BoE Interest Rate Prep

Commentary:

ING: We think the Bank of England will cut today, but markets are not fully convinced. Around 60% is priced in, so a 25bp cut will find its way through the yield curve. The 10-year Gilt yield could fall 10bp lower, helping tighten the spread with the 10-year Bund. If the BoE refrains from a cut this time, then September will be the month to watch. The September meeting is scheduled just a day after the FOMC meeting and could therefore make a safer choice for a cut.

BofA: We expect the BoE to cut rates by 25bp with a 5-4 vote, amid mixed data and a dovish stance, but is a close call. We would not expect clear guidance, with continued focus on data. We believe the BoE is unlikely to signal the start of a sustained cutting cycle.

CACIB: Ahead of the August BoE policy meeting today, our UK economist expects the MPC to deliver the first rate cut of its easing cycle. At the same time, UK rates markets are attaching a slightly greater than 50% chance to a rate cut today. So far this year, the BoE’s Swati Dhingra and David Ramsden have already voted in favour of a cut while BoE Governor Andrew Bailey further seemed to be leaning in favour of a cut in his last speech that admittedly was back in May. More recently, speeches by the BoE’s Huw Pill, Jonathan Haskell and Catherine Mann have warned against cutting rates too quickly, suggesting that the MPC remains divided on the need for easing. This partly reflects the fact that whereas the headline CPI inflation print has returned to the BoE’s 2% target, core and services inflation rates remain stubbornly elevated at a time when the UK labour market remains relatively tight and continues to fuel wage growth.

Goldman Sachs: We think when you look at the totality of that data, it’s probably enough for them to cut. But, it’s going to be pretty close because it depends a little bit where you look in terms of the data

Rabobank: We anticipate a 25bp cut to the Bank rate, bringing it to 5.00%, marking the start of a gradual easing cycle with 25bp cuts each quarter. However, there is a risk that officials may want to see another month of data first.

The chance of BoE rate cut on August 1st rises to 64% vs 60% on Tuesday – OIS Curve [July 30th]

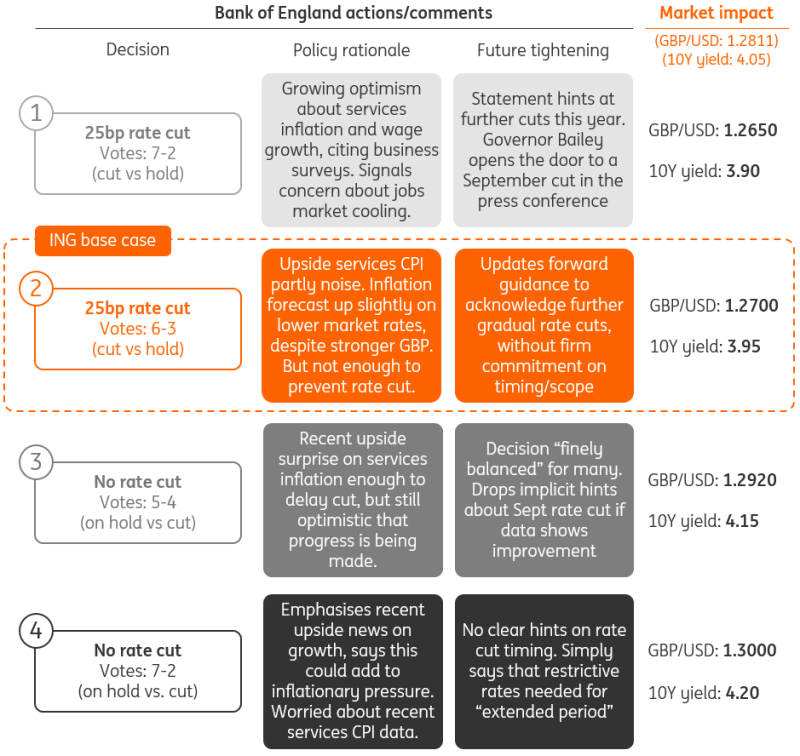

ING’s Four Scenarios:

Previous Reaction:

BoE Bank Rate Actual 5.25% (Forecast 5.25%, Previous 5.25%) [June 20th 2024]