US Nonfarm Payrolls & Unemployment Rate Prep

On Friday the 6th of September at 08:30 ET, the BLS releases the latest Employment Situation report representing August.

Here are some views on what to expect.

Overview

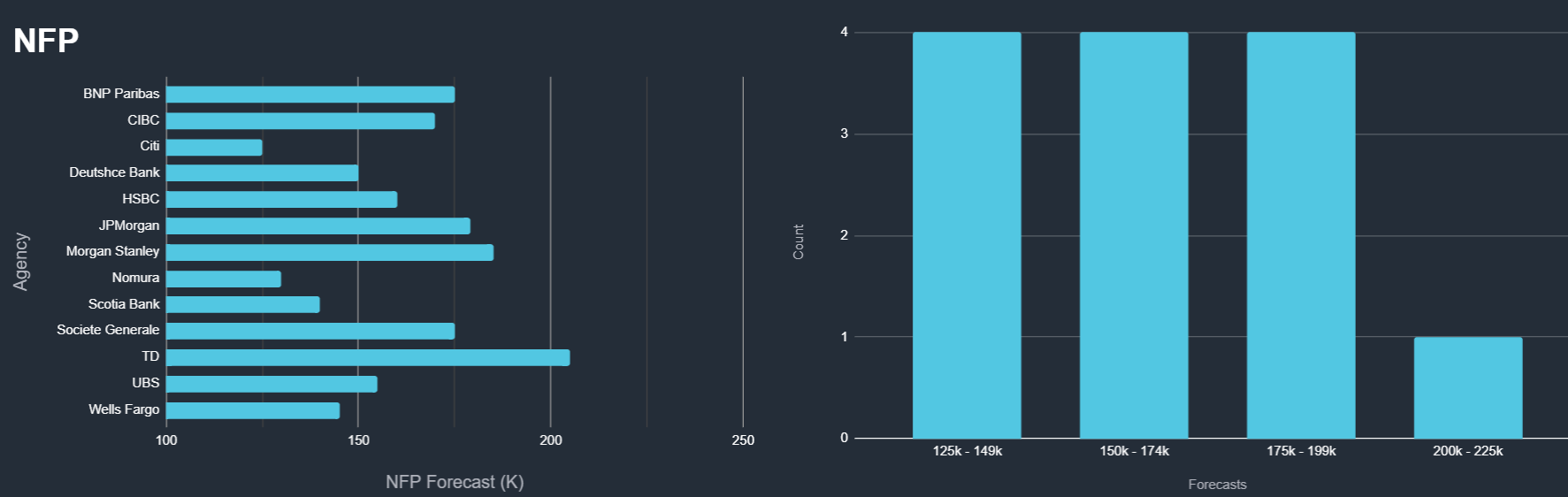

For Nonfarm Payrolls, the median forecast sees it moving up to 165k from the prior 114k.

According to a survey of 52 qualified economists, the highest estimate is 205k, and the lowest is 100k.

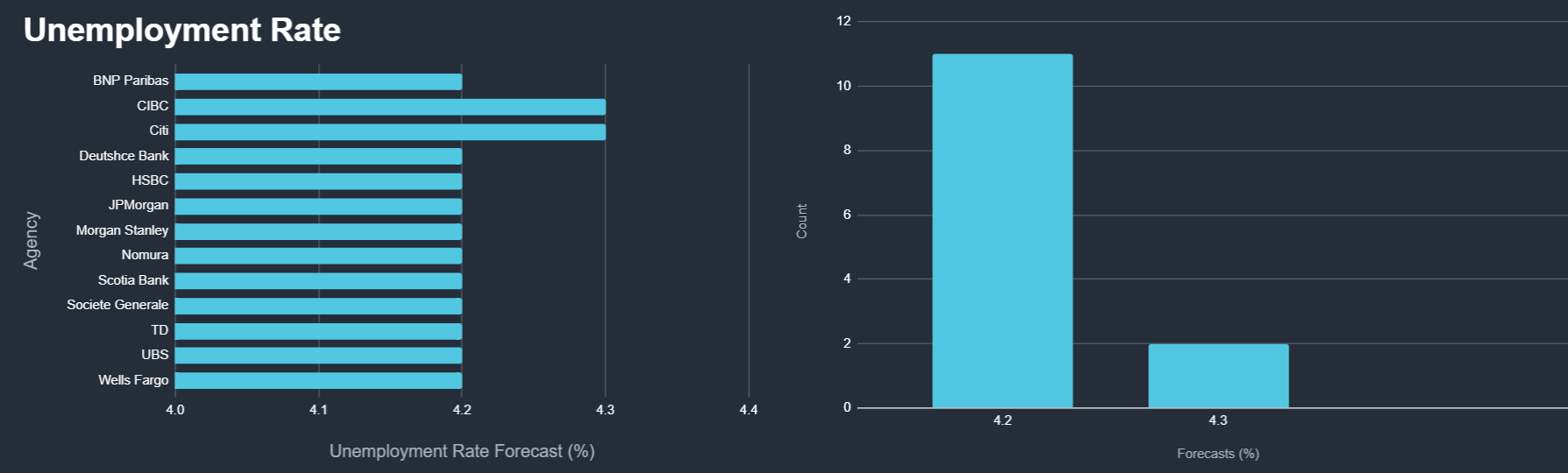

For the Unemployment Rate, the median forecast is 4.2%, which would be down from the prior 4.3%.

The highest estimate is 4.4%, the lowest is 4.1%

Here are some views from some of the largest investment bank forecasters.

General Expectations

Since the slowdown in NFP that was seen in the July report, there has been a focus on the employment situation, with numerous FOMC officials speaking about how they are now looking to the jobs side of their mandate, as opposed to focussing more squarely on just the inflation side.

If Nonfarm Payrolls comes in higher than expected, and the Unemployment Rate comes in lower than expected, we would be likely to see strength across the US assets (the dollar, bond yields and US stocks), as this helps to alleviate fears of a recession, by underlining a strong jobs market.

If Nonfarm Payrolls comes in lower than expected, and the Unemployment Rate comes in higher than expected, this would be likely to cause weakness across the US assets, as it may increase chances of a hard landing as we approach the start of the easing cycle for US interest rates.

It is worth noting that a higher NFP number would be likely to increase/solidify bets on rate cuts this year, while a lower number may reduce bets on rate cuts.

This has a chance to affect the equity markets in the opposite way than is listed above, though this is unlikely based on the last few employment reports we have seen.

Commentary

Goldman Sachs

The true test will likely come with the August jobs report.

A stronger-than-expected payroll number and lower unemployment rate would likely provide markets with greater confidence that growth risks have subsided, paving the way for equity valuations to remain elevated and a potential catch-up in some other markets/stocks that have lagged.

Conversely, another weak report and a further rise in the unemployment rate would likely rekindle growth fears and pressure equity valuations like last month. Our economists are looking for a better-than-expected non-farm payroll number of +185k and a fall in the unemployment rate to 4.2% (which is in line with consensus).

Wells Fargo

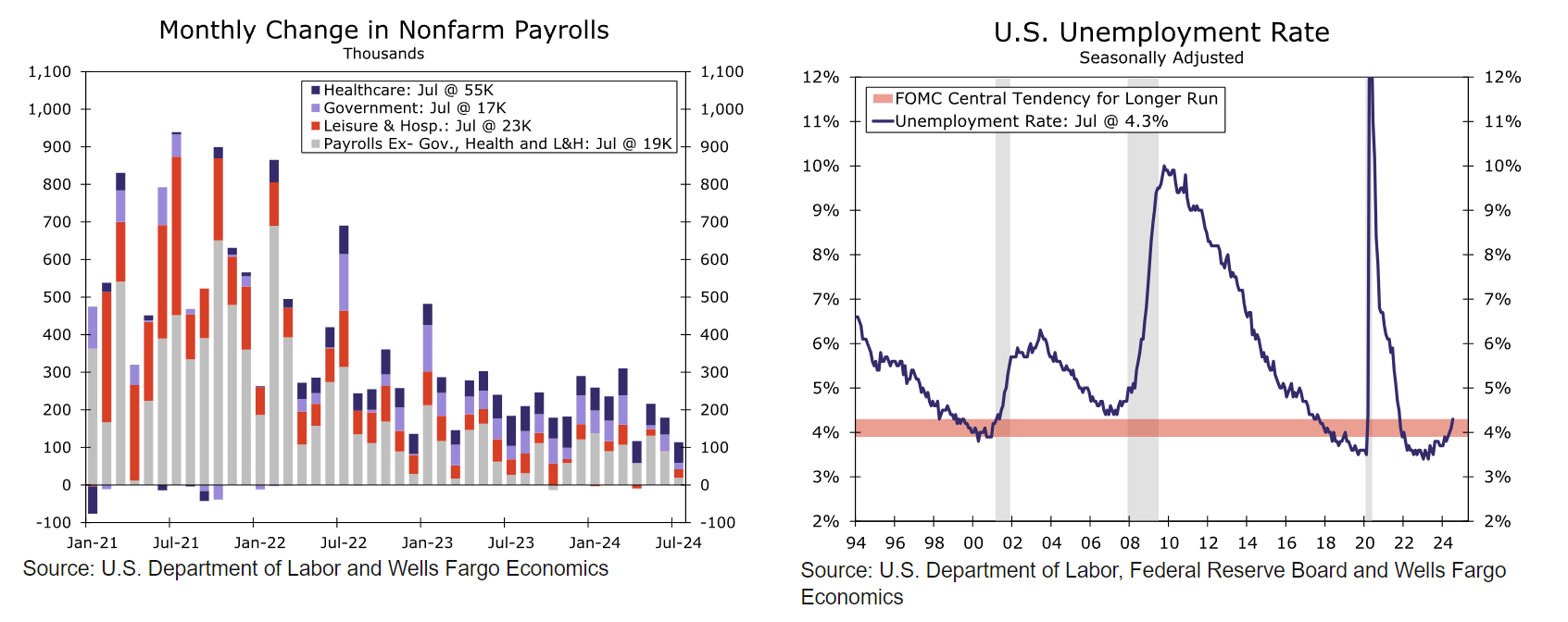

The July jobs report fired a warning shot that the widespread weakening in labor market indicators—to which payrolls until recently seemed immune—should not be ignored.

July’s 114K increase in nonfarm employment came in well short of expectations, with yet another narrowly driven increase and downward net revision to the prior two months’ hiring figures.

Even more eye-catching was the unemployment rate’s rise to 4.3%, which pushed the increase in the jobless rate over the past year above the Sahm Rule threshold historically associated with a recession.

The Employment Situation for August will be imperative in determining if the rapid deterioration in employment conditions indicated by last month’s report was merely noise—possibly amplified by the landfall of Hurricane Beryl during the survey week—or a signal that the jobs market is struggling to maintain traction.

We expect it to lean toward the latter, with only a partial rebound in hiring and partial reversal of the unemployment rate’s July increase.

Morgan Stanley

We expect a deceleration in labor markets but not a slump.

We see a solid NFP print next week confirming our view that the economy is slowing but not heading to a recession, and we don’t forecast a sharp increase in the unemployment rate in our forecast horizon.

Even though Chair Powell seems convinced that the natural rate of unemployment is at or below 4.3%, its value is just uncertain.

The FOMC publishes every quarter an estimate of a related concept, the longer-run unemployment rate, which can be interpreted as a trend value around which the natural rate of unemployment fluctuates.

The last published estimates of the long-run unemployment rate showed a wide range from 3.5% to 4.5%. Uncertainty calls for a gradual approach, adjusting rates slowly and assessing how the economy reacts to those cuts.

Previous Release & Context

On August 2nd at 08:30 ET, the BLS released the US employment situation report representing the month of July.

US Nonfarm Payrolls came out at 114k, below estimates of 175k, and the downward-revised prior of 179k.

The Unemployment Rate moved up to 4.3%, when it was expected to remain unchanged at 4.1%.

This caused large-scale weakness across the US assets, the dollar, bond yields, and S&P 500, as it triggered concern over a broader economic slowdown.

This was amplified by the fact that the FOMC had left rates unchanged just 2 days prior, which led markets to believe that the Fed may have missed its chance to cut rates to avoid an undue economic slowdown.

In this case, the markets reacted to the weak employment number’s effect on the broader economy, as opposed to monetary policy, which is why all of the US assets moved together.

It is worth noting that in the 4 weeks since this weak NFP print we have seen strong weekly US jobless claims numbers, which have contributed to moves up across the US assets, erasing the losses in the markets caused by this original report.