Morning Juice – US Session Prep

Morning, Traders!

Happy Friday! It is the 2nd of August, the day of the highly-anticipated US July Employment Situation report.

here are some things to look out for today.

Sentiment

The global stock selloff intensified, with Nasdaq 100 Index futures falling as traders fretted that the Federal Reserve had been too slow to cut interest rates, and technology earnings disappointed.

The next major data point for the market will be the monthly jobs report, which is expected to show that US employers added workers at a slower rate last month.

While Fed Chair Jerome Powell has indicated that rates will likely be cut in September, some investors believe they should move faster to avoid a deeper economic slowdown.

Markets continued to price in even more rate cuts from the Fed this year, now seeing a 50% chance that 1 of the 3 cuts that are priced in for 2024 will be 50 bps, which would equate to 100 bps of cuts this year.

Although rate cuts would normally be bullish for corporate America, traders seem more concerned about the implications of a broader economic slowdown, and the idea that the Fed may be too late to avoid it.

Docket

08:30 ET

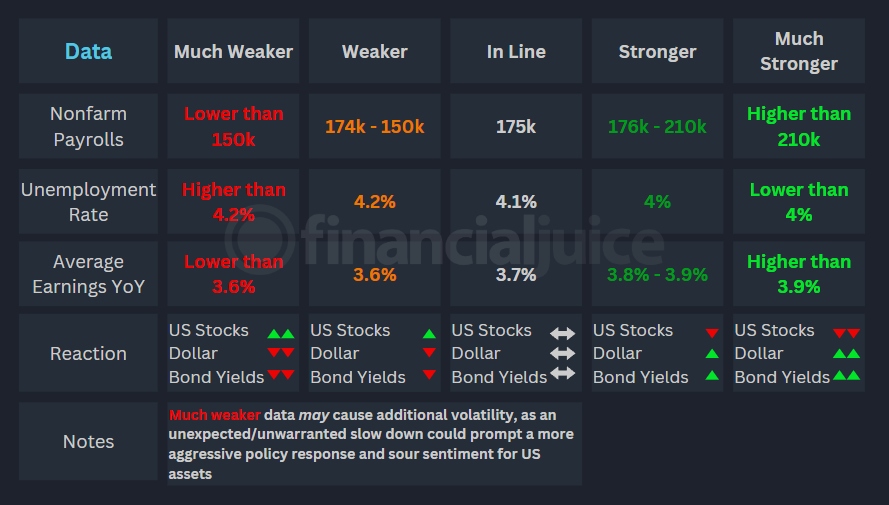

US Employment Situation for July

Nonfarm Payrolls – Median Forecast: 175k | Prior: 206k | Range: 230k / 70k

Unemployment Rate – Median Forecast: 4.1% | Prior: 4.1% | Range 4.2% / 4%

Average Earnings YoY – Median Forecast: 3.7% | Prior: 3.9% | Range: 3.9% / 3.6%

US Nonfarm Payrolls Prep article: Read Here

10:00 ET

US Factory Orders for June

Median Forecast: -3.2% | Prior: -0.5% | Range: 3.2% / -3.6%

Good luck, and have a good weekend!