US CPI Prep

On Wednesday the 14th of July, at 08:30 ET, the BLS is set to release the latest US CPI report for the month of July.

Here are some views on what to expect.

Overview

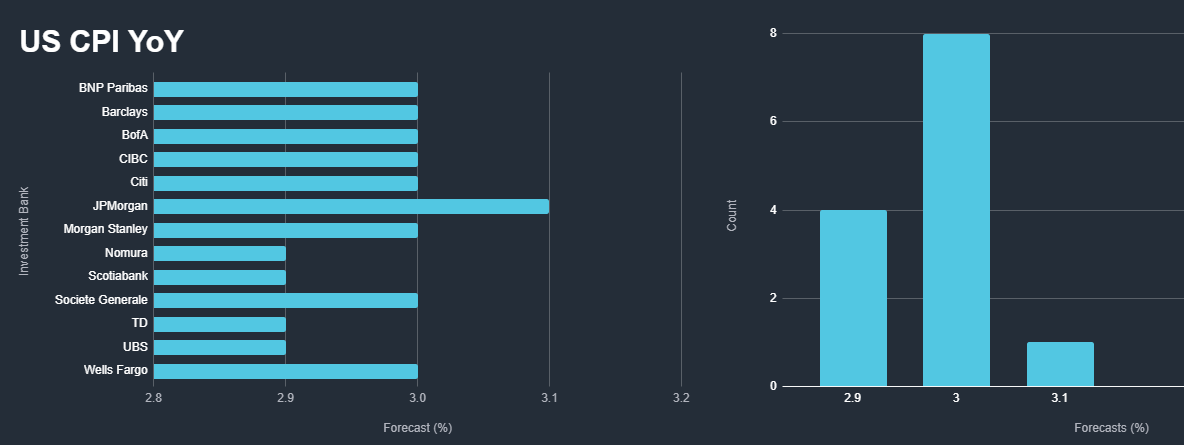

For US CPI YoY, the median forecast is 3%, expected to be unchanged from the prior of 3%.

According to a survey of 34 economists, the highest estimate is 3.1%, and the lowest is 2.8%.

For US CPI MoM, the median forecast is 0.2%, up from the prior -0.1%.

The highest estimate is 0.3%, the lowest is 0%

For US Core CPI YoY, the median forecast is 3.2%, expected to move down from the prior 3.3%.

The highest estimate is 3.5%, the lowest is 3.1%.

For Core CPI MoM, the median forecast is 0.2%, up from the prior 0.1%.

The highest estimate is 0.3%, the lowest is 0.1%.

Here are the views of some of the largest investment banks.

General Expectations

Since the employment worries that the recent weak nonfarm payrolls have sparked in the wake of the Federal Reserve’s decision to keep rates unchanged, the markets have priced in large amounts of rate cuts this year, which, even since being pared back, futures are still fully pricing in rate cuts at every remaining meeting this year.

Since then, the market’s attention seems to have turned away from reacting to the potential effects that data would have on monetary policy, and instead, is reacting to how it could affect the broader economy, and whether the data feeds into the narrative of a broader economic slowdown, or whether it counteracts that narrative.

That being said, the markets still seem to be reacting to inflation data based on it’s effects on monetary policy, which we saw in the US PPI data here

This means that if US CPI were to come in broadly higher than expected, the Federal Reserve would have to balance between risks on both sides of its mandate (maximum employment and sustainable inflation) and may decide that they needed to keep rates higher for longer to allow restrive policy more time to bring inflation down, which could risk damaging parts of the economy, namely the employment situation.

So, if CPI came in higher than expected, I would expect to see weakness in US stocks and strength in the dollar, as it would raise uncertainty on the rate path, and increase the risk of a hard landing, with restrictive policy causing problems in other areas of the economy, but the prospect of higher for longer rates would increase the interest paid on dollar-backed securities like bonds.

On the other hand, if CPI were to come in lower than expected, this would assure the markets that inflation is coming back to target, and confirm that the Fed will be able to reduce rates at the next meeting to stimulate the economy, the jobs market, and reduce the chances of a broader economic slowdown.

I believe this outcome would be likely to cause strength in US stocks and weakness in the dollar, as easier monetary policy and decreased chances of a hard landing could increase corporate profits and growth prospects for the US, but the idea of lower interest rates would decrease interest paid on dollar-backed securities like bonds.

Commentary

JPMorgan

We expect that the consumer price index rose 0.2% in July.

This would be the firmest print in three months, reflecting some firmness in food and particularly energy prices that is due to sources other than gasoline for a change.

The former likely rose 0.2% last month, while the latter is expected to have increased 0.5% following two consecutive months of more sizable declines.

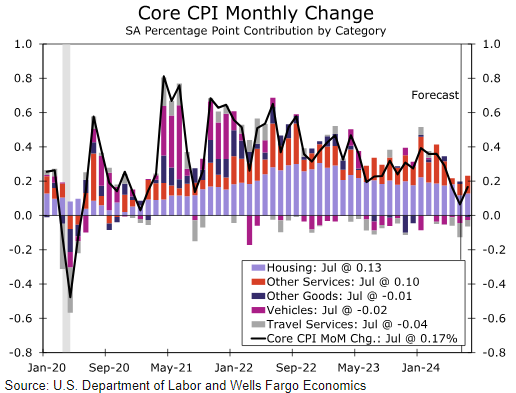

Away from food and energy, we look for the core CPI to have risen 0.17% in July, which would be somewhat above the prior two months but still broadly consistent with a cooling in the underlying pace of inflation seen over the past few months.

If realized, the year-ago core CPI inflation rate should moderate to 3.2% (from 3.3% in June) as a result. Headline CPI inflation is expected to remain at 3.0% on a year-ago basis in July.

Wells Fargo

The June CPI report was one of the most encouraging reports the FOMC had received since it began raising rates. Food and energy prices led the charge, with consumer prices declining 0.1% on the month.

Excluding food and energy, core consumer prices rose a modest 0.1%, or the smallest such increase since early 2021.

Perhaps most encouraging in the report were core services prices, which increased only 0.1%, a marked improvement from the previous six-month average monthly gain of 0.4%.

Core goods prices continued their deflationary streak for a fourth consecutive month, decreasing 0.1%.

With core goods prices consistently coming down and the outlook for core services prices moderating through the rest of the year, the risks to the inflation and labor sides of the FOMC’s dual mandate are in better balance.

We look for headline CPI to have advanced 0.2% in July, which would keep the year-over-year rate steady at more than a three-year low of 3.0%.

The core CPI also looks set to advance 0.2% in July amid a rebound in some of the more volatile “super core” components.

Looking beyond July, we expect inflation to continue to subside.

Bank of America

We forecast headline CPI rose by 0.3% m/m in July, owing mainly to a pickup in core services inflation and energy prices. This would leave the y/y rate unchanged at 3.0%.

Meanwhile, we expect core CPI increased by 0.2% m/m. While this is not quite as low as June, it is in line with prior trend in deflation and should meet the Fed’s benchmark for beginning rate cuts in September.

Citi

US core CPI should, in part, comfort Fed officials but, in other, keep them squarely focused on labor and economic trends.

Citi Economics expects 0.18%MoM core CPI, with subdued shelter inflation, which has downside risk.

Sub-0.25%MoM core CPI should keep the Fed squarely focused on jobs and activity.

Previous Release

On July 11th at 08:30 ET, the BLS released the US CPI report for June.

US CPI YoY came in lower than expected at 3%, on the forecast of 3.1%, and down meaningfully from the prior of 3.3%.

US CPI MoM came in at -0.1%, down from the forecast of 0.1% and the prior of 0%.

For the Core numbers, YoY came in lower as well at 3.3% on estimates and prior of 3.4%, and MoM came in lower as well at 0.1% on estimates and prior of 0.2%

This caused weakness in the dollar and government bond yields, and strength in the S&P 500, as it reduced bets on higher for longer interest rates which were in play at the time, and increased the likelihood of Fed cuts this year.