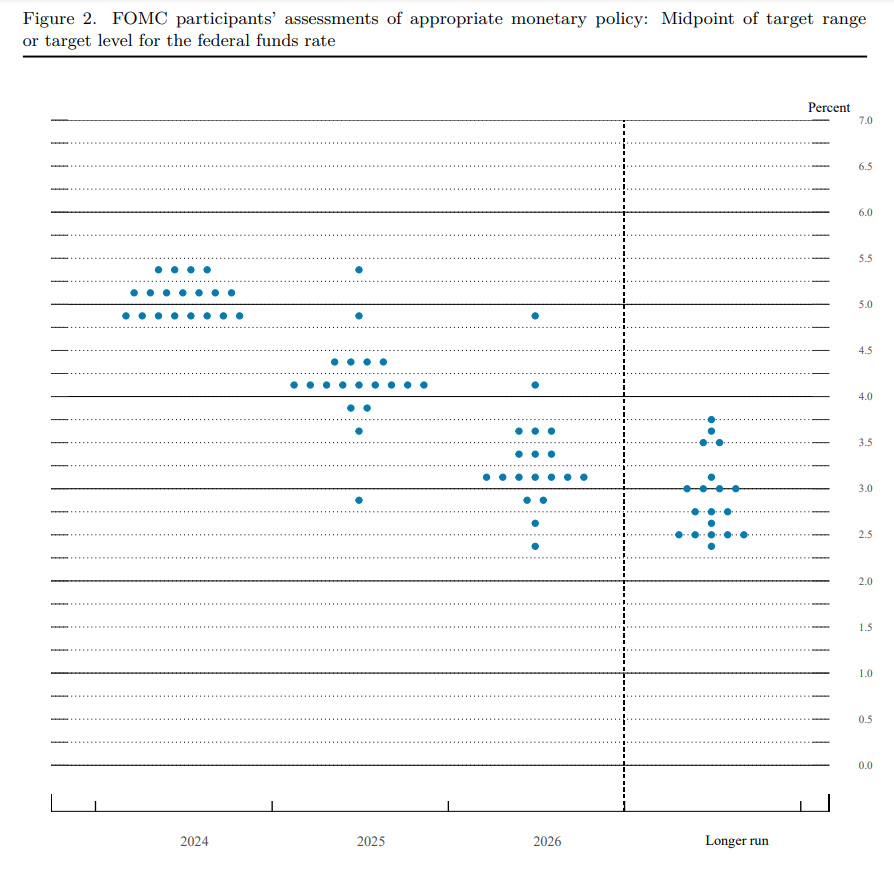

Dot Plot released with the June 12th Summary of Economic Projections.

Dot Plot released with the June 12th Summary of Economic Projections.

In the SEP, the projections implied 25 bps of rate cuts in 2024 from the current level, and another 100 bps in 2025.

This called for only 1 rate cut this year, whereas markets had priced in 2.5-3 cuts for 2024 at this stage, meaning the median Fed official projected fewer rate cuts this year than the markets had expected.

This caused the dollar and US treasury yields to strengthen and the S&P 500 to weaken, as traders pulled back on their rate cut bets for this year to more closely align their positions with the median FOMC officials from the Dot Plot.