ECB Interest Rate Prep

Sentiment:

BofA: We expect the ECB to cut the deposit rate by 25bp next week (rest of policy rates should adjust by 35bp given the narrowing of the corridor already announced later in the month). We are not expecting changes to guidance in the press release next week. We would expect the statement to acknowledge that the incoming information broadly confirms the Governing Council’s previous assessment of the medium-term inflation outlook, but that the growth outlook now appears weaker. New forecasts should come with lower growth, a bit more core inflation near term, but broadly an unchanged medium-term outlook and, crucially, inflation not far from 2% by the end of 2025, enough to justify a cut. At the same time, we would also expect it to flag that domestic price pressures remain strong and are keeping services price inflation high.

Credit Agricole: At the start of 2024, we based our bearish EUR/USD outlook on the expectation that the ECB would ‘out-dove’ the Fed. We continue to expect the ECB to deliver a total of three rate cuts this year and to follow these by another three rate cut in 2025.

Berenberg: The ECB is very likely to cut interest rates by a further 25 basis points tomorrow. After tomorrow’s meeting, there will be two more interest rate decisions this year on 17 October and 12 December. The market is pricing in a further interest rate cut of 25 basis points this year.

ING: With the latest inflation data out of the eurozone, a rate cut at next week’s European Central Bank meeting has almost become a done deal. As current headline inflation is closing in on 2% and longer-term inflation forecasts remain stable at around 2%, the ECB has enough reasons to further reduce the level of monetary policy restrictiveness

Citi: The ECB is fully priced at -25bps, so forecasts and guidance will be more important.

Deutsche Bank: On 12 September we expect the ECB to cut rates 25bp to 3.50%. This confirms that June was not a one-off insurance cut and the ECB is in the dialling back restrictiveness phase of the cycle. The question is not whether the ECB cuts in September but what the ECB says about the next steps in the easing cycle. The ECB has been reticent about its guidance so far and likely will remain so in September.

On inflation, we expect a small upward revision to 2024 core for the second consecutive quarter, reflecting sticky services inflation. However, we expect the key inflation forecasts from a policy point of view – the end-25 forecast to judge a timely adjustment to target and 2026 to judge whether inflation remains at target – to be more or less unchanged (with an underlying risk of downgrade).

Goldman Sachs: We expect the ECB to cut policy rates by 25bp at next week’s meeting, as is widely expected. Investors will focus on the ECB’s assessment of the incoming data, the updated staff projections and any guidance on the path ahead.

We expect the Governing Council to motivate the rate cut with rising confidence that the disinflation process is on track but look for limited changes in the communication. The Governing Council is likely to reaffirm its “data-dependent and meeting-by-meeting approach” without a formal easing bias. We believe that President Lagarde will emphasise data dependence in the press conference but also note that further rate cuts are likely if the disinflation process remains on track. We do not expect Lagarde to comment specifically on the likelihood of an October cut but indicate that the Governing Council will look at all incoming data when making its decisions.

MUFG: We expect the ECB to cut by 25bps, in line with the market consensus. The communications from President Lagarde will likely be similar to before – decisions will be meeting-by-meeting with more work to be done to restore price stability.

Unicredit: Today, the ECB will almost certainly cut its deposit rate by a further 25bp to 3.50%. Following the review of the ECB’s operational framework that was announced in March, the spread between the refi rate and the deposit rate will narrow from 50bp currently to 15bp, starting on 18 September. Therefore, the level of the refi rate consistent with a deposit rate of 3.50% would be 3.65%. The decision to cut interest rates for a second time in this cycle is likely to be uncontroversial, mainly for three reasons. First, the new projections are likely to broadly confirm the macroeconomic scenario published in June, in particular the expectation that the inflation goal will be met by the end of 2025. Second, downside risks to the central bank’s growth outlook seem to have intensified somewhat given some unexpected weakness in survey indicators for 3Q24. A slight downward revision to the ECB’s growth forecasts seems likely.

RBC: The market is firmly priced for a 25bp rate cut at next week’, We and the analyst consensus are expecting a 25bp rate cut and most ECB speakers have already endorsed such a move. Anything else would be a major surprise. More important for markets will be what guidance the ECB will give for future meetings, or indeed if it does so at all. The chasm between the drop in headline inflation, in no small part driven by weakness in energy base effects and the recent weakness in commodity prices, and the more domestically driven service inflation keeps growing. Different ECB members place

different weights on the respective segments making it hard to see how an agreement on firmer forward guidance can be reached. We therefore continue to think that the ECB will keep their cards close to their chest and stick to a ‘data dependent meeting-to-meeting’ approach. Neither do we see enough reasons to change our call for the next cut to be in December. The risks for faster or deeper cuts than we envision is growing, though.

Money Market Pricing & Comments:

September 6th: Money Markets nudge up bets on ECB rate cuts after US jobs data, now see 64 bps of cuts this year from 62 bps previously.

September 5th: According to a poll, ECB to cut rates in September and December, said 64 of 77 economists (66 of 81 in August poll).

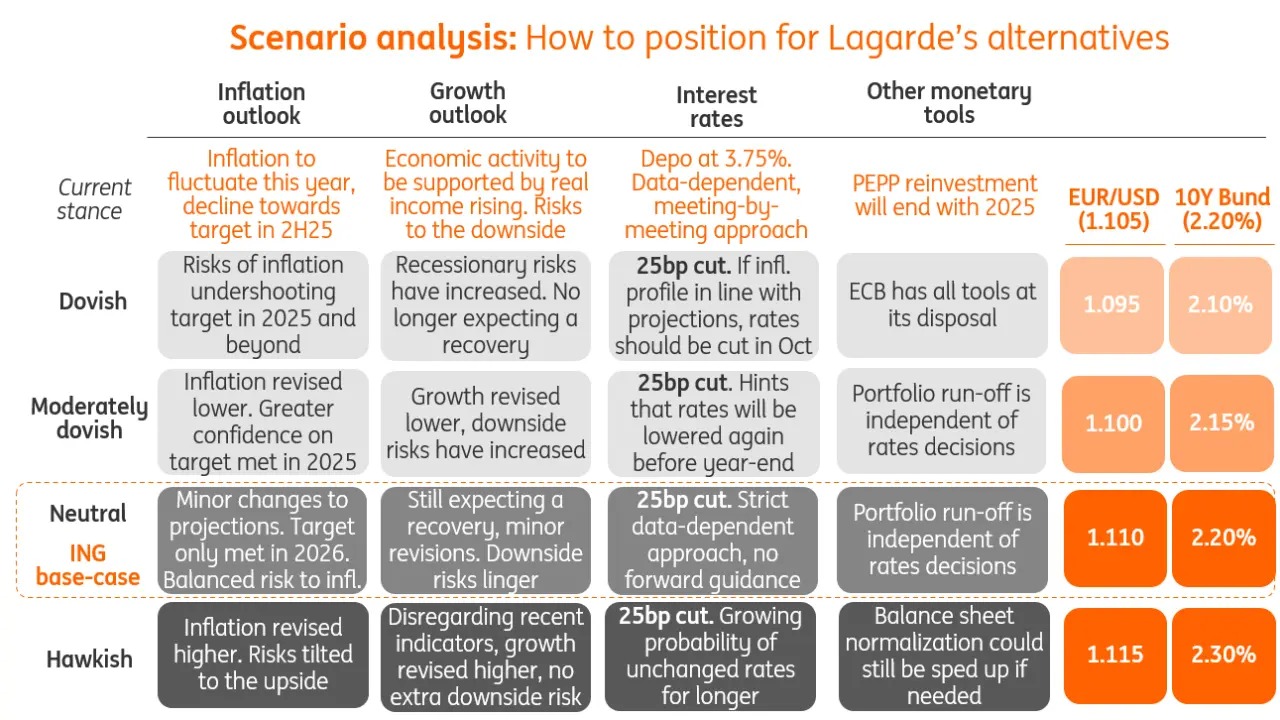

ING Cheat Sheet:

Prior Release:

ECB Interest Rate Actual 4.25% (Forecast 4.25%, Previous 4.25%) – July 18th 2024